Investor Insights

SHARE

Is the creative destruction phase beginning?

Last year, I posted a blog entitled ‘But Nothing’s Changed’, describing how the artificial intelligence (AI) bubble and market boom could end. I explained how investors will realise that even though AI technology – hailed as the 4th Industrial Revolution – will change the course of human history, it probably won’t do so tomorrow. And therefore, share prices were at risk of setbacks because there will be commercial bumps (delays in data centre builds, changes in interest rates, shortages of energy and water, and not all companies can win) along the way to an AI ‘utopia’. While timing a change in sentiment is impossible, the hype surrounding general-purpose technologies, including AI, makes such a change inevitable. It’s always been so.

This week, as the AFR reported, megacap chipmaker AMD was going “gangbusters”, adding the company had “smashed analyst expectations for both profits and revenue – revenue in its data centre business surged 39 per cent in the December quarter, and is forecast to surge 60 per cent in the March quarter.”

Despite the good news, AMD shares are down 23 per cent from their January 23 highs.

Software companies are being sold off amid fears that AI will disrupt their businesses, accelerate the pace of business maturation, and erode their moats (more on that in a moment). Meanwhile, technology stocks are also being sold off because investors who previously had hoped AI would move from invention to global adoption in a straight, uninterrupted line are realising (once again) that there will be interruptions and delays to adoption because adoption is cyclical because customers are cyclical.

In a single trading session, AMD fell17 per cent, Nvidia declined three per cent, Palantir slid more than 11 per cent, SanDisk lost 16 per cent, CoreWeave fell more than 7 per cent, Oracle declined 4.5 per cent, and chip designer ARM fell almost 9 per cent on a softer-than-expected outlook.

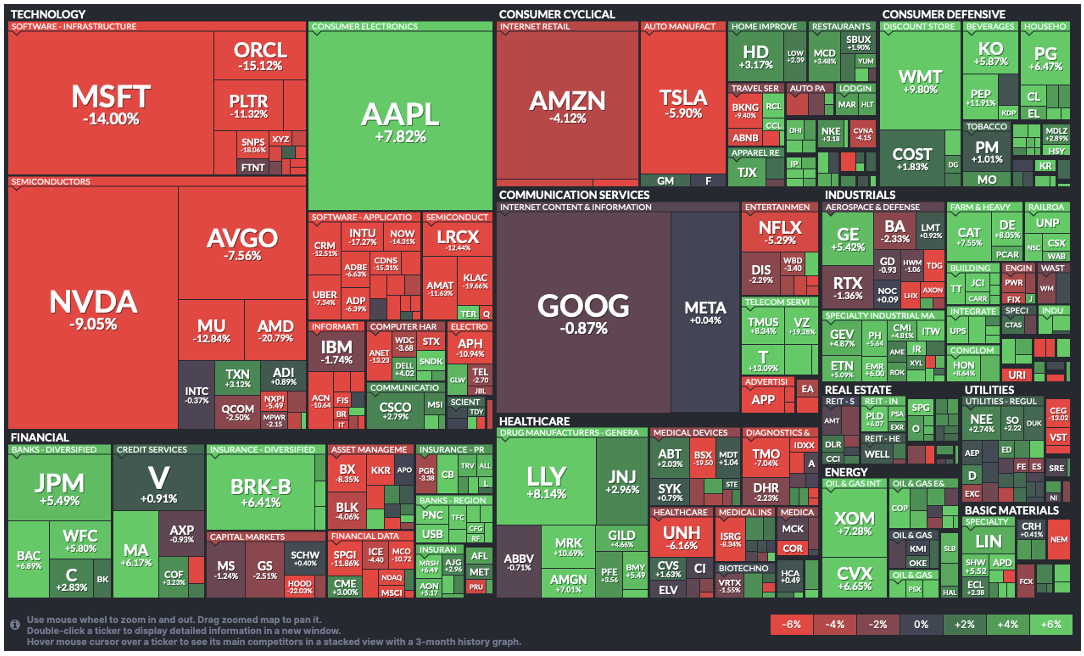

Figure 1. S&P500 Heat Map (1 Week to 4 February 2026)

Source: finviz

Sentiment changes are inevitable, unpredictable and help to explain why software companies are being sold because of the threat from AI, while the AI companies are being sold because the threat they pose isn’t transpiring fast enough.

