Download our private credit information pack

What is private credit?

Private credit is lending conducted outside of the traditional banking system.

Our private credit funds invest in a diversified portfolio of quality loans to Australian small and medium sized businesses.

Lending is to businesses borrowing for growth and all loans are secured.

Investors receive monthly interest payments, with the option to take as cash or reinvest.

Montgomery offers two private credit funds – the Aura Private Credit Income Fund (for wholesale investors) and the Aura Core Income Fund (for retail and wholesale investors).

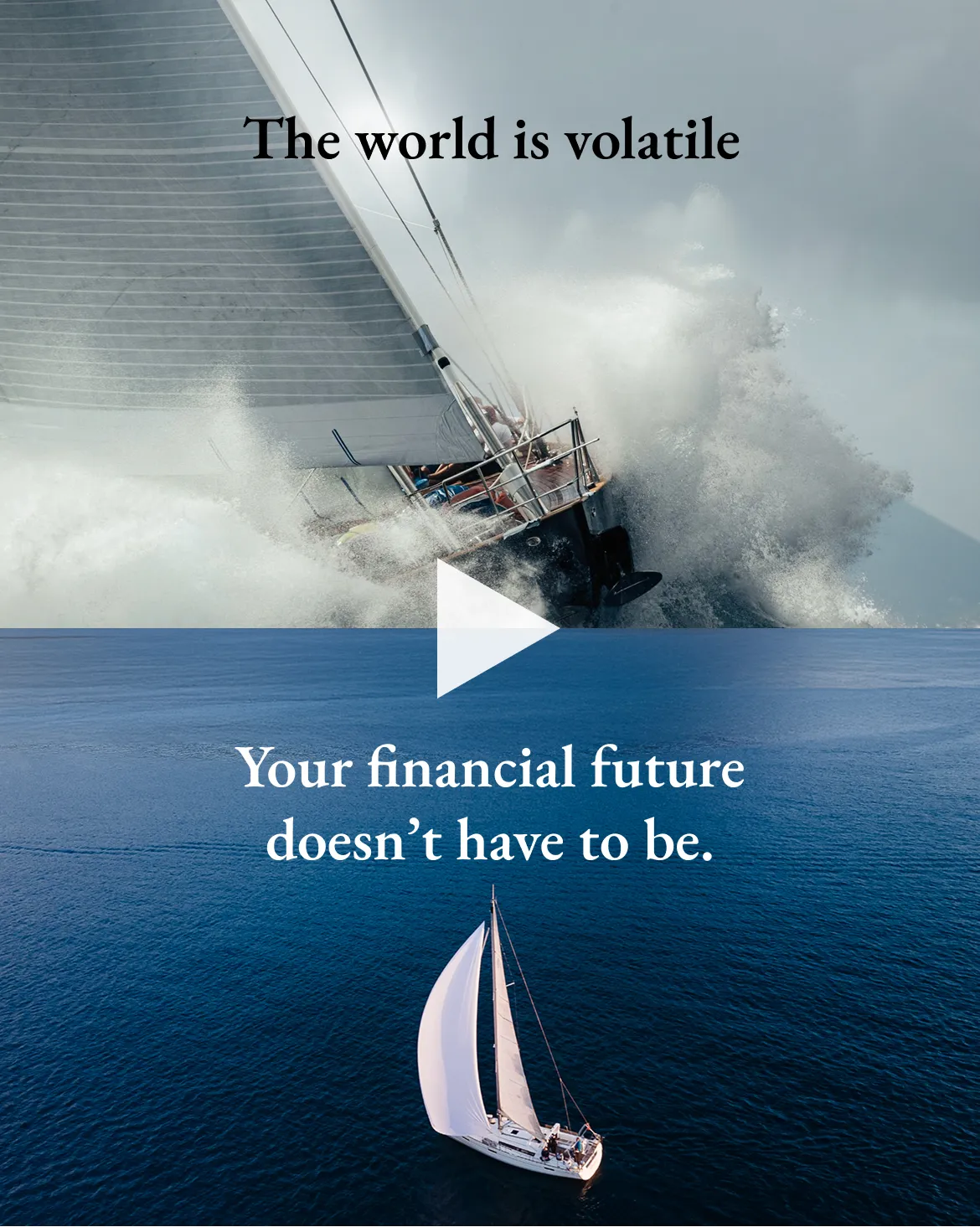

Strong returns, low volatility

Aura Private Credit Income Fund

Aura Core Income Fund

Performance net of fees and expenses.

