Investor Insights

SHARE

A high-conviction long/short strategy for diversified returns and growth

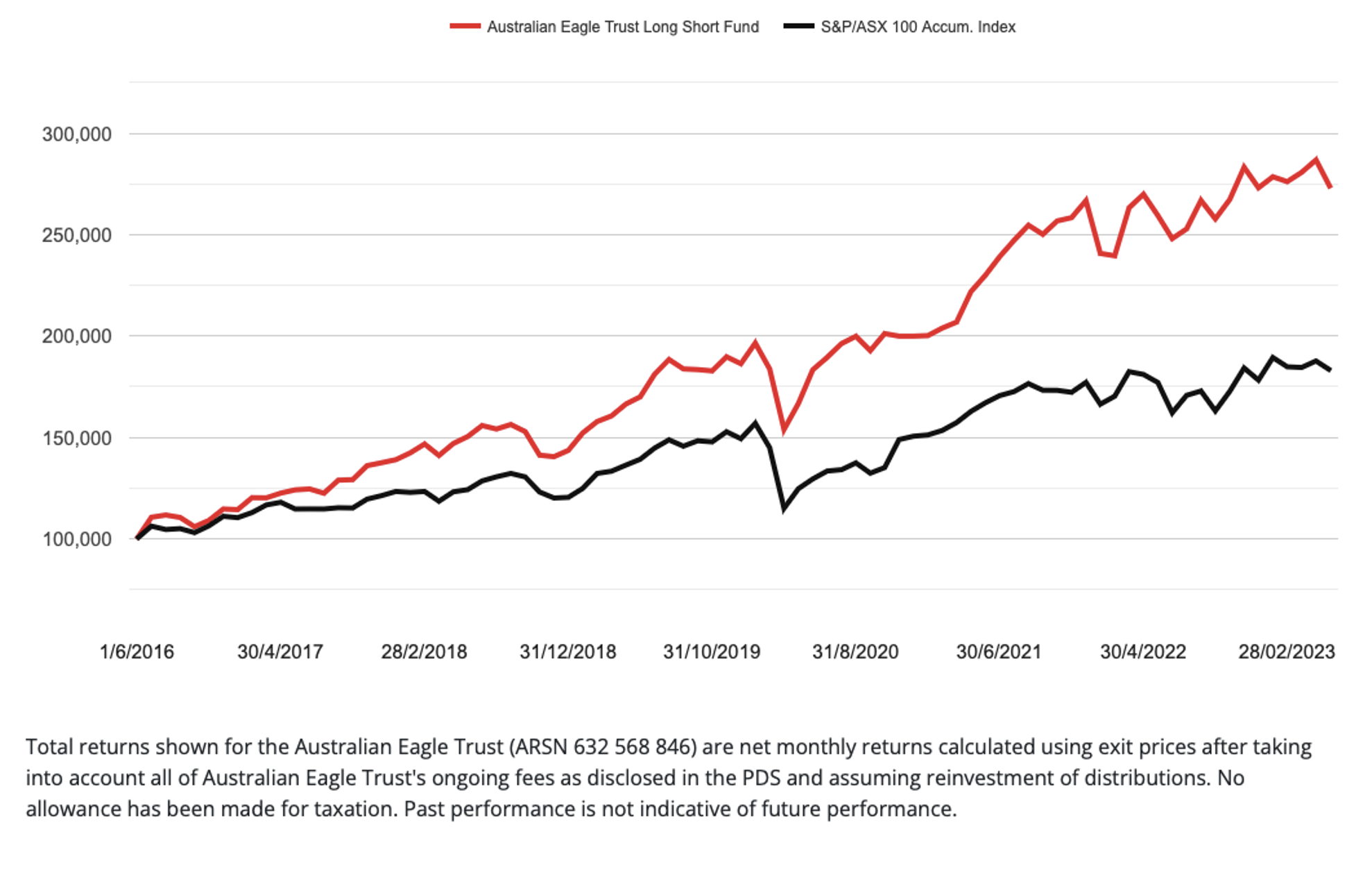

Recently, Zenith Investment Partner published their fund report for the Australian Eagle Trust Long Short Fund (The Fund), reiterating their RECOMMENDED rating. With their updated rating for 2023 investors might be interested in The Fund’s features and benefits, commencing with its historical performance (Figure 1).