The certainty of sentiment changes is what we can always rely on to pop a bubble. And as I have noted frequently in the past, bubbles can pop without a catalyst, just as this one appears to be deflating now. Jitters simply turn into a slump, and investors, licking their wounds, exclaim rhetorically, “But nothing’s changed!”

Saas – not so certain

One element of the regime shift in sentiment is the emergent concern that Software-and-a-Service (SaaS) business models could be upended by AI.

For more than a decade, enterprise SaaS was Wall Street’s golden goose. It was a world of a predictable, rising headcount, which in turn delivered more subscribers to SaaS businesses, and in turn, that reliability delivered ever-expanding multiples. Saas business were described as enjoying both the network effect and huge business ‘moats’. But as of February 2026, sentiment has changed.

What began as a nervous selloff appears to be turning into a durable, structural repricing. But really, as some analysts are now observing, the repricing probably began some time ago.

The WisdomTree Cloud Computing Fund (WCLD) might be down nearly 10 per cent in the last month, but since the debut of ChatGPT in late 2022, the Nasdaq 100 has more than doubled, while software stocks have gained only 19 per cent.

It’s easy to blame AI, but maybe SaaS has simply passed the middle of its S-Curve. The hyper-growth era is over, and sales efficiency has collapsed. Data suggests that between 2021 and 2024, public software firms increased their Sales & Marketing (S&M) spend while generating less incremental revenue. In other words they are hitting their saturation point and replacing customers who leave is much more expensive than keeping an existing customer.

And then there was the release back in January of Claude Cowork. Unlike previous AI tools, Cowork doesn’t just “help” a human; it builds the spreadsheets, browses the web, and organises files autonomously. And it was reportedly built in under two weeks.

Its release has ushered in a terrifying reality for legacy SaaS investors: What if the world is moving from a regime where software organises human labour (Software acting as a passive, rule-based tool, requiring human input to manage data, make decisions, and execute tasks), to a regime where software executes the work itself?

The shift from software that organises human labour (e.g., spreadsheets, project management tools, Customer Relationship Management (CRM) and Enterprise Resource Planning (ERP) systems) to software that executes work autonomously (e.g., AI agents, robotic process automation) is a significant paradigm change in the modern workplace. This transition, often termed the rise of Agentic AI or “services as software,” marks a move from tools that assist human workers to digital “teammates” that act independently to achieve goals.

And if a small AI team can recreate enterprise-grade workflows in days, the “moat” around a US$50 billion software company evaporates.

The sell-off we are witnessing may be an expression of that evaporation.

For twenty years, the math was simple: More Employees = More Licenses = More Revenue. Agentic AI voids the equation. If one AI agent performs the work of an entire department, the “per-user” pricing model becomes an existential liability for companies like Salesforce, Adobe, and Intuit. If customers start demanding Outcome-Based Pricing, the transition ensures the cannibalisation of existing revenue models.

In the old world humans were the “connective tissue” moving data between silos, for example from CRM to ERP. In the new world, AI agents act as the orchestrators, pulling and pushing data across systems without ever touching a user interface.

Conclusion

Not every company will lose, but not everyone will win either. That means the phase of the boom or bubble, the phase that priced every company’s shares like they were going to win, is over. What you are witnessing today is that shift, a shift that we explained last year, was inevitable.

The period we are now in, is an era we have seen following the advent of previous General Purpose Technologies (GPTs). It’s known as creative destruction. The disrupters will now be disrupted, and many are forced to disrupt their legacy business revenues in order to survive. And through that process, they emerge smaller than before.