Investor Insights

SHARE

Pick the right indicators

Investing often requires the forecasting of variables such as revenues and earnings. Every forecast is subject to (often immense) uncertainty, and the vicissitudes of the future can throw even the most well-thought out estimate far off the mark. However, when trying to build forecasts, it’s crucial to select leading indicators that have strong predictive power, as opposed to lagging indicators that could lead to incorrect conclusions.

The global team’s investing framework requires a bottom up analysis of every company we buy or short.

This requires an estimation of revenues and earnings, but typically also involves a consideration of the more granular drivers of value for a particular firm. For a retailer this might involve making assumptions around the number of store units in the future. For an auto supplier it might involve looking at global auto production volumes. If we dig into this auto sector example further, we can understand how some indicators might seem sensible, but in fact don’t hold reliable predictive power.

Misleading indicators

In forecasting vehicle sales, some analysts will look at the average age of vehicles that are registered. The logic here is that as vehicles age, there will be replacement demand that boost new vehicle sales. This however falls to consider the complexity of the auto market, and the interconnectedness of new car sales and used car sales. Many of the consumers who hold vehicles for very long periods have a tendency to trade in their vehicle for used vehicles, rendering the connection between the average age of vehicles and new car sales as tenuous at best.

Alternatively, some use scrappage rates as an indicator to predict new car production and sales. The assumption is that as more cars get scrapped, then this will drive new car demand. However, again, the replacement demand is likely to be used cars as opposed to new vehicle sales.

Lagging indicators

What about economic indicators such as the unemployment rate and household income? Unfortunately, these indicators, while obviously very important for auto demand, are actually lagging indicators. New vehicle sales typically fall before the unemployment rate begins increasing, and average household incomes generally peak after the auto cycle begins to turn.

A sensible leading indicator

One interesting observation made by Daniel Ruiz from Blinders Off Research is that 87 per cent of new vehicle sales in the U.S. are financed, and the level of equity consumers have in their vehicle at the time of trade in is hugely important when trying to predict new car sales. On average, vehicles that are financed are traded in after 3 years for a new vehicle. The vast majority of consumers that trade-in their cars still have an outstanding balance on their loan, so they roll this into the new vehicle. If there’s a high amount of equity in the loan, then there’s an increased likelihood that that consumer will purchase a new vehicle. We can think of the level of equity in the loan as the strength of a consumer’s currency or purchasing power when shopping for a new vehicle.

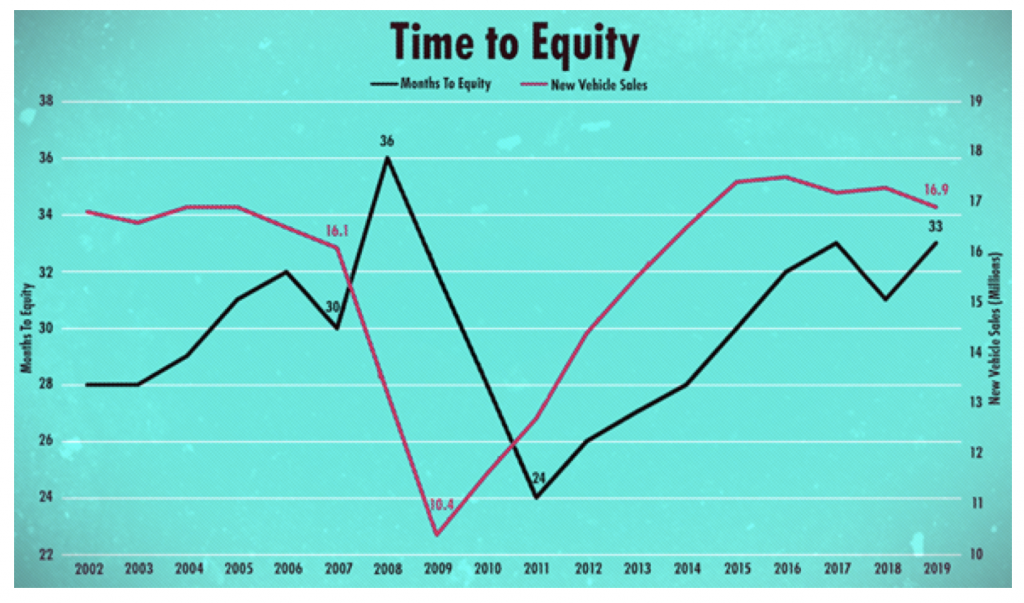

Ruiz has distilled these insights into a metric called Time to Equity, which takes data to estimate when consumers will reach the breakeven point on their loan –that is, when the used car value exceeds the principal balance on the loan. As we can see in the chart below, as the time to equity increases, as it did in 2008, it implies that it is taking longer for consumers to reach the breakeven point on their loan, and thus that they have less equity in their loan at the 3-year mark when they might be considering a new car purchase. As the Time to Equity started to sharply increase in 2008, we saw new vehicle sales fall dramatically.

Source: Blinders Off Research Proprietary Indicator

It’s evident that while some indicators might superficially seem logical to use when trying to gauge how the business might perform in the future, it’s always worth pressure testing whether those variables are genuine value drivers of that business, and whether it makes sense to divert attention to another indicator.

When trying to build investment forecasts, it’s crucial to select leading indicators that have strong predictive power, as opposed to lagging indicators that could lead to incorrect conclusions. Click To Tweet