Investor Insights

By , Polen Capital

SHARE

March quarter update on the Polen Capital Global Growth Fund

2023 began with a strong start as the U.S market tended to reward quality fundamentals in January. Concerns around inflation and central bank policy re-emerged in February when the U.S. Federal Reserve Chairman Powell remarked that rates may be kept at “a restrictive level for a period of time.” Despite the acute banking crisis impacting countries around the world, which we touch on below, quality fundamentals appeared to be, once again, rewarded in March.

For the March 2023 Quarter The Polen Capital Global Growth Fund increased 12.74 per cent, while the benchmark rose 8.65 per cent, for outperformance of 4.09 per cent.

So, what do we mean by quality fundamentals? We primarily are referring to businesses that have competitive advantages that allow them to generate high-quality, underlying earnings per share growth. And, by high-quality earnings growth, we mean earnings growth manifesting from organic sales and often margin expansion that come from cost efficiencies and economies of scale. Other earmarks of quality, to us, are high returns on capital and strong balance sheets. These aspects of what we define as quality, make up our criteria for investment candidates.

Quality fundamentals tended to not be rewarded in 2022, with price multiples falling by over 30 per cent for many of what we see as the highest-quality businesses, despite them being able to generate solid earnings growth. During the first quarter of 2023, the market witnessed many of our companies continuing to generate the outsized underlying earnings growth we anticipated. In contrast to 2022, the stocks of these businesses were rewarded, driving outperformance. We tend to perform best during periods where fundamentals are recognized in returns. More depressed or exuberant environments, where stocks move largely based on sentiment, tend to be periods where our relative performance can be less predictable. For long-term business owners like ourselves, we expect fundamentals to outweigh sentiment over time.

Turmoil in the global banking sector served as a reminder as to why we tend to not invest in traditional, commoditised banks. In fact, we have never invested in a bank in the history of the Portfolio. Banking is an important service for societies around the world, but one important aspect of its business model has kept us out of the industry since our firm’s founding in 1989.

Receiving deposits and then investing those very same deposits creates an inherent risk of a timing mismatch should depositors suddenly demand their money back. When this timing mismatch is combined with the use of this leverage to achieve returns, banks runs are always a possibility. If history is a guide – especially recent history – runs are highly probably at some point over long periods of time. They also tend to be quite unpredictable. Evidence of this unpredictability lies in the fact that First Republic Bank received a “clean bill of health” from its auditors just days before the crisis set in.

Credit Suisse’s demise highlights that this was not just a U.S.-centric issue nor a smaller-regional-bank issue. We have a long history of avoiding situations where a small chance of permanent loss of capital exists, and we will maintain this avoidant posture as long as we are managing your money. While new regulations and technological innovations may come to the banking sector, human behaviour changes at a glacial pace. Not owning banks contributed roughly 70-75 basis points to our relative outperformance this quarter.

Geographically, we were pleased to see China continue to reopen its economy. While we do not have any direct investment in Chinese-domiciled companies, this reopening boosts sales for many of our globally dominant and scaled holdings. That said, we do remain highly aware of the simmering tensions between the U.S. and China.

Our overarching goal for the Polen Capital Global Growth Fund is to construct a portfolio that is comprised of the highest-quality, most competitively advantaged businesses around the globe. Our aim for the aggregate of these businesses is for them to collectively generate roughly mid-teens underlying earnings per share over long periods of time. We believe that if we purchase these businesses at fair prices, over time, the stock prices, and thus, your returns, will approximately match the earnings growth of the Portfolio.