Figure 1. Australian Eagle Trust Long Short Fund performance 1 July 2016 – 31 May 2023

Australian Eagle Trust Long Short Fund investment opportunities

The Fund, managed by Australian Eagle Asset Management, offers an opportunity for investors to participate in a distinct investment approach and capitalise on its long/short active extension strategy.

Some long/short equity strategies are also known as ‘active extension’ strategies. The manager shorts some stocks, reinvesting the proceeds in additional long positions to achieve a net stock exposure of around 100 per cent.

This better expresses Australian Eagle Asset Management’s highest conviction stock ideas by increasing underweight and overweight positions relative to the index. They ‘short’ absolutely and relatively lower-quality companies – those with weaker fundamentals and outlooks – and use the proceeds to increase their ‘long’ positions in the highest-quality companies.

The Fund maintains a long exposure of 150 per cent and a short exposure of 50 per cent, providing a unique way to capture potential gains and hedge potential losses while offering a potentially diverse return profile compared to most long-only Australian equity funds.

Dedicated and experienced team

At the heart of Australian Eagle Asset Management is a seasoned team led by Sean Sequeira, an industry veteran with over 31 years’ experience, offering expertise and confidence in The Fund’s management. The team follows a collegiate approach to decision-making, enhancing accountability and capitalising on diverse perspectives.

Unique investment philosophy

Australian Eagle Asset Management’s investment philosophy revolves around identifying quality, undervalued stocks with a potential catalyst for change that other investors underappreciate and therefore hasn’t yet been factored into the share price. By focusing on these earnings ‘catalysts’ within the S&P/ASX 100 Index, Australian Eagle Asset Management uncovers transformational growth opportunities in high-quality, undervalued companies. This approach has been consistently applied since the strategy’s inception in July 2016, resulting in attractive investment outcomes.

Equally unique investment process

The team conducts semi-annual quality assessments based on ten equally-weighted qualitative attributes, encompassing management effectiveness, industry position, growth prospects, financial health, and more. This detailed process ensures only companies with a quality score of 30 (out of 50) or higher are considered for the long portfolio, while those below 30 forms the short portfolio.

Stocks with higher quality scores have demonstrated a tendency to outperform over the long term, emphasising the effectiveness of Australian Eagle Asset Management’s quality-based selection process. Furthermore, Australian Eagle Asset Management’s sum-of-the-parts valuation method helps identify key business drivers within each company and facilitates accurate valuation of the stock.

Australian Eagle Asset Management’s approach also includes the identification of potential investment catalysts that could significantly impact a stock’s value within six to nine months. This ensures the selected stocks have strong fundamentals and potential triggers for accelerated growth.

Australian Eagle Asset Management prefers stocks with no identified positive catalyst for the short portfolio, aligning with the fund’s hedging strategy.

The long portfolio typically holds between 25 and 35 stocks, while the short portfolio includes 15 to 25 positions from the S&P/ASX 100 Index. This balanced approach contributes to the fund’s diversification benefits.

Risk diversification

Australian Eagle Asset Management’s long/short strategy allows greater flexibility to meet long-term investment objectives and profits from the purchase of desirable companies and from the sale of companies expected to fall in price or simply underperform those that have been purchased. The combination provides a unique return profile.

The overall net market exposure remains around 100 per cent, aligning with the risk profile of the Australian equity market and means investors have the same exposure to the market as investing in a long-only equity fund. This strategy, however, offers potentially higher returns to investors who can tolerate higher levels of volatility.

Transparent portfolio construction

Australian Eagle Asset Management employs a transparent portfolio construction process, investing in stocks rated three to five on their proprietary investment grade rating system. This rating system evaluates stocks based on quality, valuation, and potential catalysts for change, providing a rigorous and objective analysis. Short positions usually consist of lower-rated stocks, enhancing potential returns in falling markets.

