Investor Insights

SHARE

Framework for investing is working already

We have been prompting investors over the last month or two to consider a framework for investing amid macro-economic, geopolitical and central bank chaos. Trying to pick how markets will respond to a barrage of sometimes conflicting influences is near impossible. The picture is so complex and dynamic, picking whether the market will fall or rise is at best just a guess.

Today, as I sit and write, bad news is good again. Fears of inflation initially morphed into fears of recession. Then concerns about stagflation emerged. But those fears have morphed into hope that a recession will prompt central banks to lower the upper target for short term rates. Now yield curves are inverted, meaning long term rates are lower than short term rates. This is common ahead of and during the early stages of recession.

But instead of taking you down the rabbit warren of macro-economic and monetary policy guesswork it is better to revisit the investment framework we referred to on June 17 in the article: Would you like P/Es with that?

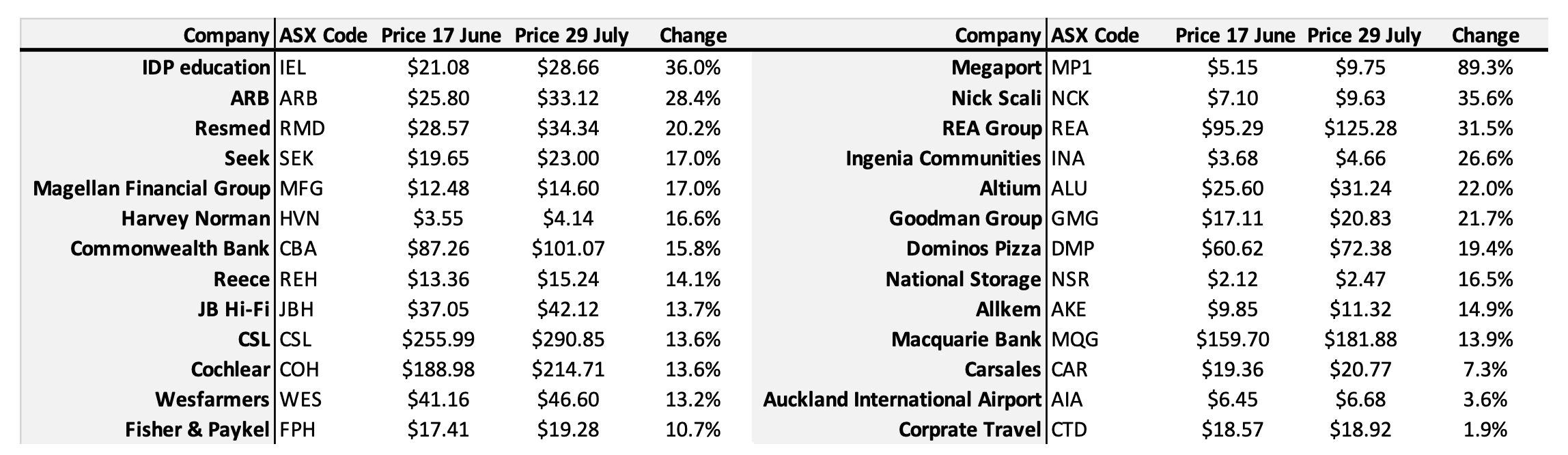

Since 17 June, stocks have surged. Wesfarmers is up 13 per cent, Harvey Norman is 17 per cent higher and JB Hi-Fi has risen 14 per cent. The following table shows share price changes since June 17.

Table 1 – Select share prices changes over six weeks since 17 June 2022

Short term validations are meaningless but the recent market strength even amid confirmations of a U.S. recession suggest investors are well advised to consider frameworks that serve beyond whatever malaise is paralysing investors.

