Investor Insights

SHARE

Montgomery Small Companies Fund – Active management in action

What does active management look like in the modern era? There are many ways to assess how active a manager actually is – from comparing their active share (or common holdings) or sector over/underweights versus the index, or the turnover rate of their underlying holdings, to name a few.

However, the short comings of these methods are they fail to describe the change in shape of a portfolio, particularly when considering investment style. Morningstar produce some interesting independent analytics which breaks down a portfolio’s holdings by both market capitalisation within the index and by investment “style” as at a point in time. In the context of the Montgomery Small Companies Fund, this analysis of its portfolio is shown below.

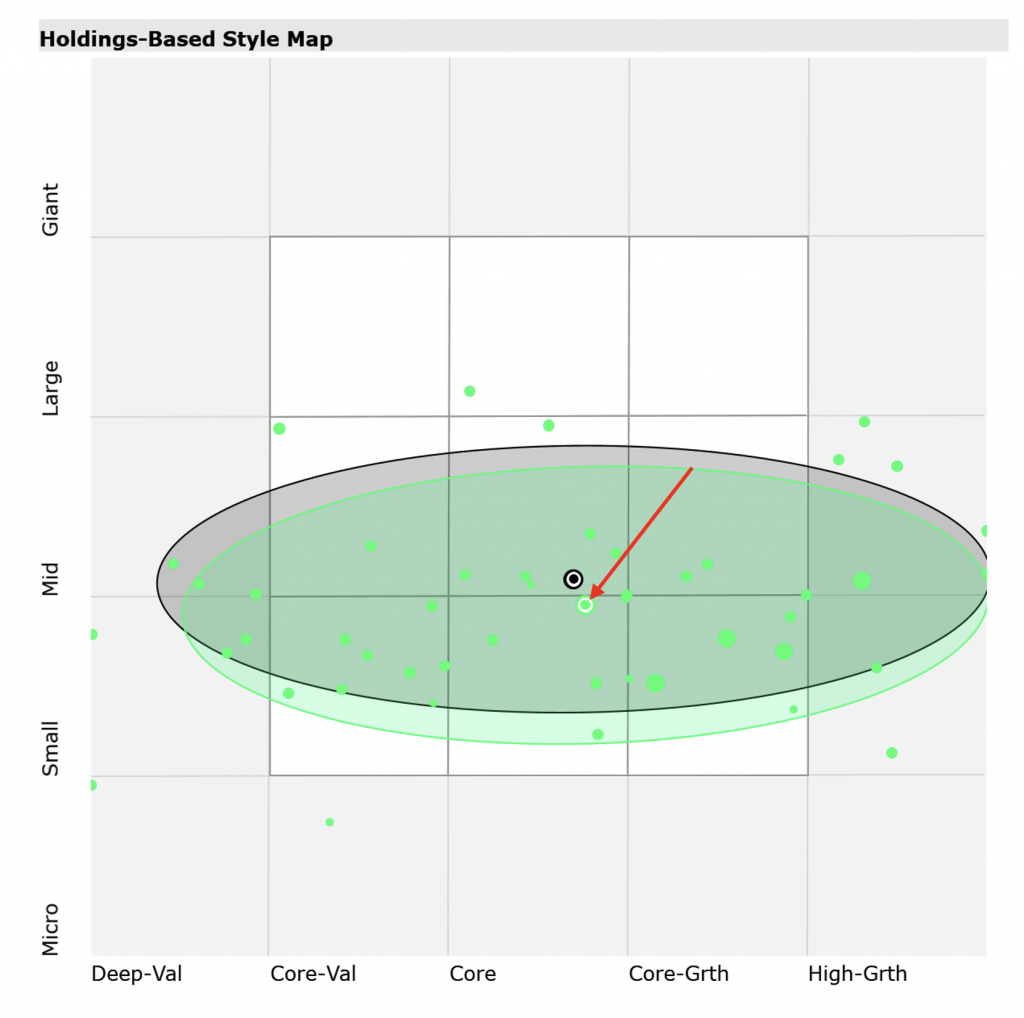

Chat 1 – Holdings based style map (as at 28 February 2021)

Source: Montgomery/Morningstar Direct

Firstly, in looking to the left-hand axis, Morningstar are able to illustrate the aggregate holdings of the Montgomery Small Companies Fund’s portfolio by size category in the context of its benchmark, the S&P/ASX Small Ordinaries Index. Giant-cap represents stocks that account for the top 40 per cent of the index by market capitalisation, and large-cap represent the next 70 per cent of the remaining market capitalisation all the way down to the micro-end representing the remaining 3 per cent of the index.