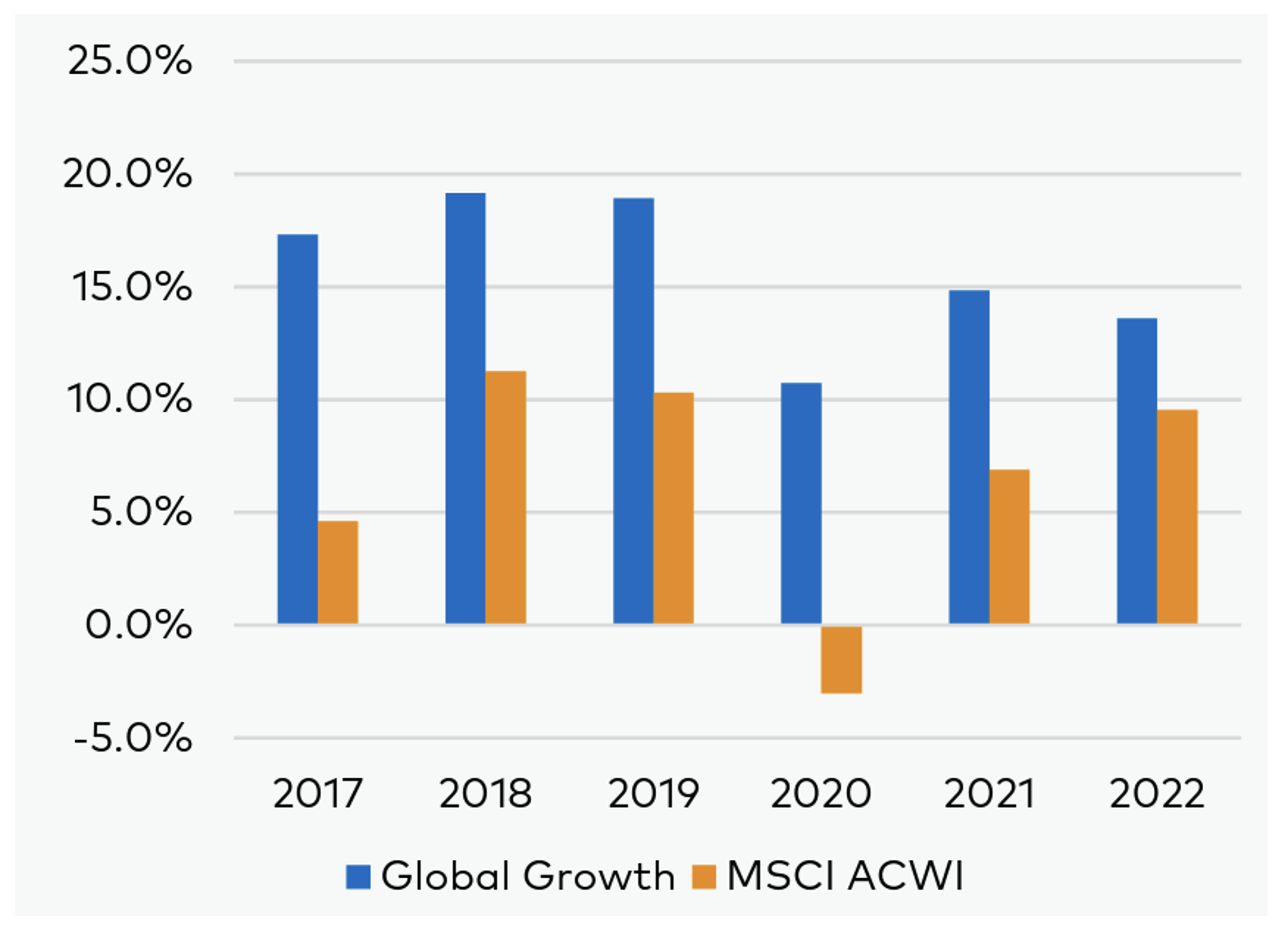

Ware on track and meeting this goal from an underlying earnings growth perspective. As depicted in Figure 1, the three-year rolling average earnings per share (EPS) growth at the end of 2022 is near 15 per cent, compared to roughly 10 per cent for the Index. We’ve also seen consistent double-digit earnings per share growth through challenging periods, which cannot be said for the Index.

Figure 1: Portfolio EPS Growth vs. Index: 3-Yr Rolling Average

Sources: Polen Capital, Bloomberg. Earnings per share (EPS) methodology for Global Growth is consistent with EPS growth methodology for other index providers. Please contact Polen Capital for more details. There is no guarantee that performance will follow earnings growth.

Portfolio Performance & Attribution

Both on an absolute and a relative basis, the top three contributors during the quarter were Align Technology, Microsoft and SAP and the leading absolute detractors that we own were Abbott Laboratories, ADP and CSL.

