Investor Insights

SHARE

Super Retail Group is still winning despite a challenging retail backdrop

Another major retailer delivered its FY23 results providing a further data point for conditions in the consumer sector of the economy, which, it is worth remembering, represents a little over 50 per cent of the Australian economy.

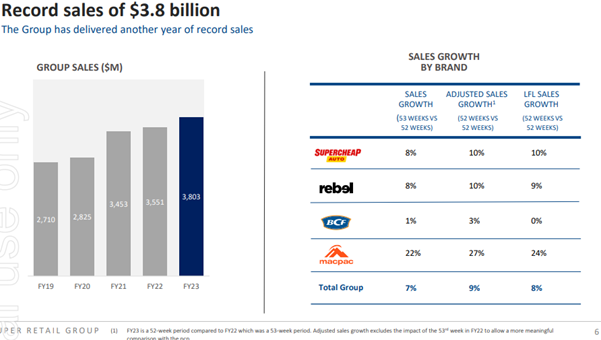

For FY23, Super Retail Group (ASX:SUL) – the owner of Rebel Sport, Supercheap Auto, Boating Camping Fishing and Macpac – delivered record sales, while proving to be a much more resilient, efficient and defensive business than some investors feared.

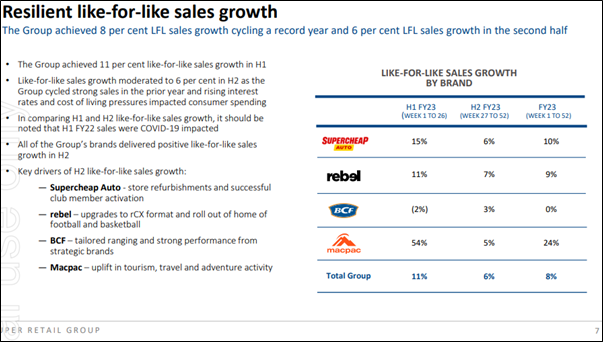

The company delivered above consensus-estimated like-for-like sales, reporting growth of eight per cent. Revenue in the second half of 2023 was, however, four per cent below consensus, perhaps reflecting rising cost of living pressures, including higher interest rates, which would have weighed on the consumer.

Source: Super Retail Group FY23 results presentation

Like-for-like sales grew for each brand, although the pace of growth slowed in the second half. Again, this could be due to the rising cost of living and also because the company was cycling strong sales growth numbers in the previous corresponding period, which took in COVID reopening.

By brand, SuperCheap Auto’s (the largest brand by sales) like-for-like sales grew 10 per cent, reflecting growth in transaction volumes and higher average transaction value. At Rebel, like-for-like sales grew nine per cent, reflecting a higher average transaction value. Over at Boating Camping Fishing, like-for-like sales were flat. In contrast, Macpac, which is a relatively small portion of group sales (six per cent), saw sales growth supported by an increase in travel and outdoor adventure associated with reopened borders.

Source: Super Retail Group FY23 results presentation

On an earnings before interest and tax (EBIT) basis, Supercheap rose 8.1 per cent to $219.4 million, Rebel was up four per cent to $161.8 million, BCF declined 11.5 per cent to $61.0 million (but much better than the market’s feared $54 million), and Macpac rose 52 per cent to $30.4 million.

Conditions in the first months of the new 2024 financial year appear to suggest some weakness in the pace of like-for-like sales growth, with Supercheap growing at three per cent, Rebel and Boating Campaing Fishing going backwards by one per cent, and Macpac declining by nine per cent.

On a group level however, like-for-like sales are flat, which is very encouraging given the company is cycling 17 per cent growth in the prior corresponding period. The numbers suggest Supercheap Auto’s target DIY mechanic market is the source of some defensiveness. As economic times get tougher, a larger and increasing number of car owners wash, wax, polish and repair their own cars.

As an aside, with Rebel, Boating Camping Fishing and Macpac going backwards, it suggests consumer demand for apparel may be contributing.

The outlook for the year sees consensus estimates predicting FY24 revenue falling 4.5 per cent, EBITDA earnings before interest, taxes, depreciation, and amortization falling as much as 10 per cent and EBIT falling 18 per cent from the FY23 reported numbers, as a result of a circa 100 basis point rise in the cost of doing business (CODB), primarily through wage and rental increases as well as a relaunched loyalty program for Rebel. The company has guided analysts to expect an increase in the CODB.

Gross margins should be supported by less promotional activity, and falling international (China) sourcing and freight costs, and these should offset any adverse impacts from a weaker currency. The company suggests a gross margin of 46 per cent is not unreasonable, and this compares to a pre-COVID gross margin of circa 45 per cent. We note group gross margins declined in FY23 by 60 basis points to 46.2 per cent as promotional activity returned to normal.

Just as JB Hi-Fi demonstrated its flexibility in optimising inventory and reducing it amid, or ahead, of slowing demand, Super Retail Group appears to have done likewise. FY23 group inventory days declined by more than 12 days 140 days and led by Supercheap Auto and Boating Camping Fishing inventory. The increase of inventory at Rebel was the result of a normalisation from a lower-than-normal base.

The positive from this development is that pressure to move stock by discounting through promotional sales is lower and analysts will like the lower risk of negative operating leverage (de-leveraging) surprises.

Supercheap’s balance sheet is strong. With lower inventory, net cash of $192 million, debt to EBITDA expected to be less than 0.5x in 2024, and cash conversion above 85 per cent, the company has little direct exposure to rising interest rates, even with expected capex of $150 million for 2024.

The strong balance sheet was also reflected in the company paying a special dividend of 25 cents, and it certainly appears as though the company has the capacity to do more.

Despite cycling record sales in FY23, many analysts are forecasting group FY24 sales to be up again in 2024 in the low single digits. And this is despite sales declines for other discretionary retailers. The optimism is reflected in the share price, which on the day of the release was up a cumulative 28 per cent from its June 2023 lows.

The company is likely to be a preferred and perhaps defensive retail exposure for professional investors, given its superior operating performance and robust balance sheet. Super Retail Group has certainly shown investors that it’s a more efficient operator and a less cyclical-than-feared business.

The company has indicated CODB outlook is more challenging, and at the same time, petrol prices have risen to a record and employment conditions aren’t likely to get any stronger and could weaken. It is also unlikely the material growth in spending last year on recreation will be repeated again this year. But we remind investors about the counter cyclical nature of Super Retail Group’s Supercheap Auto business.

There was little to fault in Super Retail Group’s result. Some investors will conclude the company’s best is in the near-term past, while others will assess the company’s defensive characteristics, strong balance sheet and room for further capital management (special dividends), relative to other retail exposures and assign preferred status to the stock. The outcome of the trading that reflects those dynamics will ultimately determine where the shares settle.

The Montgomery Small Companies Fund owns shares in Super Retail Group. This article was prepared 22 August 2023 with the information we have today, and our view may change. It does not constitute formal advice or professional investment advice. If you wish to trade in Super Retail Group you should seek financial advice.