Investor Insights

SHARE

Aura private credit: Letter to investors 21 July 2023

The Aura Private Credit strategies partner with best of breed non-bank lenders who provide Australian SMEs with specialised funding solutions. These lenders utilise alternative security forms which the banks may be unable to use due to prudential regulations that govern the banking system in Australia. The Aura Private Credit strategies specifically finance pools of loans originated and managed by these lenders via securitisation warehouse facilities. As explored in previous communications, institutional investors view these asset types favorably, opting to invest through the same securitization warehouse structures as the Aura Private Credit team. We co-invest alongside both domestic banks, investment banks and other institutional investors. The Aura Private Credit team provides both wholesale and retail investors with curated access to this historically inaccessible asset class.

The loan and security types which the Aura Private Credit strategies hold exposure to through these partnerships include the following:

- Equipment & Machinery Finance

- Property (non-development) Backed Finance

- Livestock Finance

- Invoice Finance

This week we will take an in-depth review of Invoice Finance.

Invoice Finance: The Problem for Australian SMEs

Many Australian SMEs specialise in manufacturing and supplying certain goods, which are then sold to large well-established companies.

A real example of an SME we hold exposure to is a Victorian based SME who researches, manufactures and supplies vitamins for animals, both domestic and agricultural. This SME’s customers are large landowners, pet stockists (e.g., PetBarn, PetStock, etc) and wholesalers.

The problem arises from the mismatch in market power between the SME and the large purchasers of the SMEs products. These large purchasers can dictate payment terms which are unfavourable to the SME. I.e., they will not pay for the goods sold until 30, 60, 90 or 180 days after the purchase was made. This produces a meaningful mismatch in cashflows for the SME, where expenses related to the cost of goods sold are not offset by the revenue earned on the respective sale for some time. This mismatch materially impacts the growth rate of the SME.

Invoice Finance: The Solution

Invoice financiers, if they deem the lend appropriate, will typically advance between 70 per cent – 80 per cent of the invoice value to the SME, removing the delay in revenue from the sale date, allowing the SME to reinvest the capital in further production and growth initiatives.

Invoice Finance: Loan Recourse

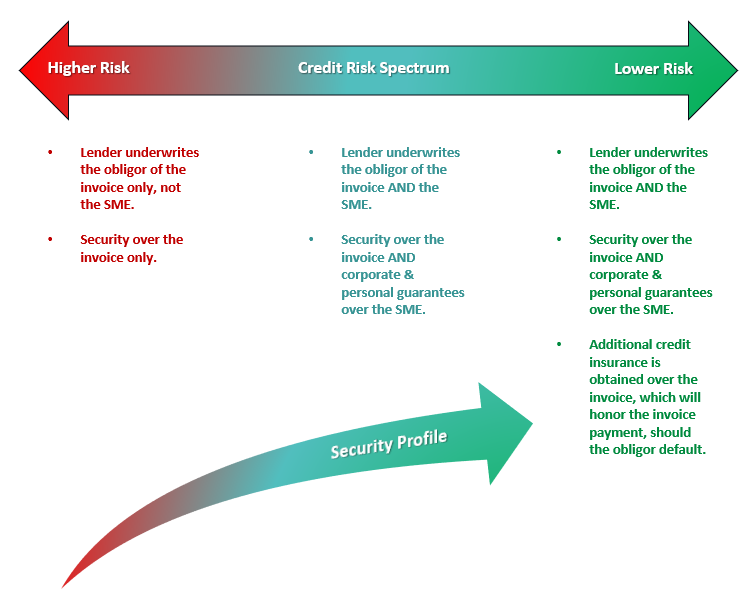

Not all invoice financiers are equal with respect to recourse supporting the loan. Recourse are the layers of security the lender has available to recoup the capital advanced to the SME borrower.

The minimum form of recourse, by definition, is the invoice, or the obligation to pay the invoice by the purchaser of the SMEs borrowers’ goods. This limits the recourse solely to the promise to pay by the obligor of the invoice with no additional recourse to the SME borrower.

The next step up in terms of recourse is a corporate and personal guarantee from the SME borrower. This means that in the case the obligor does not pay the invoice in full and the lender has not recouped principal and interest, the SME borrower corporate entity, as well as its directors in their personal capacity, are also liable to make whole on the loan.

