Investor Insights

SHARE

Gold is king. But are you paying too much?

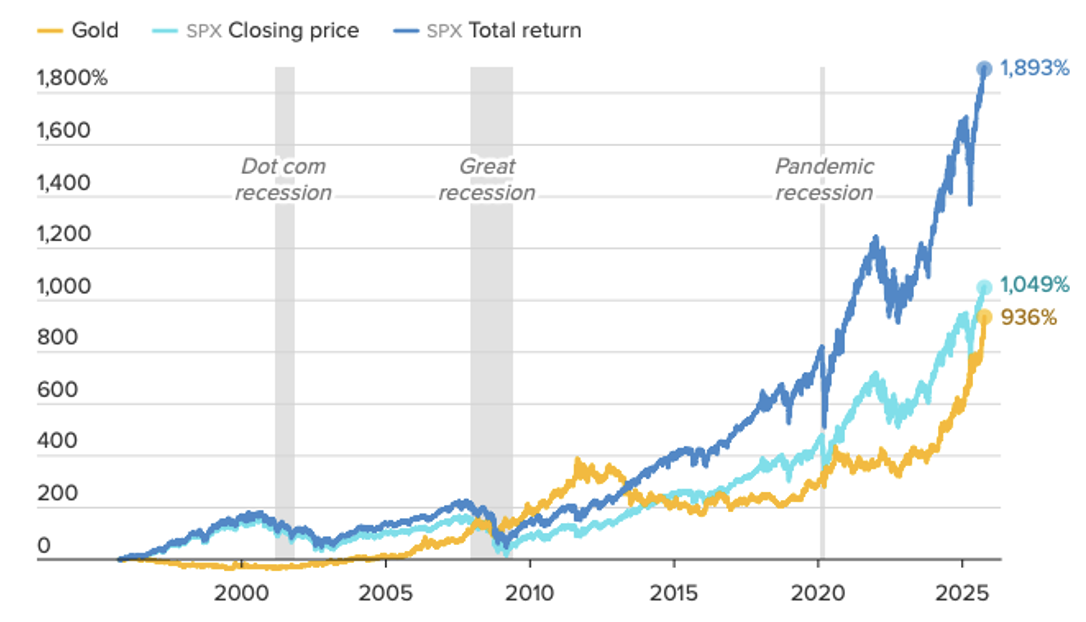

In recessions, it is said, ‘cash is king’. We mustn’t be in a recession because the price of gold has trounced cash.

In the last 10 U.S. trading sessions, six all-time highs have been registered in the gold price. And gold isn’t the only precious metal receiving a bid. Seven all-time highs have been registered in silver, six all-time highs in palladium, and three in platinum. As an aside, there have also been five new all-time highs in the S&P500 and one in Bitcoin. All have been on significant volume.

Figure 1. Gold price. September 29, 1995 – October 7, 2025

Source: Factset, CNBC

What’s the logic investors and consumers are applying to justify buying gold today? The top five reasons are:

- A hedge against inflation: Gold tends to retain or increase in value during periods of rising prices, as it can’t be printed the way fiat currencies can. For example, during the 1970s inflation spike, gold prices rose by over 2,000 per cent while the U.S. dollar lost purchasing power.

- A safe haven in economic uncertainty: In times of crisis, such as stock market crashes, recessions, or financial crises (e.g., the 2008 Global Financial Crisis or the 2020 COVID-19 pandemic), investors turn to gold’s promise of stability. In 2008, for example, gold gained five per cent, while the S&P 500 fell 37 per cent.

- Protection from currency devaluation: With fiat currencies, for example, the U.S. dollar, prone to weakening due to money printing to finance exploding levels of debt, gold is seen as a store of value.

- Geopolitical risk buffer: Amid wars, trade tensions, or political instability (e.g., Russia-Ukraine conflict driving gold to $2,000+ per ounce in 2022), demand surges. Gold’s track record has helped, with the yellow metal helping to preserve wealth during, for example, the 1973 oil crisis and Brexit.

- Central Bank and institutional buying: Over 20 per cent of global gold reserves are held by central banks, with net purchases of 1,000+ tonnes annually in recent years. China’s central bank officially purchased 44 tonnes in 2024 and 39 tonnes, so far, in 2025, bringing its official reserves to more than 2,300 tonnes. Meanwhile, Russia, for example, have been net buyers, holding over 35,000 tonnes collectively as of 2023 (IMF data). This institutional validation signals confidence.

