Investor Insights

SHARE

Higher cash rates plus earnings downgrades: an opportunity for counter-cyclical investors

In this week’s video insight David reviews what to expect in markets over the next few weeks. We are likely to see a combination of rising official cash rates and the downgrade of many companies’ earnings expectations. Will this promote an opportunity for counter-cyclical investors?

Transcript

David Buckland:

The next few weeks are likely to see a combination of rising official cash rates and the downgrade of many companies’ earnings expectations.

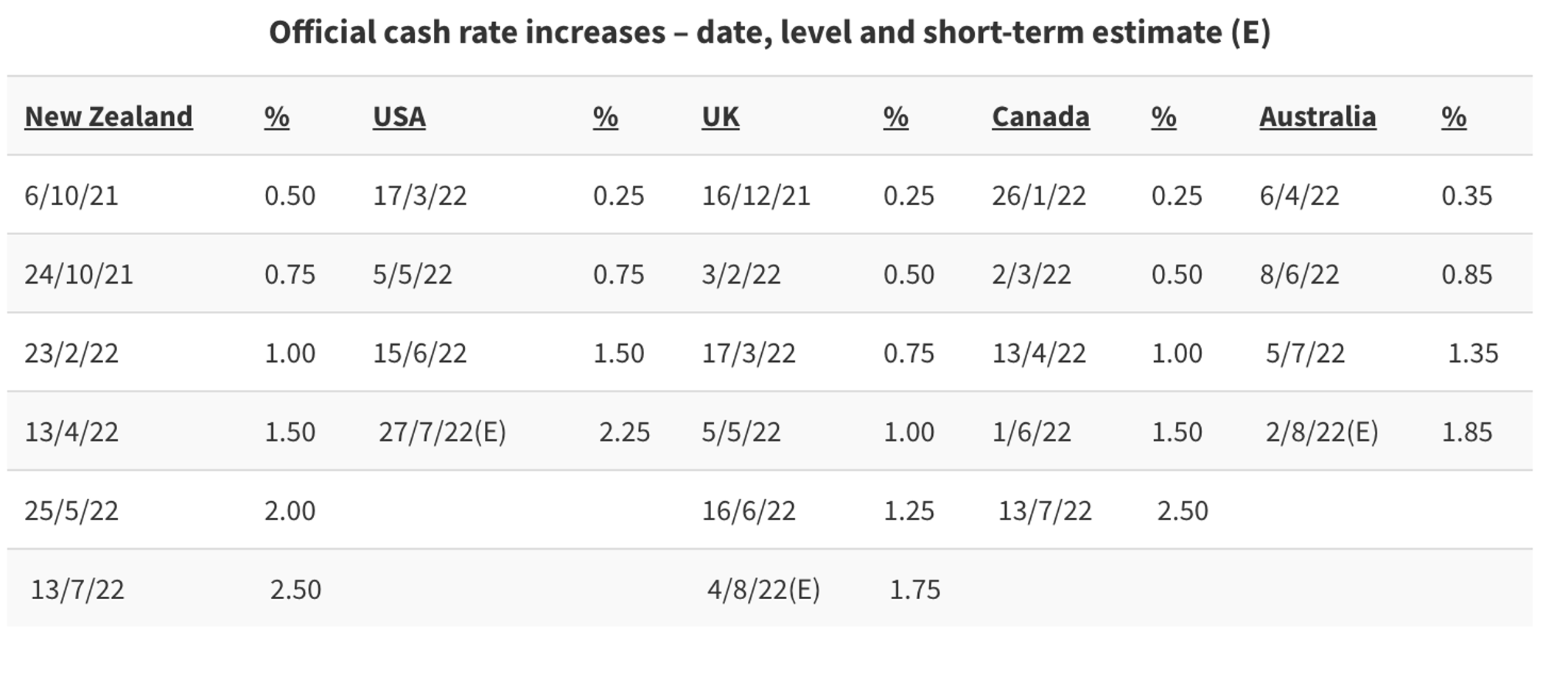

On official cash rates, I expect the U.S. Federal Reserve to push their cash rates up late next week by a minimum of 0.75 per cent to 2.25 per cent, the fourth increase in four months. In the first week of August, I believe the Reserve Bank of Australia will increase by a minimum 0.5 per cent to at least 1.85 per cent, also the fourth increase in four months; while the Bank of England will also increase by a minimum of 0.5 per cent to at least 1.75 per cent, the sixth increase in eight months.

As I have mentioned on numerous occasions, the Reserve Bank of New Zealand has easily been the most pro-active of the English-speaking Central Banks, commencing their tightening schedule on 6 October 2021, exactly six months ahead of the Reserve Bank of Australia. The Reserve Bank of New Zealand has now tightened six times in eight months to 2.5 per cent.

Given the other English-speaking Central Banks were very slow in attacking inflation – which is hitting four-decade highs in many economies – I encourage investors to “look over the ditch” to New Zealand to get a feel of how the balance of the 2022 calendar could play out.

On Monday, New Zealand released its inflation data which quickened from 6.9 per cent in the March 2022 quarter year on year to 7.3 per cent in the June 2022 quarter year on year.

That said, the average New Zealand house price is now down around 10 per cent since late-2021, and various consumer confidence indexes are hitting the lowest level for decades. One wonders whether the rate of inflation is close to its peak and the degree it could decelerate over the next twelve months.

On the earnings downgrade front, we just saw Apple indicate it would slow its hiring on the back of the likely global economic downturn. I expect many similar downbeat comments on the back of the company results to June 2022.

Share prices should quickly adjust to the combination of higher cash rates combined with forecast earnings downgrades and this could promote an opportunity for counter-cyclical investors.