Investor Insights

SHARE

Impressive outperformance from the Australian Eagle Trust Long Short Fund

On behalf of their clients, advisers, researchers and consultants appear to be taking notice of the returns Sean Sequeira, Alan Kwan, Daniel Chan and the team are generating in the Australian Eagle Trust Long Short Fund.

Available to retail or wholesale investors, the Australian Eagle Trust is a long/short fund that is 50 per cent ‘short’ equities and 150 per cent ‘long’ equities’ meaning that the fund is always exposed 100 per cent to the market. It is often termed an Australian equities extension fund.

The sale proceeds from short-sold equities (50 per cent) along with the initial capital of 100 per cent combine to fund the purchase of the 150 per cent that is invested in ‘long’ positions in equities. The long portfolio is the same portfolio of stocks but 1.5 times the weight as you will find Sean, Alan and Daniel have assembled for The Montgomery Fund, which they now manage and which is available for both retail and wholesale investors.

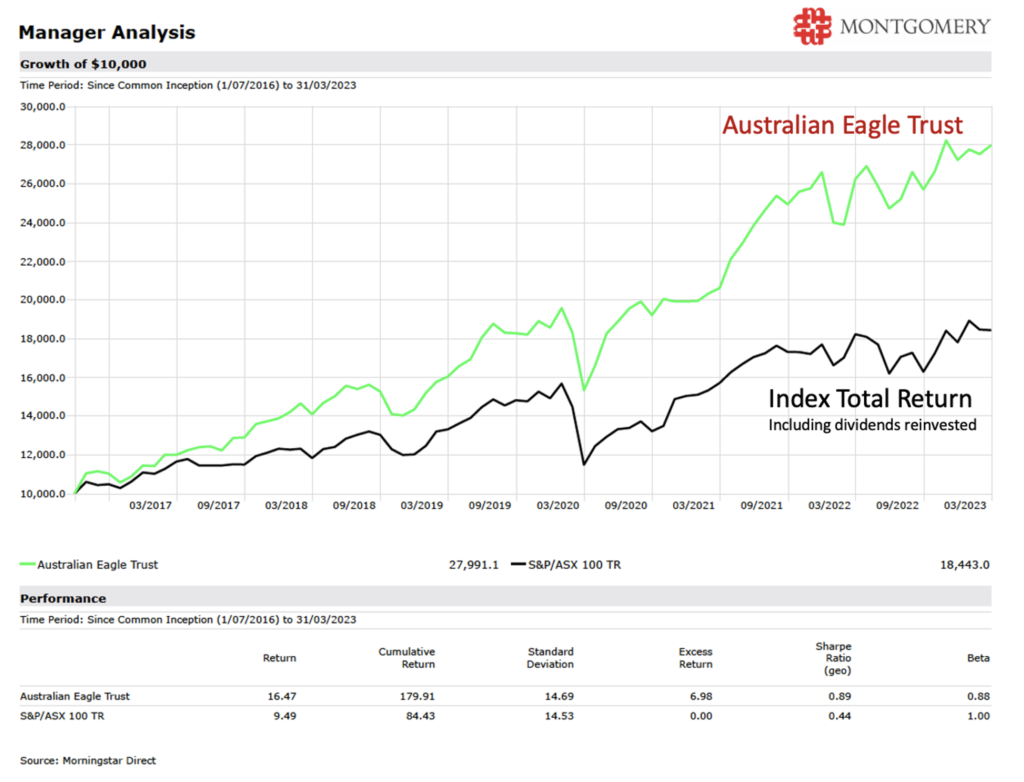

Research House Morningstar produces a neat collection of performance tables and charts on every fund they cover. Figure 1., reveals the performance of the Australian Eagle Trust against the S&P/ASX 100 Total Return index, which includes dividends reinvested. This index benchmark produces a return that matches what investors would receive if they invested in an index fund (assuming no fees or costs) that tracked that ASX100 benchmark.

Figure 1. Morningstar’s chart of $10,000 invested in The Australian Eagle Trust Long Short Fund

Source: Morningstar

The Australian Eagle Trust Long Short Fund’s historical outperformance cannot be relied upon as a guide to future returns, as performance in the future may be very different to the past.

The chart shows performance since 2016, which is now approaching seven years. In that time the Australian Eagle Trust Long Short Fund has returned 16.47 per cent per annum versus the index total return of 9.49 per cent.

