Investor Insights

SHARE

Aura Private Credit letter to investors: 28 July 2023

Last week we commenced a series exploring the different loan and security types of the Aura Private Credit strategies hold exposure to via relationships with non-bank lenders we see as best of breed. These lenders provide Australian SMEs with specialised funding solutions, utilising securitisation warehouse structures, provided by the Aura Private Credit strategies, as investment vehicles.

The loan and security types which the Aura Private Credit strategies hold exposure to through these vehicles include:

- Equipment & Machinery Finance

- Property (non-development) Backed Finance

- Livestock Finance

- Invoice Finance

Last week we explored Invoice finance. This week we will take an in-depth review of Livestock finance.

Livestock finance: The problem for Australian farmers

A recurring theme in this series is the banks’ inability to utilise security forms other than property for loans to Australian SMEs, due to prudential regulations that govern the banking system in Australia. This is again the case for Australia’s farming SME businesses where traditional bank lending practices are modeled on lending against the land assets of farmers, overlooking alternate security forms, such as livestock.

Livestock finance: the solution

Livestock financiers, if they deem the loan appropriate, will typically advance a portion of the purchase price of livestock. Security is taken over the financed livestock in addition to corporate and personal guarantees over the farming business and its directors in their personal capacity, which often encompasses the land assets of farmers. This free’s up the farmer’s capital, enabling the purchase of a greater volume of livestock, expanding the productive capacity of the farming operation. Farmers will allow the livestock to graze and fatten over a typical 7–9-month time frame, increasing in value, before selling the fattened livestock for a profit and settling the underlying loan with the livestock financier.

Livestock finance: security

Liquidity

Livestock loans are typically required be repaid within 12 months with cash or sale of the livestock assets, which are a highly liquid form of collateral with weekly livestock sale opportunities.

Livestock security

Livestock Loans are secured against the purchased livestock with rights granted to the financier to enter a property and take possession of livestock. In addition, guarantees are taken at both the corporate and director level providing livestock financiers with security over other assets of the SME borrower and directors in their personal capacity in the event of default.

All livestock in Australia must be tagged with an approved NLIS tag. NLIS is the National Livestock Identification System. Whenever livestock are sold or transported, their location and ownership is updated in the NLIS. This allows livestock financiers to track the movement of assets automatically in real time, through integration with the NLIS database. There are significant penalties prohibiting livestock transport agents, meat processors and saleyards from accepting stock that isn’t NLIS tagged and tracked. Failure to record a movement may result in a fine being issued by the relevant State/Territory NLIS authority or the Federal Department of Agriculture. Extreme cases of non-compliance may also lead to criminal prosecution.

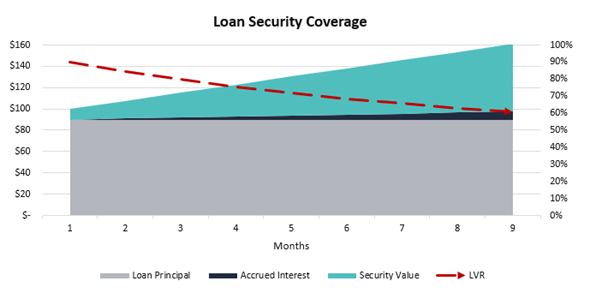

Loan to value

Livestock naturally increases in value as it grows to its target selling weight. This is an important point to note and differentiates this collateral from many other forms of asset financing where the assets naturally depreciate, such as car loans or business equipment. As animals grow, the livestock financier’s security position improves with the effective loan to value ratio (LVR) decreasing over time. Typically, we see effective LVRs decrease from circa 90 per cent at drawdown to circa 60 per cent over the life of a loan assuming stable prices.

