Investor Insights

SHARE

Why this business lender looks set to prosper

Business loan books are growing at their fastest rate since the GFC, as firms start investing again and government support is pared back. One lender that is making hay is small business loan specialist, Prospa Group (ASX:PGL). Prospa is well positioned for accelerating revenue growth, and has a strong balance sheet to fund its growth.

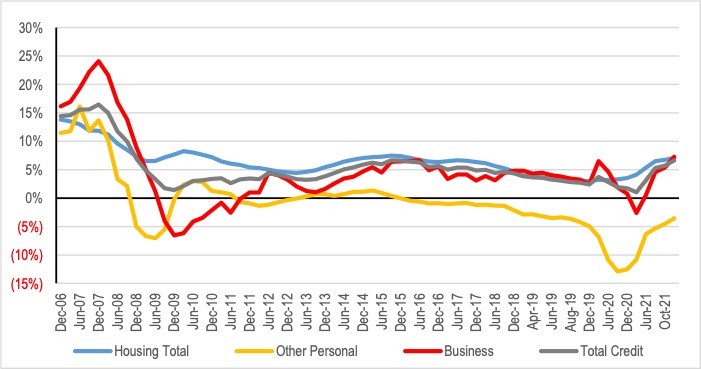

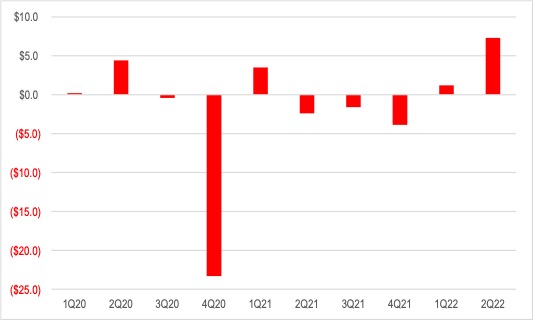

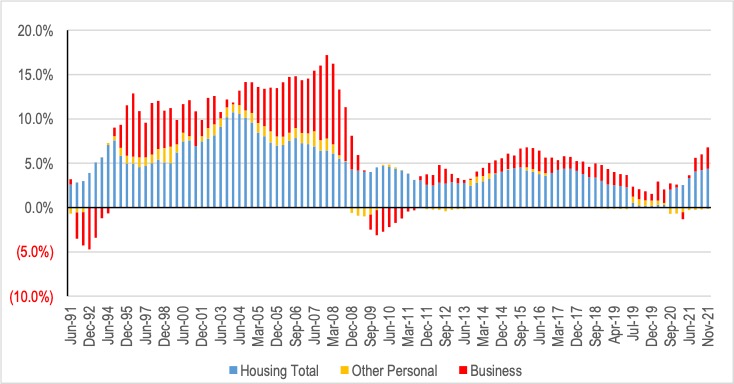

As the economy begins to move through to what is hopefully the later stages of the COVID pandemic, the drivers of credit growth are shifting from growth in mortgage lending toward accelerating demand for credit from business. The monthly lending statistics provided by the RBA and APRA show this dynamic of both accelerating overall demand for credit, and business lending driving an increasing proportion of the overall growth.

Figure 1: Drivers of overall Australian year-on-year credit growth

Source: RBA and APRA

Figure 2: Year-on-year loan book growth by segment

Source: RBA

Business loan books are currently growing at their fastest rate since the GFC. This comes on the back of a fall in business borrowing after a spike early in the pandemic as businesses drew down on their existing credit lines to provide themselves with emergency liquidity. Over the following year, the enormous amount of government stimulus supported businesses and their cash flow, allowing them to wind back their debt levels.

While the omicron wave has put a bit of a spanner in the works, business has begun investing to take advantage of the reopening of the economy. At the same time, government support has been reduced relative to 2020 levels. As a result, businesses are increasingly funding this investment through new borrowing.

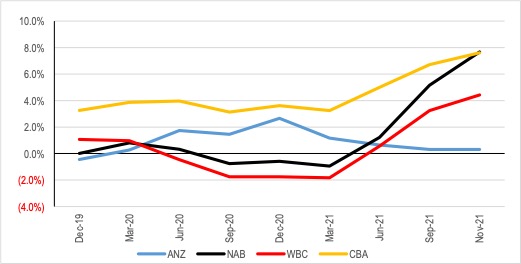

Not surprisingly, the major bank that has seen the strongest acceleration in loan book growth in recent months has been NAB given its relatively high exposure to SME lending. CBA’s growth has also remained strong as accelerating lending to business has augmented stabilising growth rates in its mortgage book.

