Investor Insights

By , Roger Montgomery

SHARE

Megaport half yearly: A solid, albeit pre-announced result

Megaport (ASX:MP1) announced its half-yearly results on Tuesday. As the numbers were largely pre-reported at the company’s previous second-quarter announcement on 30 January, they were considered ‘in-line’ with expectations.

Megaport’s total revenue for the first half of FY24 came in at $95.1 million, up $24.4 million or 35 per cent, compared to the prior corresponding period. The growth was attributed to organic sales growth and price increases. We expect to see more of the latter as structural demand growth bumps up against capacity.

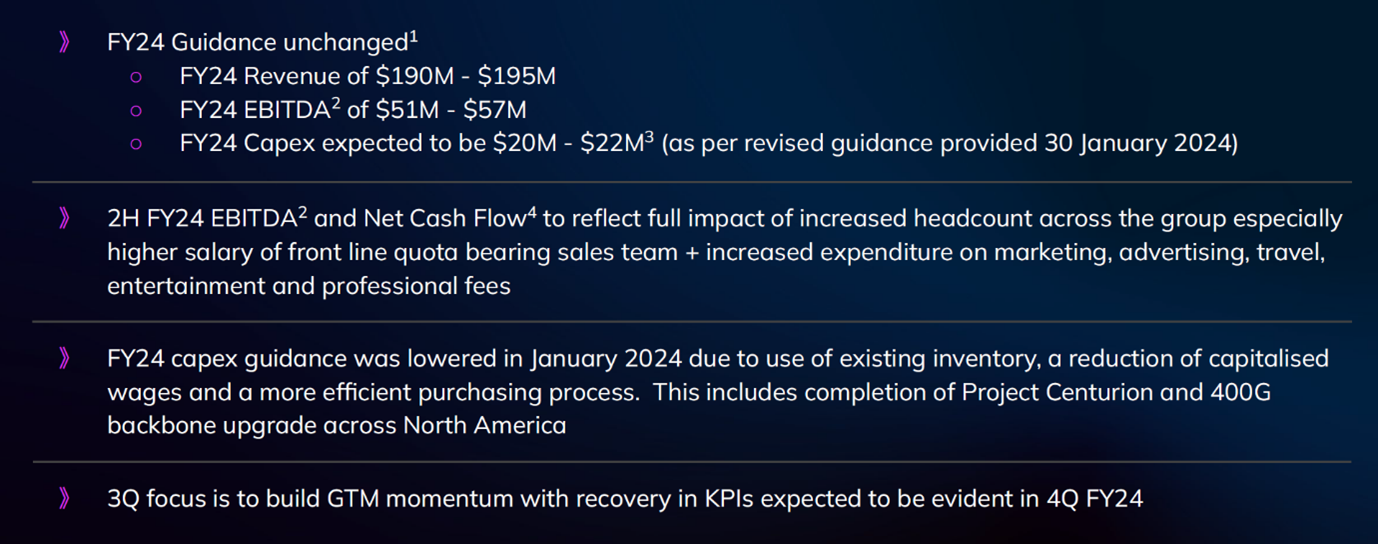

Megaport’s full-year revenue and earnings before interest, taxes, depreciation, and amortisation (EBITDA) guidance of $190-195 million and $51-57 million (a big range and analysts expect the company to hit the upper end), respectively, were maintained. Capital expenditure (CapEx) of $20 to $22 million was also maintained, and interestingly, a large amount of this is capitalised wages.

Given the marginally negative share price reaction today, however, it may be that some investors had expected an upgrade.

By the end of December, annual recurring revenue (ARR) had grown to $191.7 million, up $43.4 million or 29 per cent versus the prior corresponding period. Again, this was pre-reported back at the end of January.

The company’s ‘services’ count, which comprises ports, virtual cross connections (VCXs), Megaport cloud router (MCR), virtual edge (MVE) and internet exchange (X) has grown by 1,535 to 28,495 services.

Gross profit for the half was $66.6 million, up $20.1 million or 43 per cent on the first half of FY23.

Employee and operating costs were lower, but these, including travel, advertising, entertainment, professional fees and marketing, are expected to grow as the new direct sales team costs are experienced over a full period. This perhaps explains why the company didn’t upgrade.

Megaport announced a record half-year EBITDA of $30.1 million and EBITDA margins of 32 per cent versus five per cent in the first half of 2023. The improvement is attributed to the 35 per cent revenue growth and a strong focus on cost control. And EBITDA margins are consistently strong across all geographies, including North America, APAC and EMEA.

Net profit for the period was $4.4 million, up $17.9 million. The result compares to a consensus estimate of $8.4 million, which requires some consideration. It is possible the market had underestimated employee costs and foreign exchange (FX) losses. After adjusting for share-based payments, however, the result was roughly in line.

Figure 1. Highlights as reported by Megaport The Montgomery Small Companies Fund owns shares in Megaport. This blog was prepared 20 February 2023 with the information we have today, and our view may change. It does not constitute formal advice or professional investment advice. If you wish to trade Megaport, you should seek financial advice.

The Montgomery Small Companies Fund owns shares in Megaport. This blog was prepared 20 February 2023 with the information we have today, and our view may change. It does not constitute formal advice or professional investment advice. If you wish to trade Megaport, you should seek financial advice.