Inception date for Aura Core Income Fund is 4 October 2022, and for Aura Private Credit Income Fund is 1 August 2017.

Returns are to 31 December 2025. Returns assume reinvestment of all distributions. Past performance is not a reliable indication of future performance.

The Cash Distribution shown in the charts above represents initial capital invested plus the sum of each of the monthly cash distributions paid to an investor who elected not to reinvest. It does not reflect an investment balance and does not take into account a number of variables such as time value of money or how an investor chooses to use the cash distribution.

Download our private credit information pack

Why choose one of our private credit funds?

No loss to investor capital

Since their inception, there has been no loss of investor capital in the Aura Private Credit funds.¹

A history of impressive returns

Annual compound returns of 7.28%² and 9.48%³ net of fees.

Attractive monthly income

Investors have received average monthly income of 0.59%² and 0.76%.³

Layers of protection

Multiple layers of protection to safeguard your investment.

Highly experienced team

An investment team with decades of industry experience.

Reduced market volatility

Private credit has little correlation to public markets and is a complement to equities and property investments.

Past performance is not a reliable indicator of future performance. Funds do not guarantee the return of capital. Diversification does not ensure a profit nor guarantee against a loss.

¹ Since the inception of the Aura Private Credit Income Fund on 1 August 2017 to 31 December 2025, the Fund has delivered positive monthly income payments, with no volatility to investors capital. Since the inception of the Aura Core Income Fund on 4 October 2022 to 31 December 2025, the Fund has delivered positive monthly income payments, with no volatility to investors capital. Past performance is not a reliable indicator of future performance.

² Performance of the Aura Core Income Fund since its inception on 4 October 2022. Net returns after fees and expenses as at 31 December 2025 and assumes reinvestment of distributions.

³ Performance of the Aura Private Credit Income Fund since its inception on 1 August 2017. Net returns after fees and expenses as at 31 December 2025 and assumes reinvestment of distributions.

The funds compared

| Aura Private Credit Income Fund |

|---|

|

Average net annual return since inception

9.48%¹ |

|

Average net monthly distributions

0.76%¹ |

|

Minimum investment

$100,000 |

|

Minimum investment period

1 month |

|

Investor eligibility

Wholesale investors |

|

Independent portfolio credit rating³

BBB- |

|

Number of loans held

13,000 + |

|

Date of fund inception

1 August 2017 |

|

Awards and ratings

2022 Winner HFM Asian Performance Awards |

| Aura Core Income Fund |

|---|

|

Average net annual return since inception

7.28%² |

|

Average net monthly distributions

0.58%² |

|

Minimum investment

$25,000 |

|

Minimum investment period

1 month, subject to liquidity constraints |

|

Investor eligibility

Open to all investors |

|

Independent portfolio credit rating³

AA |

|

Number of loans held

10,000 + |

|

Date of fund inception

4 October 2022 |

|

Awards and ratings

Graded Very Strong by Foresight Analytics |

| Aura Private Credit Income Fund | Aura Core Income Fund | |

|---|---|---|

| Average net annual return since inception | 9.48%¹ |

7.28%² |

| Average net monthly distributions | 0.76%¹ |

0.58%² |

| Minimum investment | $100,000 |

$25,000 |

| Minimum investment period | 1 month |

1 month, subject to liquidity constraints |

| Investor eligibility | Wholesale investors |

Open to all investors |

| Independent portfolio credit rating³ | BBB- |

AA |

| Number of loans held | 13,000 + |

10,000 + |

| Date of fund inception | 1 August 2017 |

4 October 2022 |

| Awards and ratings | 2022 Winner HFM Asian Performance Awards |

Graded Very Strong by Foresight Analytics |

General information only. Investing involves risk. Seek independent advice before investing. Funds do not guarantee the return of capital and past performance is not a reliable indicator of future performance. All data is as at 31 December 2025 unless stated otherwise and is subject to change. Montgomery Investment Management AFSL 354564.

