Investor Insights

SHARE

Salesforce: A Symphony of Solutions (Part I)

For many people, Salesforce (NYSE: CRM) is unlikely to be a household name like Apple, Amazon or Google, which are deeply entwined into our daily lives. However, within enterprise companies there are very few software applications that are more mission critical for a business than Salesforce.

Since it was founded in 1999, Salesforce has been one of the most disruptive innovators in the history of enterprise software. It created the now ubiquitous Software-as-a-Service (SaaS) model, was first to introduce an enterprise API (Application Programming Interface) which revolutionised the industry (a year ahead of Amazon) and created the world’s first app store called the AppExchange. Rather interestingly, two years after launching the AppExchange, Apple launched a similar marketplace, which to this day, carries the trademarked name that Marc Benioff (Salesforce founder and CEO) gifted to Steve Jobs, “App Store.”

As the name suggests, Salesforce originally started out as a highly effective software application for salespeople to keep track of their customers and manage their relationships more effectively i.e. Customer Relationship Management (CRM). At their core, the services Salesforce offered were finding new customers (lead generation) and keeping existing customers engaged, which made salespeople more effective and were able to sell more products. SunGard, which morphed into fintech industry giant FIS, became an early customer in 2003, with its CEO noting “the sales people were buying it on their own; they were swiping their own credit cards and going around their managers to purchase an account.” This really underscores how disruptive Salesforce was; industry participants were simply unable to compete in the workplace without access to the product and started buying it themselves with their own money.

Fast forward to today, Salesforce dominates CRM and has been ranked number one in the world for fourteen consecutive years by the prestigious technology consultancy Gartner. By leveraging the CRM “entry wedge” Salesforce has successfully expanded into several complimentary adjacencies, entrenching itself in the enterprise and penetrating market opportunities beyond its core offering. Some of the areas that Salesforce now leads the industry, include critical enterprise functions such as customer service, marketing, analytics, e-commerce and software integration. For context, another example of a company successfully executing an initial entry-wedge is Microsoft, with its Windows and Office suite successfully opening the enormous enterprise cloud computing market to its Azure cloud platform.

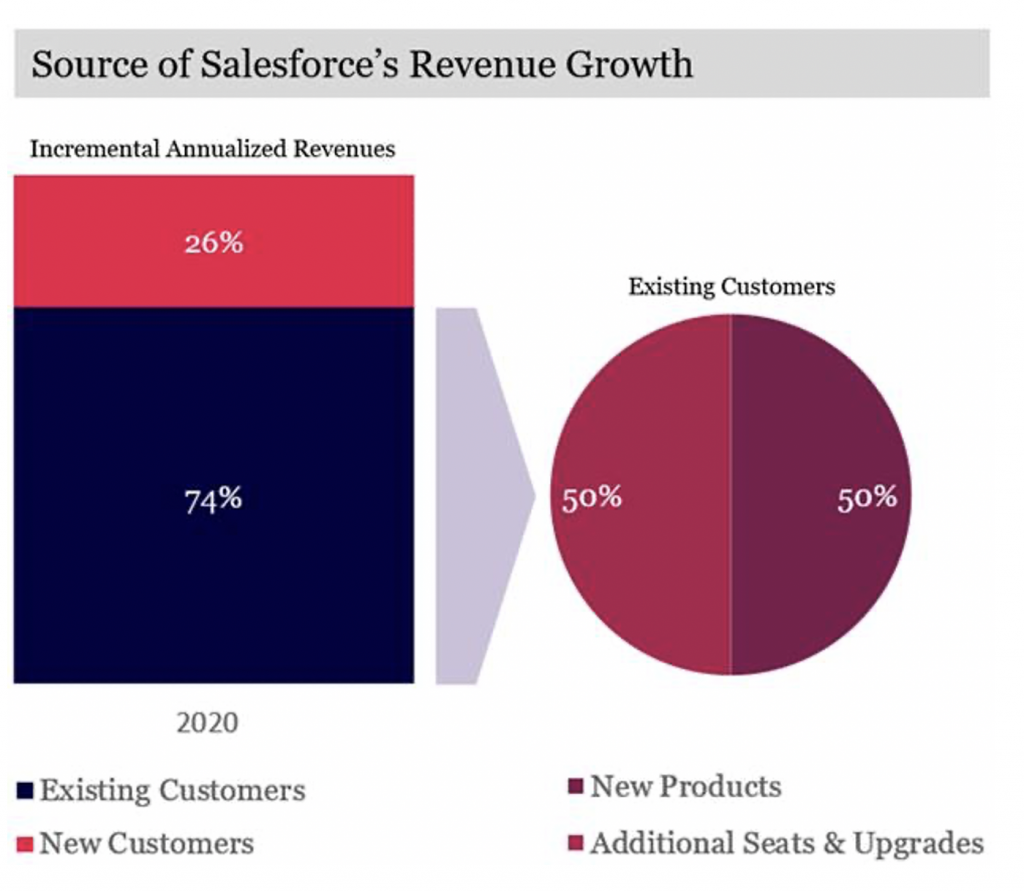

This strategy of expanding into adjacencies is commonly referred to as the “land-and-expand” model and is responsible for around 75 per cent of Salesforce’s revenue growth being derived from existing customers. This highlights Salesforce’s ability to cross-sell its product suite to customers once it has driven an entry-wedge into an account.