The bottom axis groups the holdings into five categories as per Morningstar’s bottom-up assessment of “style” at the holding level. Five factors are used to determine whether a holding falls into value or growth respectively, as captured below, and the holding is assigned a score on this basis. Where a Fund exhibits in aggregate a similar growth and value score (i.e. one is not dominant over the other), it is classified as “core.”

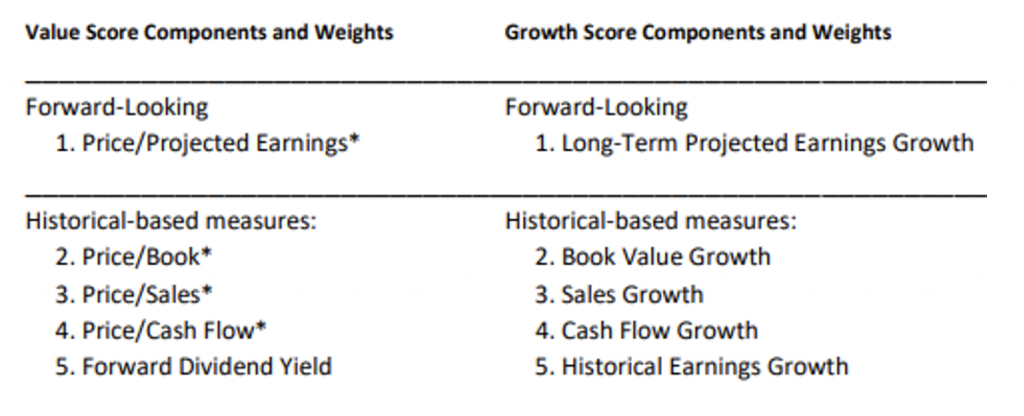

Table 1 – 10 factors for style

Source: Morningstar Style Box™ Methodology Paper, Morningstar Research, 30 June 2020

The outputs of both is the green shaded circle which represents the circle of best fit for 75 per cent of the underlying portfolio holdings in the Montgomery Small Companies Fund, as at 28 February 2021. The black shaded circle on the same basis represents the index, the S&P/ASX Small Ordinaries. The green dots are the individual holdings of the Fund plotted by style and market cap, and the larger the size of the dot, the larger the position size that holding represents in the Fund. The green circle within a circle (as per the red arrow) represents the aggregate holding by style and market cap for the Montgomery Small Companies Fund, which as at this time is core by style and the larger end of small by market cap. The black circle within a circle is exactly the same measure for the index.

The key take-outs here are really twofold. Firstly, the Montgomery Small Companies Fund is clearly not a micro-cap strategy. This is consistent with the Fund’s mantra, which whilst maintaining the flexibility to invest in early-stage businesses, whether it be upon IPO or in rare circumstances pre-IPO, is done in a risk-managed way from both a position sizing and overall portfolio exposure perspective. Namely, more than 60 per cent of the Fund’s portfolio is in businesses with a market cap greater than $1 billion and inversely less than 20 per cent is in businesses with a market cap of less then $500 million as at the time of writing. Although the shape of the green circle looks similar to that of the index, the spread of the individual holdings represented by the green dots tell another story as the actual overlap with the Montgomery Small Companies Fund and the S&P/ASX Small Ordinaries Index was only 18 per cent as at February 2021.

The second key take-out is the Fund clearly has holdings across what Morningstar would define as the style spectrum. Being a quality-first Fund, we would have limited exposure to what Morningstar defines as “deep value.” However this aside, the holdings are evidently across both value and growth style companies. This is what the team refer to as “all-weather investing” in that they have the ability to invest right across the style spectrum. Naturally, some of the core or larger holdings in the Montgomery Small Companies Fund tend to be more core-growth or high-growth in nature as this is often why one invests in smaller companies in the first place: to harness the organic value creation that occurs as a company growths from early stage to maturity.

How has the Portfolio’s shape or positioning changed from last year?

