Investor Insights

SHARE

The RBA is in a bind along with mortgagees and renters

Just 48 hours after the Reserve Bank of Australia (RBA) lifted rates for the 13th time by 25 basis points to 4.35 per cent, the U.S. Federal Reserve’s Chair Jerome Powell said at a conference in Washington that “we are not confident” the Fed has tightened enough to bring inflation down to its 2 per cent goal.

Noting officials would monitor economic conditions closely to avoid raising rates too high, Powell said there is a risk of being “misled by a few good months of data.” Bond rates rose in response, with the 10-year treasury yield climbing 0.123 percentage points to 4.629 per cent.

Central banks worldwide are in an unenviable position, and our own RBA is in a particularly precarious one. The demographics of home ownership combined mean those being punished by rate rises aren’t the same people doing the spending that keeps inflation elevated. Meanwhile, the requirement of a stable banking system prevents Australian mortgagees from borrowing for 30 years and fixing their rates the way U.S. borrowers can.

So, without the protection of a 30-year fixed-rate mortgage, Australian mortgagees are hit immediately when rates rise.

The combination ensures wealthy boomers and Gen X’ers, who own their own homes and are therefore unaffected by the RBA’s rate rises, continue to spend, putting pressure on prices which, in turn, forces the RBA to lift interest rates, which in a bitter irony punishes those with a mortgage, those who, by necessity, have already tempered their spending. And of course, the increased rates result in higher returns on cash balances and term deposits, which provides more spending power for those without mortgages.

The simple fact is that higher interest rates and inflation don’t affect all Australians equally. Recently the Commonwealth Bank, using its spending data live-streamed from 7.8 million customers, confirmed over-65s spent six per cent more in the year to September 30 (that’s above the rate of inflation, which means it’s due to greater volume as as well as prices increasing), while those under 40 reduced spending and those between 25 and 29 reduced their consumption the most. Given inflation was about five per cent, the reductions by the younger cohorts are even more meaningful.

According to the Australian Institute of Health and Welfare, there were nearly 9.8 million households in Australia in 2021. And, where household tenure was known, 67 per cent (6.2 million households) were homeowners, 32 per cent (2.9 million households) were homeowners without a mortgage and 35 per cent (3.3 million households), with a mortgage. Almost a third of households, or 31 per cent (2.9 million households), were renters.

It is entirely plausible that the spending activities of the wealthiest third, enriched by rising rates on cash deposits, are causing pain for at least that cohort of households with mortgages and certainly for the estimated 15 per cent of households whose income does not cover the monthly mortgage and other expenses. Meanwhile, a third of all households renting are enduring rising rents in part due to high levels of immigration and a shortage of available properties.

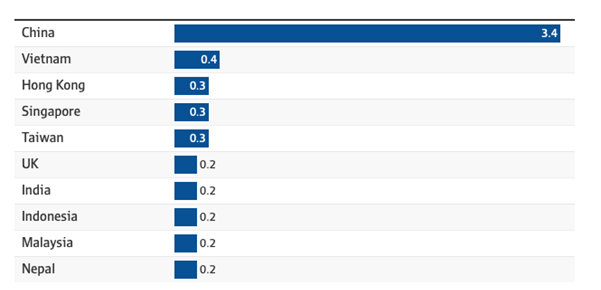

According to the Australian Financial Review (AFR), “Treasury data reveal overseas buyers are flooding back into the Sydney, Melbourne, and Brisbane markets. Approvals by the government are up 40 per cent in the past quarter, compared with the previous year, and buyers from mainland China, Hong Kong, Taiwan, and Vietnam are leading the influx.”

Figure 1. Foreign residential real estate investment by country, FY23 ($billion)

Source: Treasury, AFR

Source: Treasury, AFR

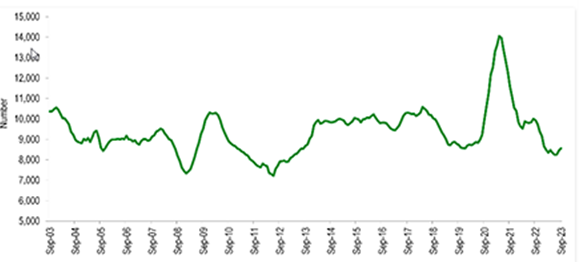

It also appears the housing shortage will not ease any time soon with the volume of new house approvals at the lowest level in a decade.

Figure 2. Monthly Australian detached dwelling approvals (3-month rolling average)

In something approximating a vicious circle, building approvals are being weighed down by the most rapid increase in interest rates Australia has experienced. A lack of supply puts pressure on rents for existing properties, contributing to inflation, and forcing the RBA to raise rates. Rising rates reduce demand for building, contributing to the lack of supply of new rentable dwellings, as well as those vacated as households move into newly constructed dwellings.

The government, for its part, is encouraging immigration while also funding massive infrastructure construction activity. Both are contributing to the rising cost of housing in Australia, the former directly and the latter indirectly, by reducing the labour force available to build residential dwellings. Few solutions are available and certainly none that can provide immediate relief.

I wrote here last month that house prices must go up and, despite rising interest rates, they continue to perform as predicted. None of this will help the cash flows of those renting or those with mortgages. And the RBA’s latest rate rise will only compound the pressure being heaped on them.