Source: Salesforce

It is worth noting that Salesforce’s revenue growth has largely been driven by customers adding new products, more seats and opting for higher priced upgrades which enhance their own businesses (versus Salesforce hiking prices). This is indicative of true value creation for customers who choose to become more deeply invested in the product suite and translates into an ultra-high quality, durable earnings stream for Salesforce. This is part of the reason Salesforce can act as “kingmaker” in the enterprise by offering an emerging company’s product alongside its own via a partnership (e.g. Snowflake) or an outright acquisition (e.g. Tableau, Mulesoft) unleashing enormous value for the businesses.

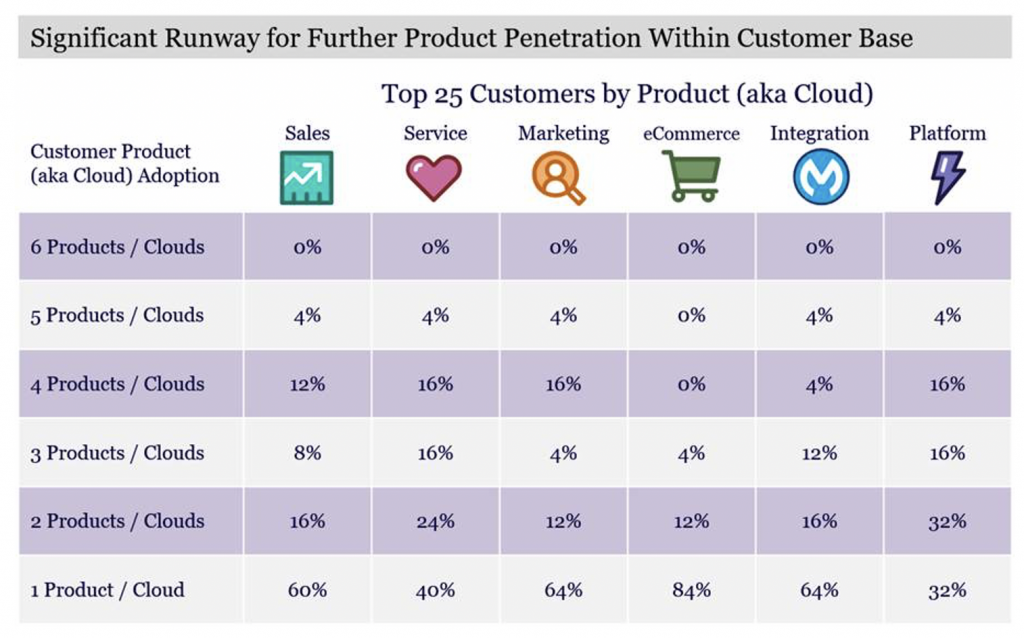

Looking at Salesforce’s existing customer base, significant growth remains, within with only approximately 4 per cent of its top 25 customers by product utilising five of Salesforce’s six clouds, with the vast majority using only one or two currently. As a consequence of the pandemic, this dynamic has begun to accelerate and shift, with Salesforce noting it is “starting to see more customers become wall-to-wall Salesforce customers, using the entire platform for their revenue operations” (Bill Patterson, Salesforce Vice President).

Source: Salesforce

Beyond its core suite of products, Salesforce was a pioneer in opening access to its platform for third parties to build businesses upon (now called “Lightning Platform”). This platform has given birth to numerous billion-dollar success stories, including recently listed nCino and Veeva Systems which are based on Salesforce’s platform architecture. The AppExchange, which we briefly touched on earlier, has grown into the world’s leading enterprise cloud marketplace, with thousands of ready-to-install apps where developers, partners and service providers create an ever-expanding universe of applications for Salesforce’s product line, generating powerful network effects. Michael Dell (Founder and CEO of Dell Technologies) sums it up succinctly:

“By igniting the SaaS industry and then offering its Platform-as-a-Service, Salesforce has spawned an ecosystem of countless new companies…we are in unprecedented economic times, but we are also in a new era of innovation.”

In Part II of this series, we will look at how large Salesforce’s opportunity might be and how much runway remains in its journey. Hint, we believe Salesforce is a long-term winner in an industry that is both attractive, growing and our analysis suggests substantial upside remains.

You can read Part 2: Salesforce: A Symphony of Solutions (Part II)

Montaka owns shares in Salesforce. This article was prepared 26 November with the information we have today, and our view may change. It does not constitute formal advice or professional investment advice. If you wish to trade Salesforce you should seek financial advice.

Amit identifies why the Montaka team see Salesforce as a long-term winner in an industry that is both attractive, growing and our analysis suggests substantial upside remains. Click To Tweet