Align Technology

Align Technology had a difficult 2022 as it lapped extremely high prior year comparables. The company delivered a steady quarter recently, and the business continues to deliver as expected. On a three-year basis, Align has grown case shipments over 15 per cent and net revenues at 16 per cent. The pandemic has given the company a chance to highlight its benefits relative to wires and brackets, and doctors are responding. Recently, Align disclosed that the Invisalign treatment allows patients to go through the orthodontia process five months faster than braces, with roughly 35 per cent fewer visits to a doctor. While Align continues to stay ahead of clear aligner competition through sales, marketing, and research and development (R&D), research indicates that the real fight is against braces, and we believe it is better positioned than ever to win market share.

Microsoft

Microsoft’s fundamentals have largely stayed intact despite the headwinds many technology companies are facing due to the macroeconomic environment. While growth has decelerated below our longer-term target (we expect low-double-digit revenue growth over the next 3-5 years), we believe the deceleration should prove to be ephemeral. Azure and Office Commercial remain bright spots, while Windows original equipment manufacturer (OEM) has been and will continue to be a drag over the next few quarters. With respect to Azure, even at a decelerated rate, the business continues to grow well. After eight consecutive quarters of Azure’s top line growth being in the mid-to-high-40s range, over the last two quarters, growth has been 42 per cent and 38 per cent, respectively. Microsoft is a scaled business with multiple and interlocking competitive advantages, and we believe the company will compound at high rates for a long period of time.

SAP

SAP has a long-term vision for a cloud transition, and this strategy is beginning to bear fruit. The cloud backlog and cloud sales are both accelerating, as well as margins inflecting higher in the most recent quarter. It appears that the company is past the tipping point with respect to the transition, and we believe the growth is proving to be durable, despite the macroeconomic environment.

SAP is trading at a fair price, according to our analysis, while offering mission-critical

software products with more than 80 per cent recurring revenue. We think the company can grow free cash flow per share in the mid-teens. even in a tough environment.

Apple and NVIDIA

Not owning Apple and NVIDIA detracted from our relative performance. With respect to Apple, we have not felt that the combination of growth available and the valuation made for one of our best ideas. Concerning NVIDIA, while there seems to be strong demand for data center chips, the valuation and lack of clarity around pace and magnitude of that growth has kept us at bay to date.

Abbott Laboratories

Abbott Laboratories is expected to see roughly $6 billion in COVID test sales evaporate this year, creating a headwind for margins and underlying earnings per share. As long-term owners of the business, these test sales were never part of our original investment case. The core business, our primary focus, has a clear path of growing high single digits in 2023 with durable growth beyond, in our view. We believe the current price of 23x NTM P/E (forward next twelve months price-to-earnings ratio), while reasonable, is also misleading considering earnings this year will be artificially depressed because of the drop in COVID testing sales. On normalised earnings, the price is lower. We anticipate underlying earnings per share (EPS) growth of at least low-teens over the next three to five years.

Outlook

We are always pleased to be in markets where fundamentals matter as opposed to those driven by extreme emotions that can create wide gaps between businesses and their stocks. While it is too early to tell, we appreciate that the first quarter was generally driven by fundamentals. Going forward, markets are still in a position to be heavily influenced by central bank activity, and we do not pretend to know what that activity is likely to be. That said, we are confident in the current Portfolio and note that, due to 2022, our companies are trading at very reasonable prices.

If you would like to learn more about the Polen Capital Global Growth Fund, please visit the fund’s web page to learn more: Polen Capital Global Growth Fund

Past performance is not an indicator of future performance. Returns are not guaranteed and so the value of an investment may rise or fall.

This report has been prepared for the purpose of providing general information, without taking into account your particular objectives, financial circumstances or needs. The issuer of units in the Polen Capital Global Growth Fund (ARSN: 647 518 723) is the Fund’s responsible entity Fundhost Limited (ABN 69 092 517 087) (AFSL: 233045). The Product Disclosure Statement (PDS) contains all of the details of the offer. Copies of the PDS and Target Market Definition (TMD) are available from Montgomery Investment Management, contactable on (02) 8046 5000 or at www.montinvest.com and at https:// fundhost.com.au/ An investment in the Fund must be through a valid paper or online application form accompanying the PDS. Before making any decision to make or hold any investment in the Fund you should consider the PDS and TMD in full. The information provided is general in nature and does not take into account your investment objectives, financial situation or particular needs. You should consider your own investment objectives, financial situation and particular needs before acting upon this information and consider seeking advice from a licensed financial advisor if necessary.You should not base an investment decision simply on past performance. The investment returns of the Fund are not guaranteed, and so the value of an investment may rise or fall.