Investor Insights

SHARE

Australian small companies outlook for 2023

Having not long finished the festive season and commenced a new year, many of us take the moments shortly after to reflect on the year that was, and also consider what we would like to see in the year ahead.

With that in mind I thought I would take a look back at 2022. Last year will likely be remembered for three key events, firstly it generally saw the world exit the pandemic cloud of COVID-19. Secondly, we saw the commencement of the war between Ukraine and Russia. Thirdly, we saw inflation return with a vengeance being quickly followed by one of the fastest tightening cycles in history by Central Banks. The official cash rate in Australia increased from 0.1 per cent in April 2022 to 3.10 per cent by the December meeting of the RBA.

This mix of events led to one of the strongest risk-off years we have seen since the Global Financial Crisis, there are few places for investors to find sanctuary with losses occurring across both growth and defensive assets alike.

Investor sentiment was broadly very negative during 2022, it is always a challenge for any growth (or risk) asset to perform well when the market doesn’t have an appetite for risk of any kind.

If we look specifically at the Australian small ordinaries index, its return for the calendar year of 2022 was negative 20.7 per cent. To give this context the ASX 100 declined by 3.9 per cent and the ASX 300 return was negative 6.1 per cent. It is fair to say that the risk on trade in Small Companies over the last few years moved into reverse in 2022. This was a consequence of the above macro factors, coupled with a more bearish investor and market.

What to consider for 2023?

In moving to our outlook for 2023 we need to initially consider the 3 points above and ask where we see them today and where they may evolve to over the next 12 months. With the final question being what impact this will have on equity market performance?