Here’s the thing: these arguments were also promoted as reasons to buy gold in 2024, 2023 and even 2022.

A crowd draws a crowd, and new highs beget more buying, especially from those who hesitated in the past. Trends exist because information is distributed unevenly and because investors respond to the information at different speeds.

When prices move sharply upwards, as gold is doing now, it’s important to understand that this can be due to those previously hesitant buyers – who might have been waiting for a pullback – finally giving in (throwing in the towel) and buying out of a fear of missing out on further gains.

Given the logic behind today’s buying isn’t different from what it was three years ago, it’s more than likely we’re seeing the gold price react to this Fear Of Missing Out (FOMO) buying – an indication that the run might be nearing at least a short-term peak.

Figure 2. The queue at ABC Bullion Company, Sydney, 15 October 2025

Figure 2 shows a large queue forming at the ABC Bullion store in Sydney’s Martin Place, where people, reacting to news of all-time highs in the gold price, are waiting to purchase physical gold (and possibly silver) with Australian dollars. How can I tell they’re buyers rather than sellers? I asked.

This blog, however, is not a prediction of where the gold price will go. It is, instead, an alert about the frictional costs of buying physical gold from stores like ABC Bullion.

Figure 3. ABC Bullion Buy/Sell price physical gold, 9 am, October 15, 2025

Source: ABC Bullion daily email

If anyone in that queue buys an ounce of physical gold, they will need to pay $A6,599.70 at the time of writing. That is higher than the spot price of physical gold, which on the same day is $A6,423.30.

And if they walk out of the store, change their mind merely a second later, and re-enter the store, to sell the same ounce of gold, they will receive just $A6,230.30.

The difference represents an immediate loss of $369.40 or 5.5 per cent. That 5.5 per cent is risk-free revenue to ABC Bullion, and it is the ‘frictional’ cost of trading physical gold.

As an aside, ABC Bullion is a vertically integrated precious metals group founded in 1972 and half owned by Andrew, Paul and Phillip Cochineas. Other shareholders include CEO Janie Simpson, her father Francis Gregg, and presumably others. It retails through ABC Bullion, refines through ABC Refinery, sells into Hong Kong through Goldenage International, offers storage facilities through Custodian Vaults and manufactures the Melbourne Cup trophy through W.J. Sanders. The company reportedly generated A$18.5 billion in revenue in 2024 – more than Gina Reinhradt’s Hancock Prospecting.

Those revenues are at least partly thanks to the massive brokerage the company earns when people trade physical gold. For a buyer of a kilogram of gold bullion, the frictional cost is just under A$10,000.00.

My question is, why would you pay this if you can gain precisely the same gold exposure through an exchange-traded fund? Buying shares on the ASX-listed ETF GOLD would result in materially lower costs.

The ASX-listed GOLD ETF is managed by Global X, and the Australian administrator is Global X Management (AUS) Limited. The fund’s vault is based in London.

Each unit of the GOLD ETF represents a fraction of a fine troy ounce of gold. Buying 107.4 GOLD ETF units would provide equivalent exposure to an ounce of gold, requiring an outlay of A$6,331.

Importantly, however, a round-trip transaction on the ASX would incur brokerage costs of between $20 and $40 through Nabtrade or Commsec – a far cry from the $370 associated with buying and selling an ounce of physical gold at ABC Bullion.

A kilogram of gold is equivalent to 32.15 Troy ounces. Therefore, buying 32 Troy ounces through the GOLD ETF would incur an outlay of about A$203,000 and brokerage of just $220 to $240 through Commsec and Nabtrade. Double that for a round trip and it is still miles away from the $10,000 spread you’re handing over to ABC Bullion for the same transaction.

So why does anyone buy physical gold?

One reason explained to me is the belief that if anarchy were to break out in Australia, or the nation were invaded, our paper currency would be worthless and having a few ounces of gold would help keep the lights on and food on the table.

The issue with this idea is that in a lawless society, a gold hoard is likely to be stolen or violently appropriated from its holder. Indeed, having stores of physical gold is likely to be a liability rather than an asset in the scenarios contemplated by many who buy physical gold.

And so, buying physical gold is irrational on several fronts. Perhaps leave its accumulation to central banks and those commanding armies. And if your only reason for buying gold, is the belief its price is going to continue surging, buy the ETF rather than physical gold.