Figure 3: Year-on-year loan book growth by major bank

The major banks are not the only stocks exposed to the acceleration in demand for credit from business. Prospa is a pure play on the sector through its lending to SMEs on an unsecured basis, offering loans with an average duration of 17 months as well as unsecured revolving lines of credit.

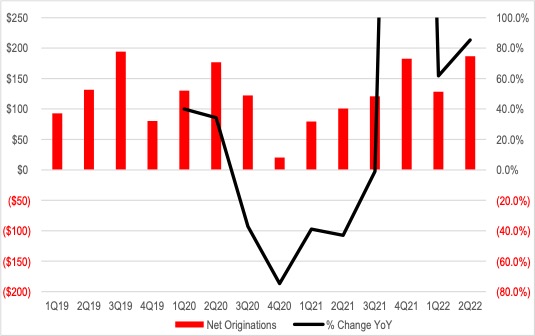

Because its loans are short duration relative to the banks, they amortise quickly. This makes the company more reliant on the flow of loan approvals (originations), with the size of its loan book changing far more quickly than the banks when origination volumes accelerate or decelerate.

The benefit of shorter term loans is that the shape of the book in terms of mix of exposures can be changed more dynamically as risks in individual industries change. This has served Prospa well in navigating the pandemic with government payments reducing the risk of defaults from pre-pandemic loans, and an ability to wind back overall exposure, especially to the more exposed sectors like tourism, hospitality and retail in the early stages, refocusing lending on the strong construction market.

With Australian vaccination rates rising through the latter part of 2021, demand for credit from SMEs increased as economic risks began to recede. Prospa has been able to increase its lending volumes to help meet this growing demand with origination volumes accelerating materially over the last nine months back above pre-COVID levels.

Figure 4: Prospa quarterly net originations

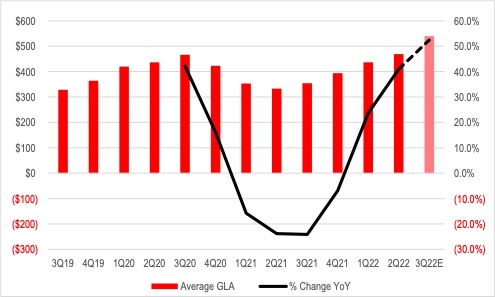

With originations rebounding strongly, the loan book has returned to sequential growth over the last three quarters. The quarterly average loan book has returned to similar rates of year-on-year growth as it was delivering pre-COVID. This, along with changes in average loan book yields, will in turn drive accelerating revenue growth. Growth is likely to continue to accelerate in the March quarter given gross loans finished December at A$515m, up 51 per cent on the same time in 2020, and demand has remained strong in January.

Figure 5: Prospa period end gross loans

Source: Company, MIM estimates

Surprisingly, the average yield generated by the business increased slightly on a sequential basis in the December quarter, rising from 32 per yield to 34 per cent. Yields are expected to fall over the long term as the business increases its scale. This will further support revenue growth in the near term.

While operating costs are increasing as the business both cycles the emergency measures taken at the height of the pandemic, and reinvests in sales and marketing to take advantage of the strong demand for credit, EBITDA increased to its highest quarterly level in the December quarter. This was partially due to some provision write backs given the better than expected bad debt experience, but the underlying level of EBITDA is also showing an encouraging improvement.

Figure 6: Prospa quarterly EBITDA

With revenue growth accelerating, the outlook for underlying EBITDA is also on of accelerating growth.

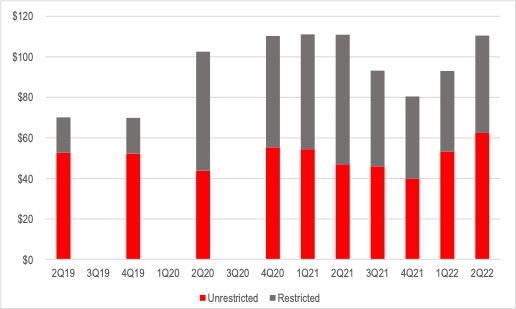

This, along with improved funding, has resulted in growing cash in the balance sheet, both on a restricted and unrestricted basis. Unrestricted cash at the end of December equated to A$0.38 per share, 45 per cent of the company’s current share price.

Figure 7: Prospa balance sheet cash at period end

With strong demand for credit from businesses, Prospa is well positioned for accelerating revenue growth, only partially offset by increased investment, while having a strong balance sheet to fund its growth.

The Montgomery [Private] Fund owns shares in Prospa Group. This article was prepared 21 January 2022 with the information we have today, and our view may change. It does not constitute formal advice or professional investment advice. If you wish to trade these companies you should seek financial advice.