Investor Insights

SHARE

Can active-trading add value?

Conventional wisdom typically holds that actively trading positions in your portfolio destroys value. Whether it’s Warren Buffett recommending a “buy-and-hold” strategy, or your advisor recommending against active-trading to minimise brokerage and taxes, there are plenty of experts out there who contend that active trading is inadvisable.

Certainly, we would agree that needless trading ought to be minimised or eliminated wherever possible given the associated costs to transact. That said, we believe in active portfolio management when based on a strict assessment of the risk/reward profile at any given stock price level. A simple way to think of this is to ask yourself: at any given stock price level, how much upside could there be; versus how much downside?

It makes sense to us that:

- At a stock price level for which the upside is large and the downside is small: the portfolio position should be large; and

- At a stock price level for which the upside is smaller and the downside is larger: the portfolio position should be reduced – or even eliminated completely.

A corollary of this approach is that portfolio position sizing is largely in the hands of Mr Market. As the stock prices of portfolio holdings increase – we typically reduce the position size absent any new information. Similarly, we typically add to positions when stock prices fall. We don’t change position sizes every day – but certainly pressure-test position sizes at least every month.

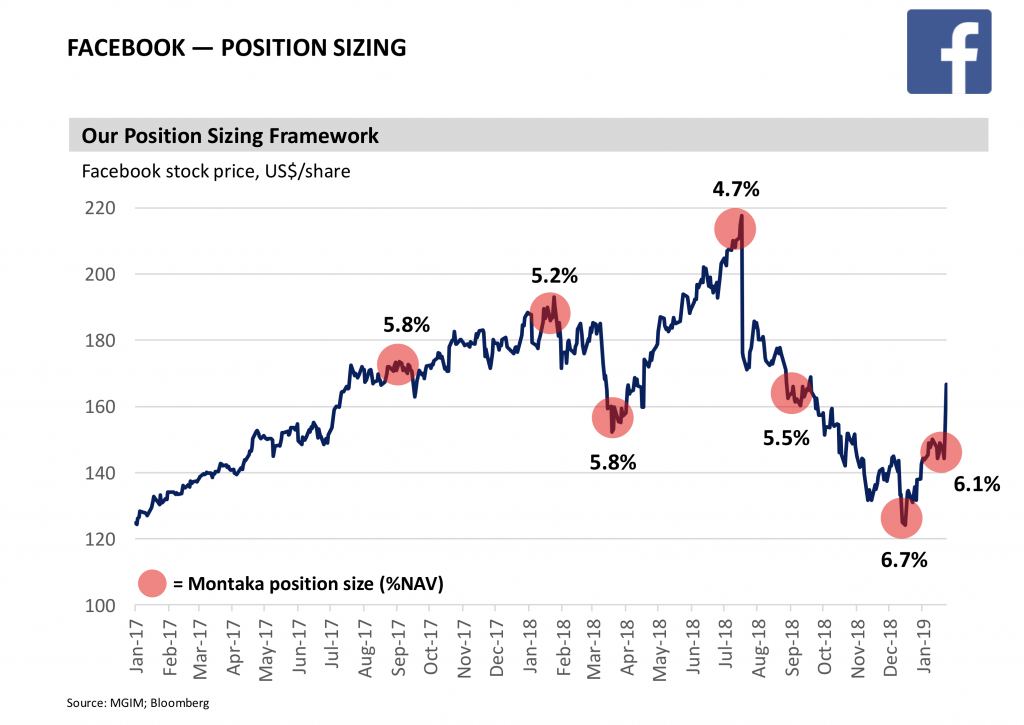

Shown below is an example of how Facebook’s position size evolved in our portfolio over the last 18 months. Interestingly, the stock itself has done an approximate round-trip from $170/share to $170/share. Under a buy-and-hold strategy, your return over this period would have been approximately zero.

Yet, by applying our portfolio sizing framework with discipline, we reduced our exposure when the stock price increased and added to it when the stock price fell. We estimate that our approach generated approximately 0.8 per cent in incremental return over the period. This may not sound like much, but when applied to each stock in the portfolio over many years this will likely add up to become a meaningful contribution to our investors.

The Montgomery Global Funds own shares in Facebook. This article was prepared 06 February with the information we have today, and our view may change. It does not constitute formal advice or professional investment advice. If you wish to trade Facebook you should seek financial advice.