¹ Performance of the Aura Private Credit Income Fund since its inception on 1 August 2017. Net returns after fees and expenses as at 31 December 2025 and assumes reinvestment of distributions.

² Performance of the Aura Core Income Fund since its inception on 4 October 2022. Net returns after fees and expenses as at 31 December 2025 and assumes reinvestment of distributions. Past performance is not a reliable indicator of future performance.

³ S&P Equivalent Portfolio Credit Rating. One month lag and subject to change. The Funds have not been rated by S&P.

⁴ Please read the Product Disclosure Statement (PDS) for full Fund terms, including Limited Withdrawal Offers, as the Fund is considered illiquid.

Download more information

Learn more about the private credit funds Montgomery offers

Invest now

-

Aura Private Credit Income Fund

Apply online -

Aura Core Income Fund

Apply online

Insights Subscribe

Disclaimer

This information is provided by Montgomery Investment Management Pty Ltd (ACN 139 161 701 | AFSL 354564) (Montgomery) as authorised distributor of the Aura Core Income Fund and Aura Private Credit Income Fund.

The Aura Core Income Fund (ARSN 658 462 652)(Fund) is issued by One Managed Investment Funds Limited (ACN 117 400 987 | AFSL 297042) (OMIFL) as responsible entity for the Fund. Aura Credit Holdings Pty Ltd (ACN 656 261 200) (ACH) is the investment manager of the Fund and operates as a Corporate Authorised Representative (CAR 1297296) of Aura Capital Pty Ltd (ACN 143 700 887 | AFSL 366230). Montgomery Investment Management Pty Ltd (ACN 139 161 701| AFSL 354564) (Montgomery) is the authorised distributor of the Fund. As authorised distributor, Montgomery is entitled to earn distribution fees paid by the investment manager and, subject to certain conditions being met, may be issued equity in the investment manager or entities associated with the investment manager.

You should obtain and carefully consider the Product Disclosure Statement (PDS) and Target Market Determination (TMD) for the Aura Core Income Fund before making any decision about whether to acquire or continue to hold an interest in the Fund. Applications for units in the Fund can only be made through a valid online application form accompanying the PDS. The PDS, TMD, continuous disclosure notices and relevant application form may be obtained from www.oneinvestment.com.au/auracoreincomefund or from Montgomery.

The Aura Private Credit Income Fund is an unregistered managed investment scheme for wholesale clients only and is issued under an Information Memorandum by Aura Funds Management Pty Ltd (ABN 96 607 158 814, Authorised Representative No. 1233893 of Aura Capital Pty Ltd AFSL No. 366 230, ABN 48 143 700 887).

Any financial product advice given is of a general nature only. The information has been provided without taking into account the investment objectives, financial situation or needs of any particular investor. Therefore, before acting on the information contained in this report you should seek professional advice and consider whether the information is appropriate in light of your objectives, financial situation and needs.

Montgomery, ACH and OMIFL do not guarantee the performance of the Funds, the repayment of any capital or any rate of return. Investing in any financial product is subject to investment risk including possible loss. Past performance is not a reliable indicator of future performance. Information provided may be based on information provided by third parties that may not have been verified.

Aura Group has entered into a Distribution Partner Agreement (Distribution Agreement) with Montgomery Investment Management to distribute the Aura Private Credit Income Fund and the Aura Core Income Fund, to its client base. Montgomery may receive a share of the fees you pay Aura Funds Management and Aura Credit Holdings Pty Ltd as well as equity in Aura Credit Holdings Pty Ltd ACN 656 261 200 (Aura Credit Holdings).

Where information provided by Brett Craig, Portfolio Manager of the Fund, consists of General Advice, this is provided as an Authorised Representative (AR No. 001298683) of Montgomery.