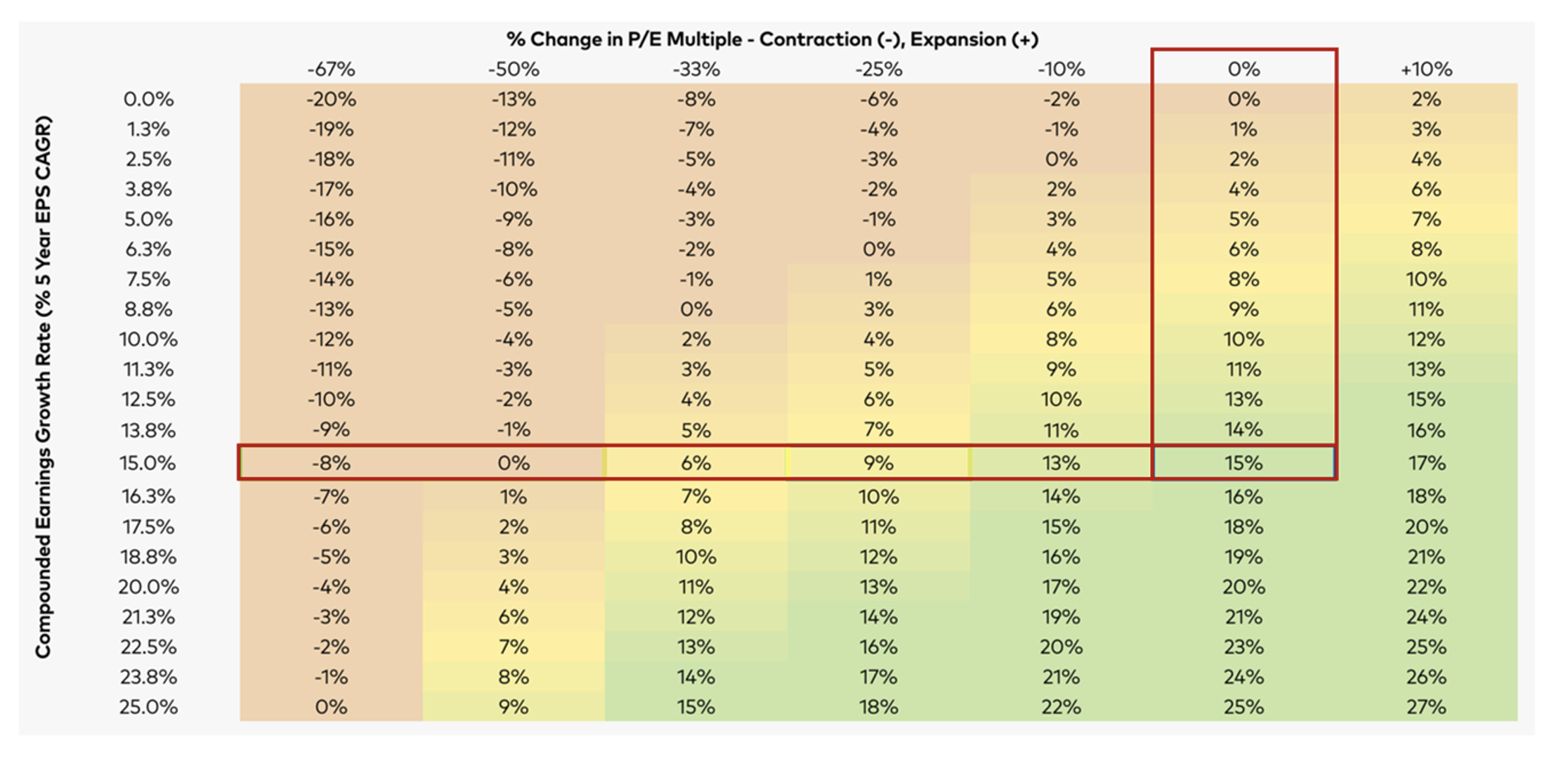

Table 2 – Returns from changes in P/E for a given EPS growth rate

Source: Polen Capital

The above table reveals the return for investing for five years in a stock producing a given earnings per share growth rate when the Price to Earnings Ratio changes from that at the time of purchase.

For example, take the intersection of the 15 per cent row and the zero per cent column highlighted. Purchasing a share in a company producing a compounded annual earnings growth of 15 per cent over five years, with no change to the P/E ratio at the time of purchase and sale five years later, will give the investor a 15 per cent annual return. Buy the shares on a P/E of ten time earnings and sell on a P/E of ten times earnings and the investor will receive 15 per cent per annum compounded. Buy and sell on 20 times earnings or 12 times earnings and the investor will still receive 15 per cent per annum.

If, however the shares are purchased on a given P/E and that P/E contracts by 25 per cent at the time of sale in five years (-25% column), the investor who purchases shares in a company growing earnings by 15 per cent per year, will receive a nine per cent return.

Note the P/E for this investor would have to halve (decline by 50 per cent) before the investor breaks even after holding the shares for five years.

The decline in P/E ratios, that explained almost all of the sell-off in share prices earlier this year, prompted us to consider the bargains on offer. Table 2., reveals that quite extreme further P/E declines would be required before investors lost serious money over the next five years.

We cannot predict what share prices and P/E ratios will do but we do know that P/Es had compressed considerably and that at some point in the next five years, it is reasonable to expect equities to become popular again boosting P/E and the returns from investing in high quality names generating earnings growth.

The move in share prices highlighted in Table 1, demonstrates in miniature, just how that process can work, and therefore how valuable such a framework can be.