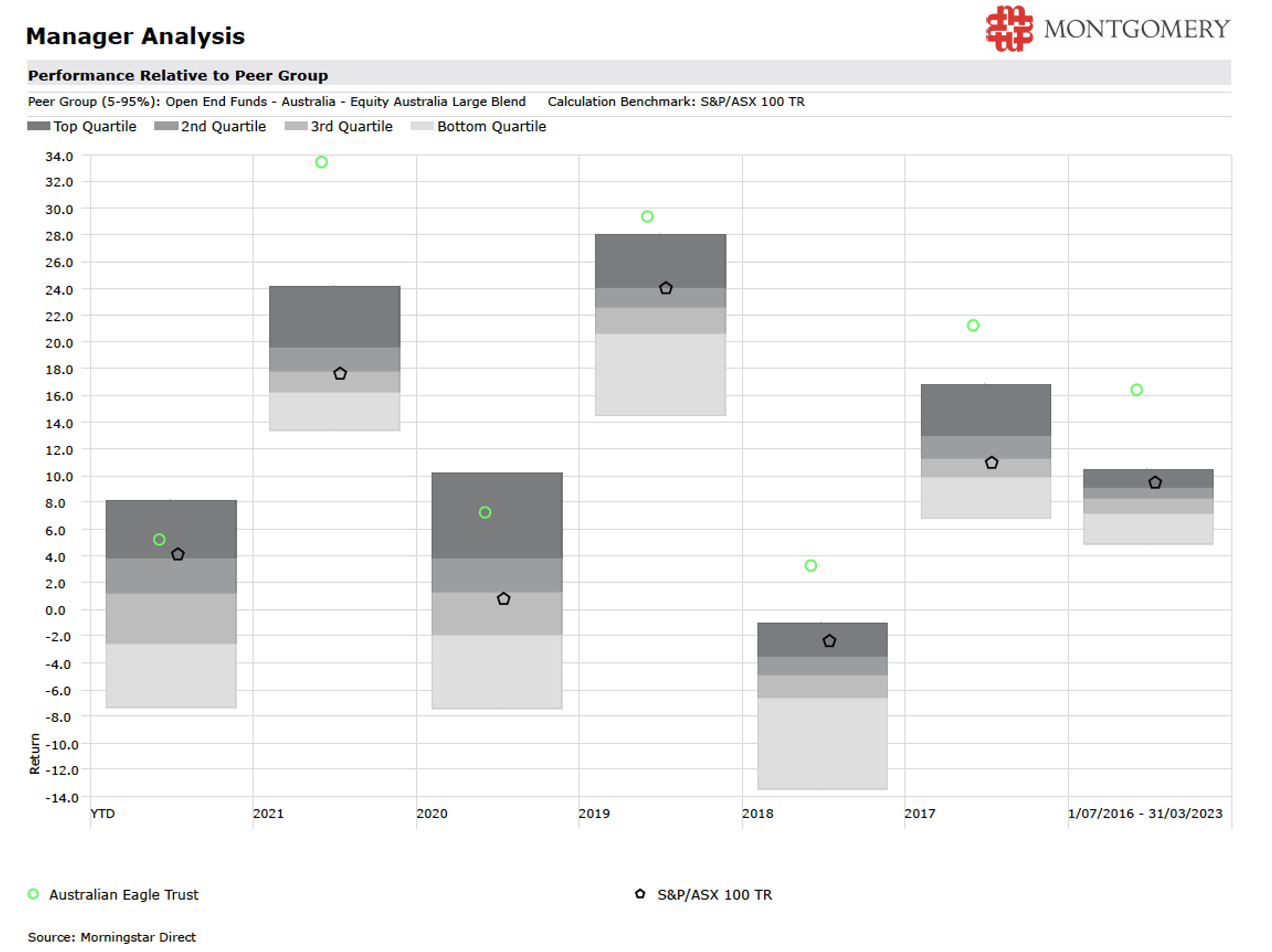

Another produced by Morningstar’s Direct software application is worthwhile as it reveals each calendar year’s performance for the Australian Eagle Trust Long Short Fund against Morningstar’s selected peer group for the fund.*

Figure 2. Morningstar’s performance relative to peers

Source: Morningstar

The green circles show where the Australian Eagle Trust Long Short Fund ranked against the index, which is highlighted by the black pentagon, and against Morningstar’s peer group, which is presented in quartiles across the range of respective returns for each calendar year.

Consistently beating the index is never easy, and it is certainly not easy to replicate, but it is what Sean, Alan, Daniel and the team aim to keep achieving in the Australian Eagle Trust Long Short Fund. Consistent out-performance is also what they aim to achieve since taking over management of The Montgomery Fund.

You can learn more about the Australian Eagle Trust Long Short Fund here.

*Morningstar’s peer group for the Australian Eagle Trust Long Short Fund is the category: Equity Australia Large Blend as of Mar 31, 2023. Please see Morningstar’s definition here.

Past performance is not indicative of future performance

The issuer of units in Australian Eagle Trust (ARSN 632 568 846) (Trust) is the Fund’s responsible entity The Trust Company (RE Services) Limited (ABN 45 003 278 831) (AFSL 235150), part of Perpetual Limited. Australian Eagle Asset Management Pty Limited (ABN 89 629 484 840) is the investment manager of the Trust. The Product Disclosure Statement (PDS) contains all of the details of the offer. Copies of the PDS and Target Market Definition (TMD) are available to download from the fund’s web page which you can access here: Australian Eagle Trust Long Short Fund.