The final form of recourse is credit insurance where an insurance provider, for a fee, will guarantee the payment of the invoice should the obligor fail to make payment of the invoice.

The invoice finance lenders the Aura Private Credit strategies partner with incorporate all three levels of recourse; first against the obligor of the invoice, then the insurance provider and finally, against the SME entity and the personal capacity of the directors of the SME borrower.

Investors’ capital in the Aura Private Credit strategies is further protected at a structural level via cash injected by the invoice finance lenders, which act as a first loss absorption piece, should the above levels of recourse prove insufficient. At the time of writing, these layers of recourse have been sufficient, with no impact ever occurring to our investors’ interest or capital.

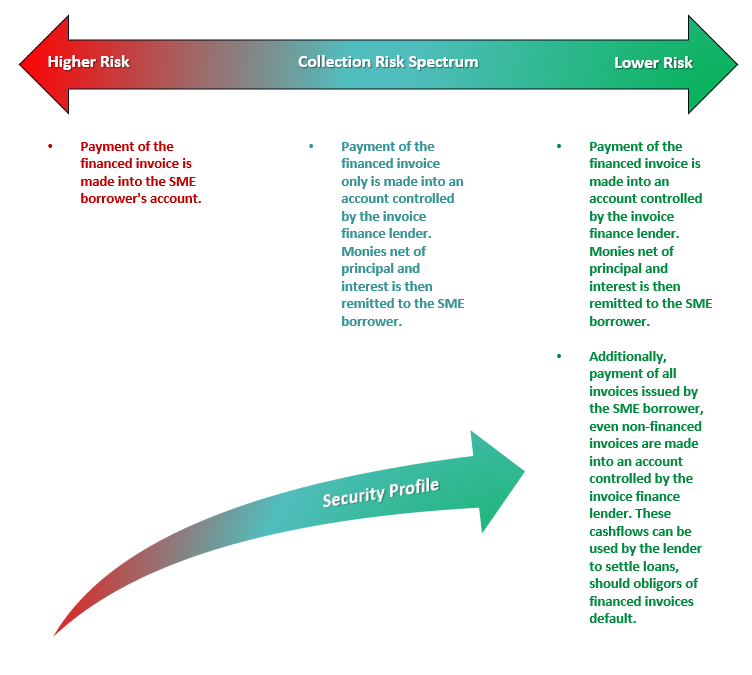

Invoice Finance: Collection Methodology

Another layer of risk mitigation is the collection methodology. The riskiest method is for the payment of the invoice to be made into the SME borrower’s account with payment of principal and interest subsequently made by the SME borrower to the lender. This creates collection / repayment risk as the borrower may use the funds for purposes other than repayment of the loan.

A more secure method of collection is for the payment of the invoice to be made into an account controlled by the invoice finance lender. This allows the lender to close out the loan before transferring the balance to the SME borrower.

The third and preferential method is for payments of all invoices issued by the SME borrower to be made into an account controlled by the lender. This method allows for overcollateralisation, where cashflows from non-financed invoices can be used to repay loans, should the obligors of the financed invoices default, or not pay in full.

The third and most secure method is that used by the invoice finance non-bank lenders that the Aura Private Credit strategies partner with. This structure fosters both trust and an ongoing commercial relationship between the SME borrower and the invoice finance non-bank lender.

The Aura Private Credit investment team view invoice finance favourably, both from a loan purpose perspective, enabling SMEs to turn over their capital more efficiently, facilitating further growth and, from a credit risk perspective, relying on five levels of risk mitigation:

- Payment of the financed invoice into an account controlled by the lender;

- Credit insurance which pays out the invoice value, should the obligor of the invoice default;

- Payments of non-financed invoices which also flow through an account controlled by the lender, which can be used to settle loans should the above layers prove insufficient;

- Corporate and personal guarantees further securing the loan by the capacity of the SME borrower’s corporate entity and its directors in their personal capacity; and

- Credit enhancement at a structural level in the form of cash injected by the invoice finance lenders which act as a first loss absorption piece, should all four of the above levels of recourse prove insufficient.

We hope this week’s piece proves useful and insightful. We look forward to exploring other loan and security types the Aura Private Credit strategies hold exposure to in future communications.