Investor Insights

SHARE

Insights from the Australian Securitisation Forum

Last week the team attended the Australian Securitisation Forum. The event is held annually and brings together the leading industry bodies, representing participants in the securitisation and covered bonds markets.

We had the opportunity to hear from a wide range of market leaders and competition. Each provided valuable insights into their own current views and outlook on the market. The themes and findings at this year’s conference were largely in line with our internal investment team’s views.

The consensus was that the market is demonstrating resilience; however, most lenders are erring on the side of caution when taking on new borrowers. As we have been communicating of late, general market confidence is subdued however conditions are still showing signs of strength. Businesses are finding difficulty tapping into equity markets, placing more demand on raising debt for business funding. We, as an investment team, are seeing a number of high-quality funding opportunities within our pipeline and are still seeing consistent growth from our lenders. Investors are seeking out alternatives within their portfolio and as such, we are seeing consistent growth within our private credit offerings. Our aim is to achieve consistency in providing our investors with a risk-adjusted return, capital protection and consistent monthly income.

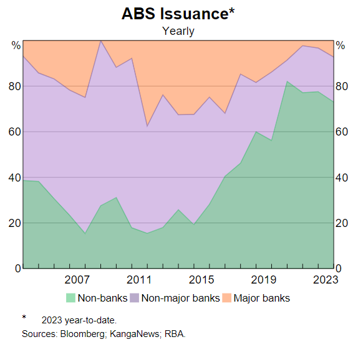

The Reserve Bank of Australia (RBA) spoke on the Australian securitisation market and noted the continued shift to non-bank lenders. In the Residential Mortgage-Backed Securities Market (RMBS) and Asset Backed Securities (ABS), the banks were the main issuers of ABS for many years. Since 2010, non-bank lenders have increased their share of issuance through the pandemic and now make up 75 per cent of the ABS issuance. This is further supported by the maturity of the Term Funding Facility. Just this year alone, there has been a three times increase in the number of non-bank lenders issuing RMBS.

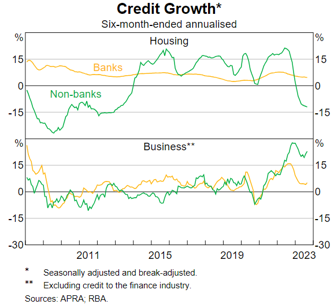

Non-banks are continuing to expand into personal and business lending. Non-bank lenders have identified this as a niche where the banks are not as competitive. Our research has shown that banks are shifting away from the business lending space, leaving room for the lenders we back to capture this market share and expand growth and product opportunity within this space. The following graph demonstrates the growth in the non-bank lending space. Non-bank business lending has continued to grow at a faster rate than bank business lending. Business lending is currently exceeding the demand for housing credit, and non-bank lenders are continuing to increase their share of this market. It is the best of breed lenders within this space that we seek to fund.

We believe taking a conservative view is currently the right approach and is backed by the RBA, our peers, and competitors. We remain cautious as we face ongoing market uncertainty. The key areas of focus flagged at the conference and key elements that back our investment strategy include:

- Credit quality fundamentals and lending standards – maintaining credit worthy borrowers;

- Funding conditions – ensuring non-bank lenders are well capitalised; and

- Evolution of competition in lending – non-bank lenders need to remain agile and ensure they are positioned to achieve longevity.