Investor Insights

SHARE

Big days in small companies

Overnight, U.S. stocks posted their strongest rally in years, after the country’s October consumer price data provided further confirmation inflation has indeed peaked. These are big moves that investors cannot afford to miss, which is why we will continue to generally advise being greedy when others are fearful.

Precisely one month I ago, I wrote an article entitled Three scenarios that could kickstart a new bull market. It was republished on Livewire and I was interviewed about it on several radio programs and podcasts. A few days later I wrote another piece entitled Why I think Inflation is headed in the right direction, offering two leading indicators that suggested easing inflation pressures. And variously since then I have been reminding investors bull markets follow bear markets.

If you’ve missed it, we have also explained the arithmetic of investing in companies generating double-digit earnings growth when price-to-earnings (P/E) ratios are compressed. We’ve shown how buying and selling, on the same P/E ratio, a company’s shares will generate a return equal to the earnings per share growth the company generates. This should reinforce the need to invest in companies with strong earnings growth when P/E ratios are compressed. You can read the post here Is it time to hit the buy button?

Overnight, U.S. stocks posted their strongest rally in years, after the country’s October consumer price data provided further confirmation inflation has indeed peaked. October’s U.S. consumer price index rose just 0.4 per cent for the month and 7.7 per cent from a year ago, its lowest annual increase since January and a slowdown from the 8.2 per cent annual pace in September. The print was also lower than economists had forecast.

And perhaps the most reassuring sign that rates are done rising, the average rate on a U.S. 30-year fixed-rate mortgage dived 60 basis points to 6.62 per cent from 7.22 per cent yesterday, according to Mortgage News Daily. The drop matches the record single-day fall at the beginning of the COVID-19 pandemic.

The Dow Jones Industrial Average soared 1,201.43 points, or 3.7 per cent for the day. It was the largest single-day rise in the Dow since the recovery from the worst of the COVID-19 bear market. Meanwhile, the broader S&P 500 leapt 5.54 per cent – its largest rally since April 2020, and the Nasdaq Composite surged 7.35 per cent.

These are returns that are sometimes posted by the major indices for 12 months. Indeed, there have been 29 years since 1872 that the S&P500 has rallied between five and 10 per cent. Such returns over a day are rare but they are also reinforce the importance of being greedy when others are fearful.

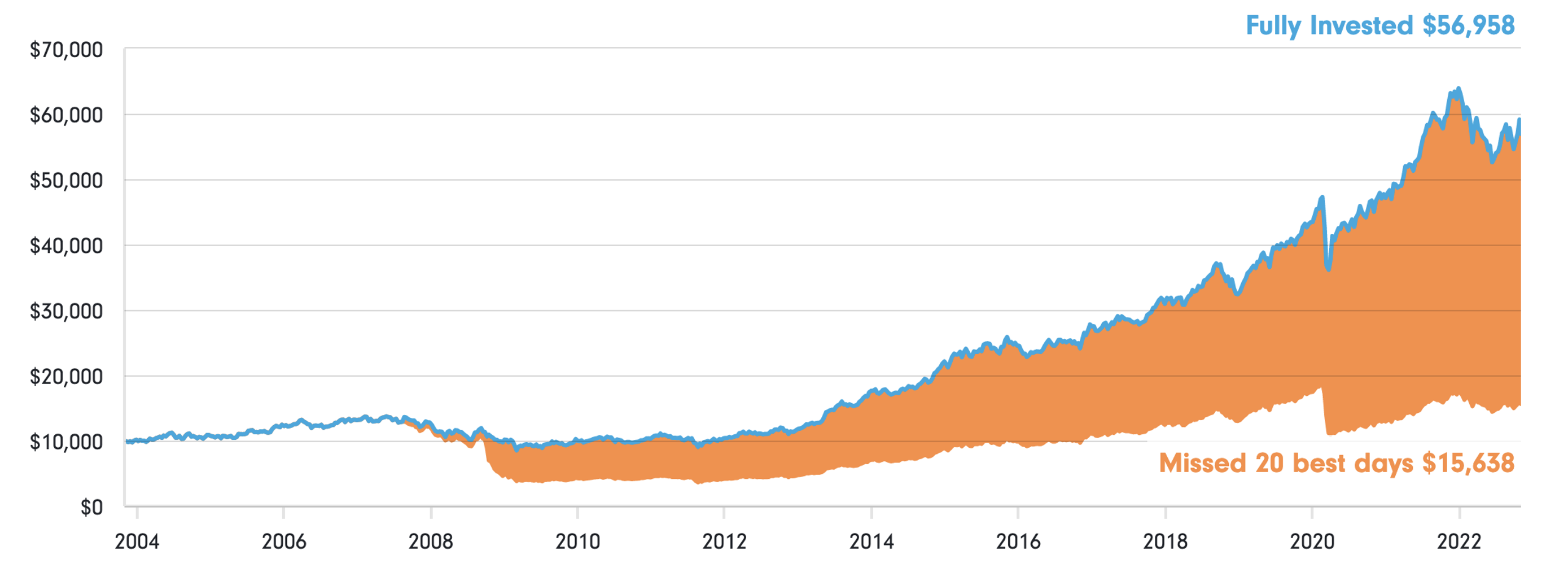

Figure 1. Cost of missing the 20 best days

Source: Fidelity International

Figure 1., demonstrates how a $10,000 investment on 31 October 2003 would have performed if fully invested versus the same investment with the 20 best days missed. The chart uses the MSCI North America index in Australian dollars unhedged as the proxy for returns.

One can immediately see the value in remaining invested. What it doesn’t show of course is the boost to returns when the investors add to their holdings during periods of heightened fear, such as we have experienced recently.