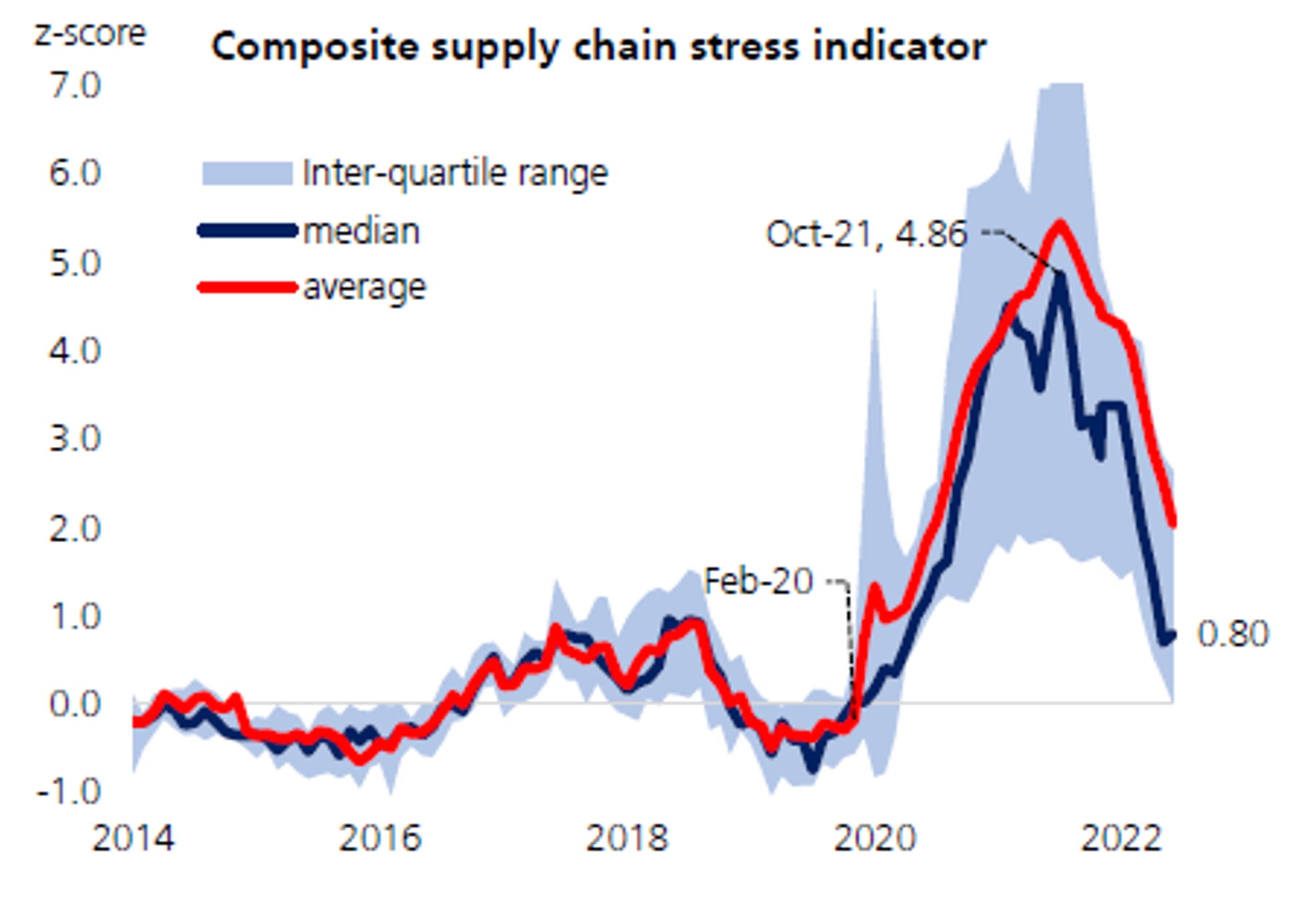

As a starting point it is fair to say that the impact of COVID-19 continues to pass and become more of a memory than a current issue. Even China who were the final strong hold have now moved to accept an existence with COVID-19 and they cope with re-opening and reintegrating with the rest of the world. As it stands today, we would expect the impact of COVID-19 to continue to diminish from here. One datapoint that has been interesting to follow over the pandemic has been a UBS Composite Supply Chain Indicator which is now in a strong downward trend and moving closer to pre-pandemic levels.

Source: UBS

A second example where we can see this is in spot indexes for international container freight costs which are now off roughly 80 per cent from their peak 18 months ago. This is interesting as it was one of the early contributors to the increase in inflation. As a leading cause it is positive to see this returning to more normal levels.

Next, we move to the war in Ukraine, which continues to grind along, and will no doubt continue to influence energy prices and broader speculation. Having said that, although the outcome is unknown, this is what at times in markets is called a known unknown. We are all aware of what is happening, many governments and countries are working around it. This is best seen in Europe where they continue to diversify their sources and supply of Energy, along with continued fast tracking of non-Russian dependent infrastructure. Short of a shock surprise, this event we can largely say has been priced into markets.

Finally, inflation and interest rates have been a biproduct of the above two events. These two arguably caused the most disruption to equity markets in 2022. At the time of writing the most recent inflation data for Australia was released last week and came out higher than consensus expectations with trimmed inflation (removing the most volatile items) coming in at 6.5 per cent against an expectation of 6.1 per cent.

At this point most major market commentators have the belief that we are likely to see two further interest rate increases in the first quarter of this year. Post this timeframe the speculation begins to grow; a portion believe inflation is going to be more stubborn and require further effort from Central Banks. Other market commentators believe that the remaining two expected rate increases will be sufficient to manage inflation, particularly given the delayed transmission mechanism we have here due to the nature of Fixed Rates and their term to reset.

Some also believe we may see interest rates start to fall in late 2023, which would become a tailwind for equities, in particular some of the growth names which had the toughest performance over 2022.

What can we expect from small caps?

Looking through all of this noise and to our outlook for Australian Small Companies for 2023 we think as always the starting point is important. At a market level we started 20 per cent cheaper than the same point in the prior year. Further to this we have seen some earnings downgrades in some parts of the market, where others have proven to be far more resilient than expected. Sectors like the Resource sector managed to grow their earnings over 2022. So in some pockets, we find valuations from a fundamental perspective to be very attractive.

While there is a belief that interest rates have further to go, we still see some significant risks in the more speculative parts of the market. This is mainly around companies that will have little control over their earnings power in the next 12 months, or are less mature and as a result less capable to weather the economic conditions ahead. Increasing interest rates are also not favourable for building stocks, or some consumer stocks (although some of the high-quality names will be resilient and based on valuation look interesting).

Any companies that missed the market’s expectations on earnings were punished, if the company had to go as far as an earnings downgrade the market showed little mercy. We think this trend will likely continue into the February 2023 reporting season. These are risks we are aiming to avoid by assessing the quality of our investments and their earnings streams.

Looking further out, there is an argument that Australian Small Companies offer a significant investment opportunity for investors over 2023 if they wish to add some risk to their portfolios. They were the most sold down part of the market in 2022 so the valuation of this sleeve of the market looks attractive.

History tells us that once the economy has reached peak inflation, the peak of interest rates is usually not too much further into the future. If we do in fact only see two further rate rises from the RBA and inflation is contained then we will start to have a foundation that would be more solid and look to underpin a backdrop that would be conducive to a rally in equity markets.

As always we are not out of the woods and do expect some earnings challenges to come to the fore in February’s interim reporting season. Stock selection and active management will be critical to navigate this.

Should we see an improved outlook and also a reduction in interest rates later in the year we may start to see an improvement in investor and market sentiment. This is likely the final ingredient needed to see capital flows return more strongly to equities and in particular Small Companies.

Overall we continue to have a meaningful exposure to the Resource sector as we think that with China reopening and supply shortages still an issue for Europe in the medium term, coupled with the continued drive of decarbonisation that 2023 should be another supportive year for the sector.

We have quality exposures to structural growth companies that over a medium term investment horizon represent excellent value and are growing quality businesses. We believe we are closer to the end than the beginning of the inflation and interest rate story which over the course of 2023 we think will provide a favourable foundation for the market and the Montgomery Small Companies Fund.