Livestock finance: purchase and funding process

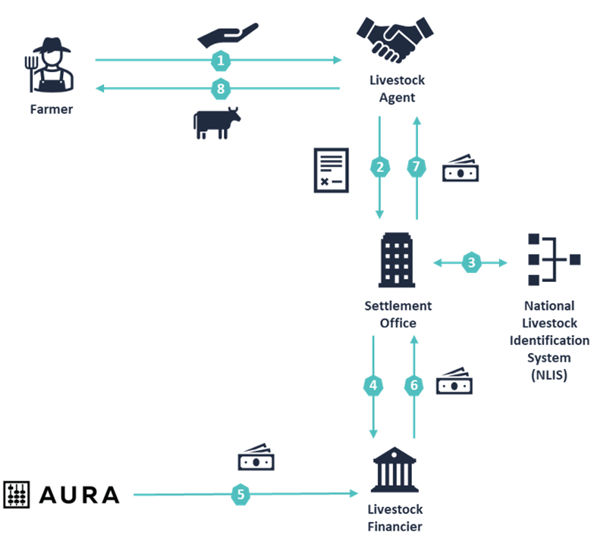

Key features of livestock finance are the separation of the farmer or SME borrower and the financier. Third party livestock agents interact with livestock financiers through a settlement office on the borrower’s behalf, ensuring perfection of security in favour of the financier and that loan funds never touch the borrower’s bank account.

A typical livestock purchase follows the below process:

- Farmer requests livestock be purchased through the agent and invoice funded by the livestock financier.

- Agent provides loan drawdown request, invoice, NLIS tag numbers and 10 per cent of the purchase amount be provided by the farmer to the settlement office.

- Settlement office vets for discrepancies & inputs into livestock system. Livestock system has direct interface to NLIS for monitoring.

- Livestock financier advised of loan drawdown for approval via livestock system. Farmers 10 per cent amount sent.

- Livestock financier reviews loan application for adherence to Aura Private Credit parameters, approves the loan and draws from Aura Private Credit securitisation warehouse for funding.

- Loan amount sent through to settlement office. Farmers 10 per cent amount allocated to loan (90 per cent LVR).

- Settlement office pays agent’s invoice with loan drawdown amount.

- Farmer and livestock agent can see confirmation of drawdown through online portal and are granted the financed livestock.

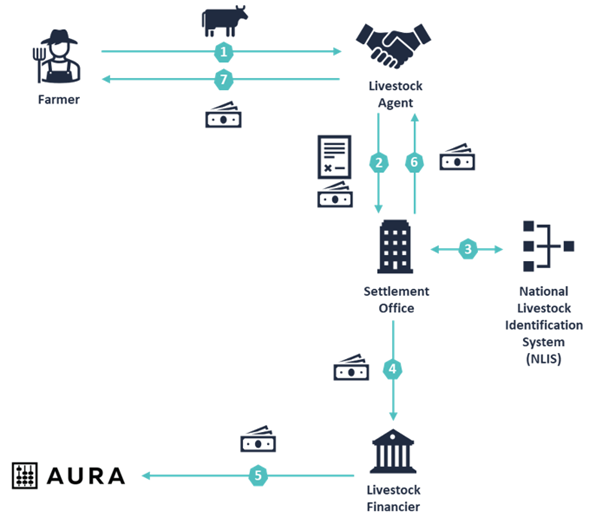

Invoice finance: sale and collection process

A typical livestock sale follows the below process:

- Farmer arranges with agent for livestock to be sold.

- Settlement office receives sale contract and funds from agent.

- Settlement office confirms sale details are updated in livestock system.

- Livestock financier receives payment for livestock sold from settlement office.

- Aura Private Credit securitisation warehouse receives principal and interest payment.

- Agent paid any remaining funds from settlement office.

- Livestock agent pays farmer profits.

The Aura Private Credit investment team view livestock finance favourably, both from a loan purpose perspective, enabling SME farmers to free up working capital and expand their productive capacity, facilitating further growth, and, from a credit risk perspective, relying on four levels of risk mitigation:

- Strong oversight over funding and collections processes with loan funds never touching the borrower’s bank account;

- Livestock security which increases in value as the livestock fattens, resulting in an improving LVR over the life of the loan and protecting against price volatility;

- Corporate and personal guarantees further securing the loan by the capacity of the SME borrower’s corporate entity and its directors in their personal capacity; and

- Credit enhancement at a structural level in the form of cash injected by the livestock financier which act as a first loss absorption piece, should the above levels of recourse prove insufficient.

We hope this week’s piece proves useful and insightful. We look forward to exploring other loan and security types of the Aura Private Credit strategies hold exposure to in future communications.

You can view last week’s blog here:

Aura private credit: Letter to investors 21 July 2023