Tying all of the above together, I have explained in previous posts how I have been using the 50 per cent decline in the value of the Polen Capital Global Small and Mid Cap Fund, run by Rob Forker in Boston, to add to my investment personally in that Fund. When Rob was in Australia for our client dinners and webinars, he noted the aggregate earnings per share growth rate of the portfolio was over 20 per cent. Despite this strong forecast growth, the unit price of the Fund had halved, thanks to the collapse in the share prices.

Some of the holdings in the Polen Capital Global Small and Mid Cap Fund include the U.S. esky/cooler company with a cult following, Yeti, and the credit scoring company Fair Isaac Corp., the e-commerce company Revolve, and pick and shovel supplier to the life sciences industry, Azenta.

Overnight, Yeti rallied almost 32 per cent, Fair Isaac surged 31 per cent, Revolve was up almost 22 per cent and Azenta rose 16 per cent.

These are big moves that investors cannot afford to miss, which is why we will continue to generally advise being greedy when others are fearful.

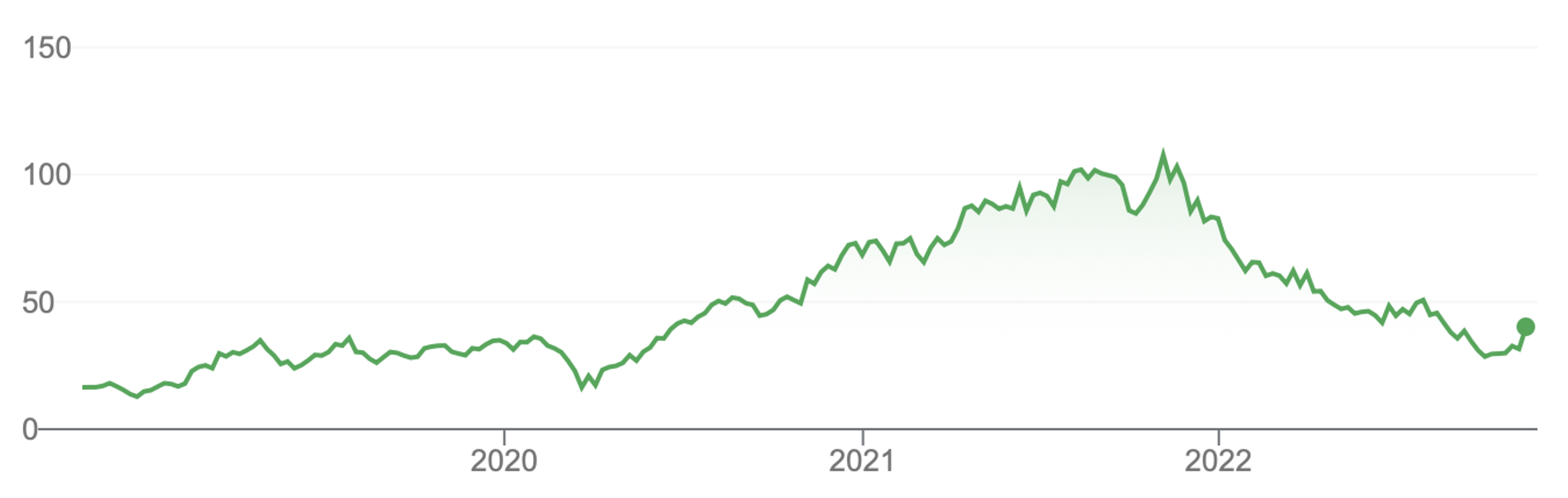

Figure 2. Yeti Share price in $USD

And fear remains, so there is still plenty of opportunity. As Figure 2 demonstrates, while Yeti rallied 31 per cent overnight, it is a long way from the heady days of the boom.

Investors who are considering taking advantage of fear, haven’t missed out entirely. There is still a great deal of uncertainty on which to feast.

Buying when P/E ratios are compressed is wise, buying such companies when they are also generating double digit earnings growth is even wiser, and knowing that in the next five or ten years we will see a period of exuberance that will have P/E ratios much higher than they are today is perhaps the wisest of all.

If you would like to learn more about the Polen Capital Global Small and Mid Cap Fund, please visit the fund’s web page to learn more: Polen Capital Global Small and Mid Cap Fund

The Polen Capital Global Small and Mid Cap Fund own shares in Yeti, Fair Isaac Corp, Revolve and Azenta.This article was prepared 11 November 2022 with the information we have today, and our view may change. It does not constitute formal advice or professional investment advice. If you wish to trade these companies you should seek financial advice.

Past performance is not an indicator of future performance. Returns are not guaranteed and so the value of an investment may rise or fall.

This article has been prepared for the purpose of providing general information, without taking into account your particular objectives, financial circumstances or needs. You should obtain and consider a copy of the Product Disclosure Document (‘PDS’) relating to the Fund before making a decision to invest. The PDS and Target Market Determination (‘TMD’) are available here: https://www.montinvest.com/our-funds/polen-capital-global-small-and-mid-cap-fund/and here: https://fundhost.com.au/ While the information in this document has been prepared with all reasonable care, neither Fundhost nor Montgomery makes any representation or warranty as to the accuracy or completeness of any statement in this document including any forecasts. Neither Fundhost nor Montgomery guarantees the performance of the Fund or the repayment of any investor’s capital. To the extent permitted by law, neither Fundhost nor Montgomery, including their employees, consultants, advisers, officers or authorised representatives, are liable for any loss or damage arising as a result of reliance placed on the contents of this report. Past performance is not indicative of future performance.