Investor Insights

SHARE

Winners and losers from vaccine announcements

In a year full of big moves and volatile share prices, last Tuesday saw one of the biggest disparities in the share price performance of the so called “growth vs value” stocks. The spark was the announcement from the Pfizer and BioNTech’s vaccine, which led to a significant rotation into the traditional “value” stocks, funded largely by profit taking in many growth stocks.

A closer examination of the moves also reveals significant disparity in the share price reactions in the “reopening” versus the “stay-at-home” winners, as the market de-risked the prospect of a post-COVID world. Undoubtedly some of the re-opening trades would have been accentuated by the high level of short interest in many of these stocks, while so called “stay-at-home” winners may have been impacted by the rush to lock in profits.

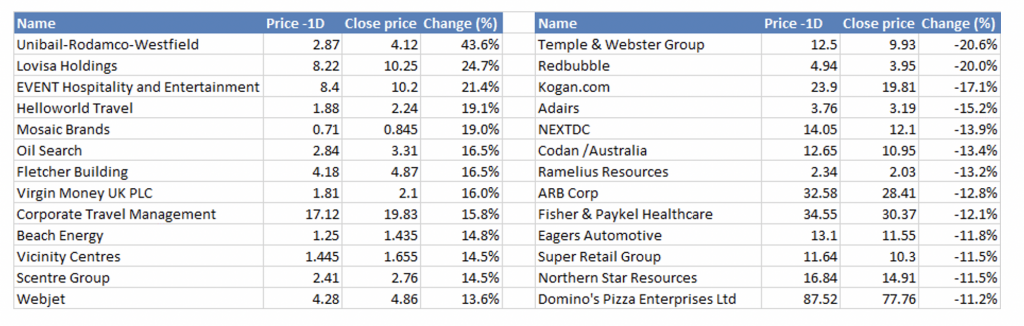

Here is a list of some of the moves that the market witnessed on 10 November, as well as the share price of the companies the day before and the close price as at 10 November.

Winners and losers on the Great Rotation Day (10 November)

Source: Bloomberg, Montgomery

Unsurprisingly, the winners on the day were the businesses most heavily impacted by COVID including travel, shopping centres, fast-fashion or retail without significant online presence and oil / energy – which had been a very notable laggard in the reopening trade momentum.

On the negative side of the ledger were generally businesses that had performed very well during COVID and throughout the year, and had seen a significant re-rate of their share prices even following the aggressive sell-off. These businesses include e-commerce, tech plays, gold miners and auto/auto parts sellers, and other beneficiaries (ventilator sellers, pizza companies).

It’s notable that many of these reversed recent price trends experienced in late October and early November had performed well in the month prior. As COVID reared its head in the Northern Hemisphere (US and Europe) movement restrictions were back and this resulted in a changing of the positive sentiment surrounding all re-opening trades experienced in September.

Investing implications

While it’s questionable that such a significant rotation would have occurred without the extremely positive “90 per cent effectiveness” headline from a reputable vaccine developer, there are two things worth noting from the moves:

- Positioning ahead of the event – with most of the re-rating / de-rating on the “re-opening” vs “COVID winners” occurring in the first few hours, it highlights the importance of positioning ahead of the event – especially for funds that require significant liquidity to adjust their portfolio. This is despite consensus expectation that science would eventually overcome the most acute impacts of COVID-19 on society.

- Portfolio diversification – a portfolio of “stay at home” winners would likely have outperformed materially for the past three months – however, such a portfolio would have materially underperformed on the day. Similarly, a portfolio full of “re-opening” trades may have underperformed for many months, albeit would have recouped much of the performance in a single day.

The sharp moves highlight the importance of market timing in certain situations, as well as looking ahead to potential changes to the environment.

For example, investing in retail stocks on the expectation that such strong sales growth would continue even as Australia’s COVID cases remained low and the country was re-opening held a degree of risk given the potential shift in “share of wallet” as consumers looked to spend more of their discretionary income on services. While there will be some structural winners in the retail space, it is unlikely all of these companies will grab a greater share of consumer wallets as spending patterns normalise.

On the flip side, assuming economies and societies would open entirely without regarding the risks of rolling restrictions as COVID flare-ups re-emerged would expose an investor to sharp changes in sentiment experienced in late October as previously noted. This is compounded by the potential equity damage to assets with declining values over time, most notably in the energy space given their finite reserves.