Leveraging partnerships

Australian Eagle Asset Management’s distribution partnership with Montgomery Investment Management is a strategic move that allows the Australian Eagle Asset Management team to concentrate on research and portfolio management while leveraging Montgomery’s distribution capabilities. This enhances the Fund’s operational efficiency and market reach, leading to potential growth in the business, which should provide comfort to investors and researchers.

ESG

Australian Eagle Asset Management has demonstrated its commitment to responsible investing, incorporating environmental, social, and governance (ESG) considerations into its research process. Zenith has assigned the Fund a responsible investment classification of “Aware,” signalling that the Fund is conscious of ESG matters and incorporates them into its investment decisions.

Investment considerations

Investors should note that while the Fund offers the potential for high returns, it comes with a higher degree of volatility. It’s best suited for investors with a long-term outlook who can tolerate higher risk. The Fund does not specifically target income returns, with distributions typically made annually. The Fund’s role in a portfolio is best served by blending it with other Australian equities funds for a more diversified exposure.

The level of expected turnover should be expected to be high. Still, most of the turnover is driven by the short portfolio, which tends to be made up of smaller positions. Long positions tend to be larger and held for a longer period of time. Consequently, capital gains are likely to be eligible for the capital gains tax discount. Moreover, a significant component of the Fund’s returns is expected to be delivered via capital appreciation in the unit price rather than through the realisation of capital gains. Therefore, the Fund may appeal to investors in both high and low tax brackets, given the relatively tax-efficient outcomes it offers.

The Fund’s management cost stands at 1.39 per cent per annum with a performance fee of 20.5 per cent. Though it is slightly higher than the industry average and Zenith believes the Fund’s fee structure is expensive, relative to peers, given its stated objectives. However, Zenith believes the fees paid over the past three years (ending 30 June 2022) are attractive given the Fund’s risk-adjusted performance over the same period (15.64 per cent per annum from 1/7/16 to 31/5/23, for the out-performance against the S&P/ASX 100 Accumulation Index of 6.50 per cent per annum).

Australian Eagle Asset Management’s unique investment approach, dedicated team, and rigorous process, are combined in the Australian Eagle Trust, presenting a compelling investment opportunity for investors seeking diversification and potentially higher returns over the long term.

You can learn more about the Australian Eagle Trust Long Short Fund here.

Past performance is not indicative of future performance

The issuer of units in Australian Eagle Trust (ARSN 632 568 846) (Trust) is the Fund’s responsible entity The Trust Company (RE Services) Limited (ABN 45 003 278 831) (AFSL 235150), part of Perpetual Limited. Australian Eagle Asset Management Pty Limited (ABN 89 629 484 840) is the investment manager of the Trust. The Product Disclosure Statement (PDS) contains all of the details of the offer. Copies of the PDS and Target Market Definition (TMD) are available to download from the fund’s web page which you can access here: Australian Eagle Trust Long Short Fund.

Zenith Investment Partners:

The Zenith Investment Partners (ABN 27 103 132 672, AFS Licence 226872) (“Zenith”) rating (assigned June 2023) referred to in this piece is limited to “General Advice” (s766B Corporations Act 2001) for Wholesale clients only. This advice has been prepared without taking into account the objectives, financial situation or needs of any individual, including target markets of financial products, where applicable, and is subject to change at any time without prior notice. It is not a specific recommendation to purchase, sell or hold the relevant product(s). Investors should seek independent financial advice before making an investment decision and should consider the appropriateness of this advice in light of their own objectives, financial situation and needs. Investors should obtain a copy of, and consider the PDS or offer document before making any decision and refer to the full Zenith Product Assessment available on the Zenith website. Past performance is not an indication of future performance. Zenith usually charges the product issuer, fund manager or related party to conduct Product Assessments. Full details regarding Zenith’s methodology, ratings definitions and regulatory compliance are available on our Product Assessments and at Fund Research Regulatory Guidelines