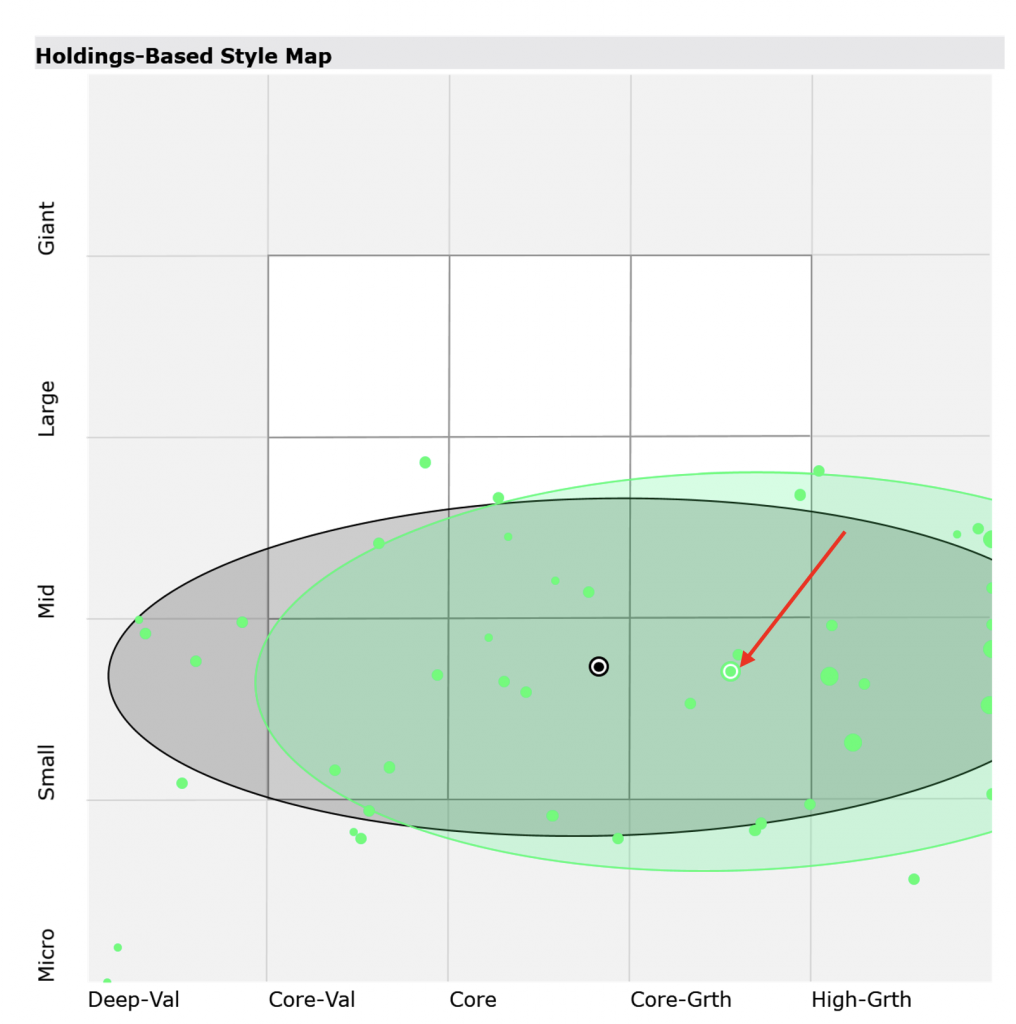

Chart two below shows the same holdings analysis for the Fund as at fiscal year end 19/20.

Chat 2 – Holdings based style map (as at 30 June 2020)

Source: Montgomery/Morningstar Direct

The aggregate portfolio holding as that this time (again as per the red arrow) was still small cap by size, albeit a little smaller. However, it was more importantly core-growth by style versus more recently core, highlighting a visible shift in the aggregate style of the portfolio.

You can observe the holdings of the Montgomery Small Companies Fund are skewed more to the right (to growth) than that of the index’s aggregate holdings. This was a reflection of the investment opportunity set post the market sell-off in March last year. The difference between the holding maps at these two points of time evidence active management in action and is a by-product of the change in the investment landscape with the positive vaccine news the world received later in the year. The team, as a result of this, shifted more of their portfolio from growth into value, or from what they would describe as structural winners and stable compounders (which at the time made up almost 70 per cent of the portfolio), into tactical opportunities including cyclical and travel business exposed to a re-opening , which now account for over 40 per cent of the portfolio which has doubled since 30 June 2020.

How will the shape of the portfolio look heading into 2022? Only time will tell, however the Montgomery Small Companies team have proven their ability to actively (and successfully) manage their portfolio across the style spectrum to take advantage of the opportunities ahead.