Investor Insights

SHARE

Risk perception for the modern investor

Investing is a commitment to a lifetime of learning. In an ever-evolving world, there are endless opportunities to improve your understanding of any subject. While personally I am still shifting up the gears as I move through this challenge, the most resounding message to emerge from experts such as Graham, Buffett, Munger and Marks is that a comprehensive risk management framework is fundamental to long-term success.

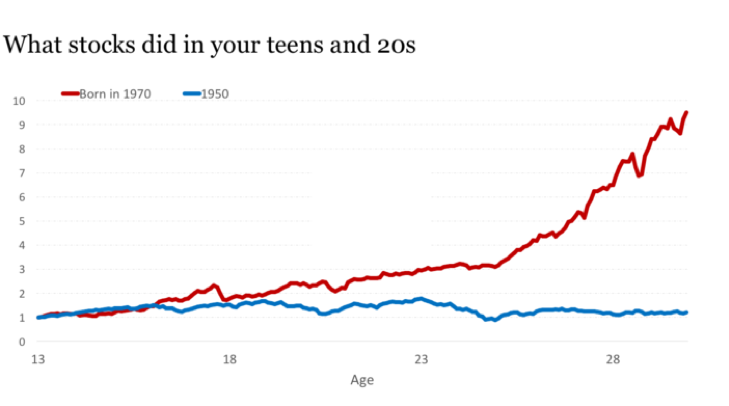

An individual’s personal experience is granular when placed in the scheme of human history. Nonetheless, our experiences form the lens through which we each view the world. They shape our impression of events and hence anchor risk-related decisions. For instance, if you were born in the 1950s you would have had a vastly different worldview to someone born in 1970. Your most impressionable years were spent learning from a risk averse generation operating in the wake of the Great Depression. High growth opportunities were scarce; the stock market was flat. By contrast, those born in 1970 saw ever expanding opportunities through to the dot-com boom of the late 1990s. The stock market grew 10-fold as those embracing new technology with new inventions were rewarded for taking risks.

My experience has seen the world evolve from a cautious population licking their wounds post-recession to a burgeoning tech environment where profitless venture-backed startups are consistently valued above $1 billion. The entrepreneurial culture of growing US cities, and especially college towns such as Berkeley or Stanford, attracts the brightest young minds looking to take advantage of the growing pool of resources. More vision funds have increasingly more venture capital to give to anyone who believes they have the next great idea.

Venture capital investment relies as much on intuition and experience as it does on known information and concrete fact. Whilst their businesses appear innovative and attractive, these start-ups often fail. Most do not even get funded.

According to a Harvard Business School study by Shikhar Ghosh, 75 per cent of million-dollar venture-backed start-ups are bankrupt before returning any money to investors. Exciting new ideas certainly do not guarantee the next Uber or Amazon.

As such, venture capital’s ongoing success should raise some red flags, especially now that it is being exposed to public markets. A commonly fatal misperception among investors is the situation where favourable conditions allow a bad process to produce a good outcome. The last 5-10 years have been some of the best in history to invent something new and disruptive – more openings, lower barriers, better returns, greater upside. Less perceived risk.

If the investing greats of history have taught me anything so far, it’s that this is unsustainable. As market prices rise higher, more capital is invested with lower margins of safety, in turn spent by highly leveraged businesses who promise to return it with interest. The longer these positive conditions persist, the more investors will be willing to ignore the potential for Black Swan events such as the Global Financial Crisis.

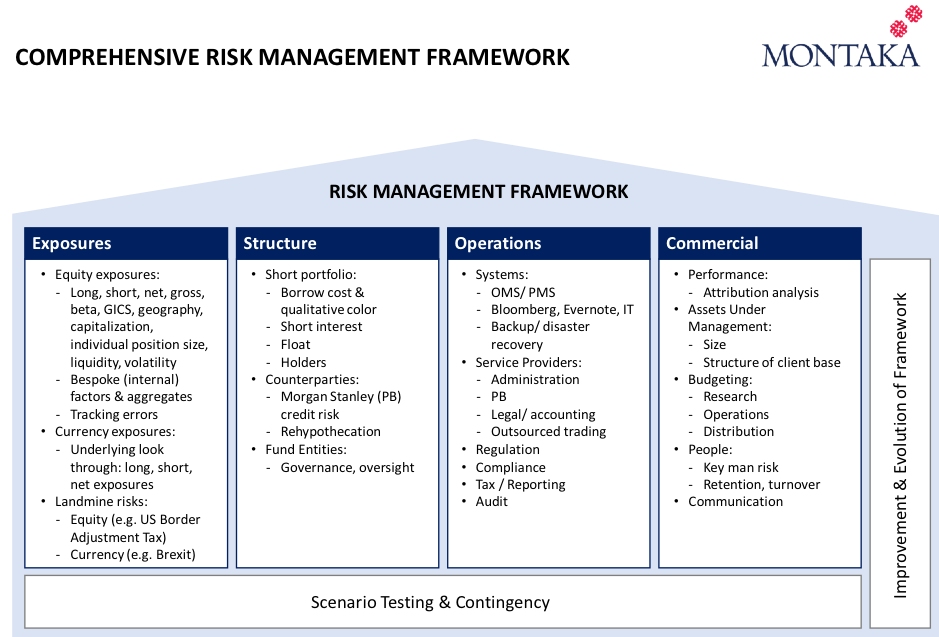

We consider risk management to be not only the most important feature of our investment philosophy, but also our greatest strength. Our Montaka Funds’ framework incorporates a vast range of exposures in a naturally risk-averse long-short structure. Along each risk dimension we consider the consequences of every potential scenario, and then take proactive mitigating action to insure against any unacceptable externalities. Moreover, we use our flexibility to adjust our net exposure to reflect the risk environment we face in any given period.

Although the investment business will continue to evolve through generations, the risk-averse philosophy of old will always ring true. We work to emulate the greats before us through our comprehensive risk-conscious approach to capital management.