Investor Insights

SHARE

What’s in a global equity benchmark?

The MSCI (Morgan Stanley Capital International) organisation is arguably the best know provider of global equity indexes and provide an excellent insight into the investable equity markets around the world. The MSCI indexes are market cap-weighted indexes, which means stocks are weighted according to their market capitalisation—calculated as stock price multiplied by the total number of shares outstanding.

The stock with the largest market capitalisation gets the highest weighting on the index. This reflects the fact that large-cap companies have a bigger impact on an economy than mid or small-cap companies. A percent change in the price of the large-cap stocks in an MSCI index will lead to a bigger movement in the index than a change in the price of a small-cap company.

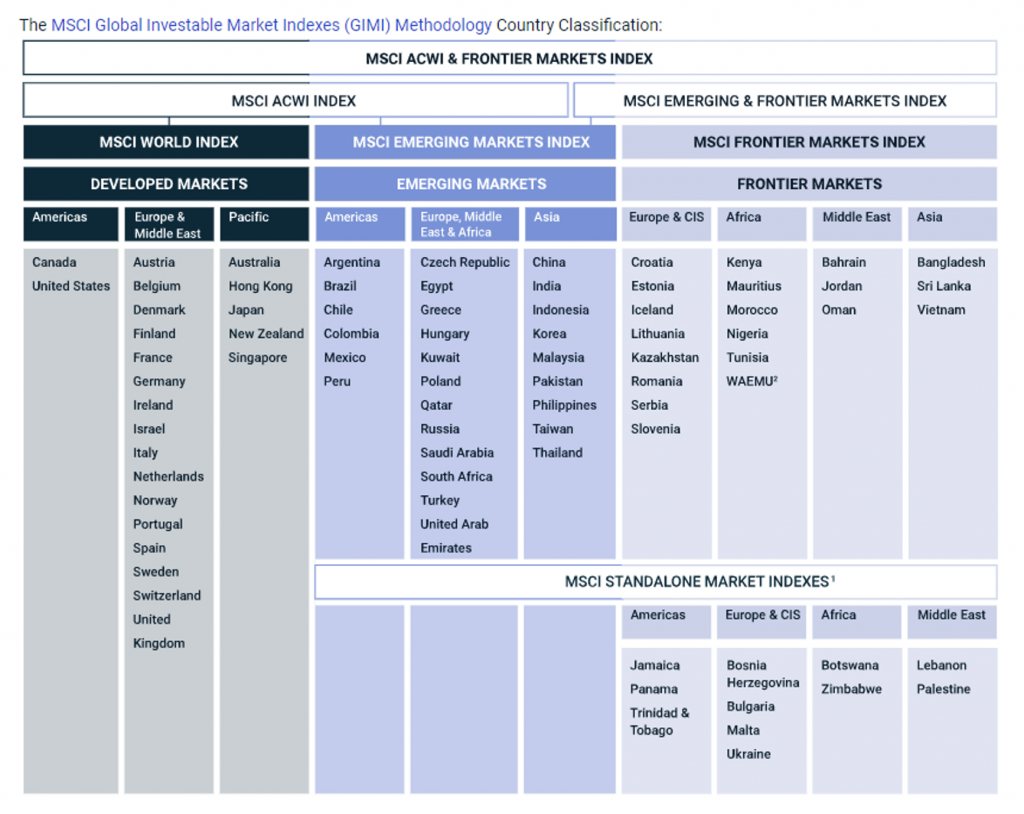

The table below from MSCI shows the basic architecture of their different global equity indices and the countries that are included.

The two main global equity classifications are MSCI World Index and MSCI ACWI Index.

The MSCI ACWI Index, MSCI’s flagship global equity index, (ACWI – All Country World Index) is designed to represent performance of the full opportunity set of large and mid-cap stocks across 23 developed and 27 emerging markets. As of June 2021, it covers more than 2,900 constituents across 11 sectors and approximately 85 per cent of the free float-adjusted market capitalisation in each market.

The MSCI World Index, is a broad global equity index that represents large and mid-cap equity performance across 23 developed markets countries. It covers approximately 85 per cent of the free float-adjusted market capitalisation in each country and MSCI world index does not offer exposure to emerging markets.

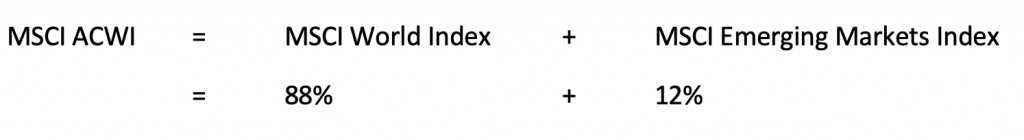

So, the key difference in the indices as you can see is the exposure to Emerging Markets. In simple terms the addition of Emerging Markets into the MSCI World Index to form the MSCI ACWI Index looks like this:

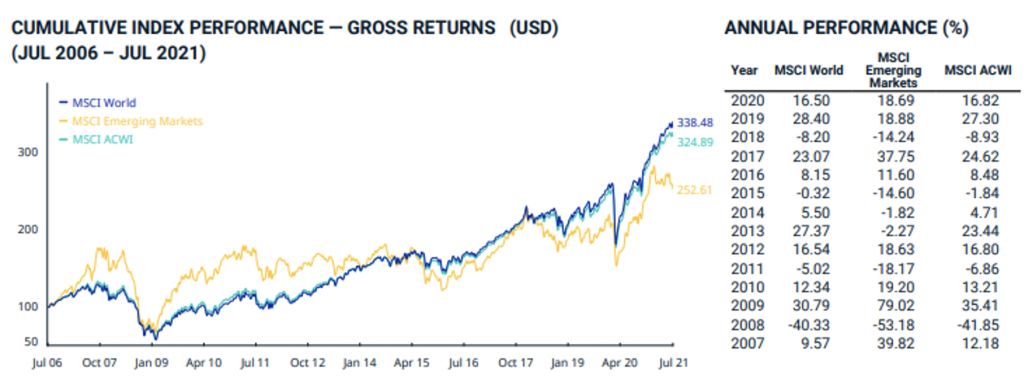

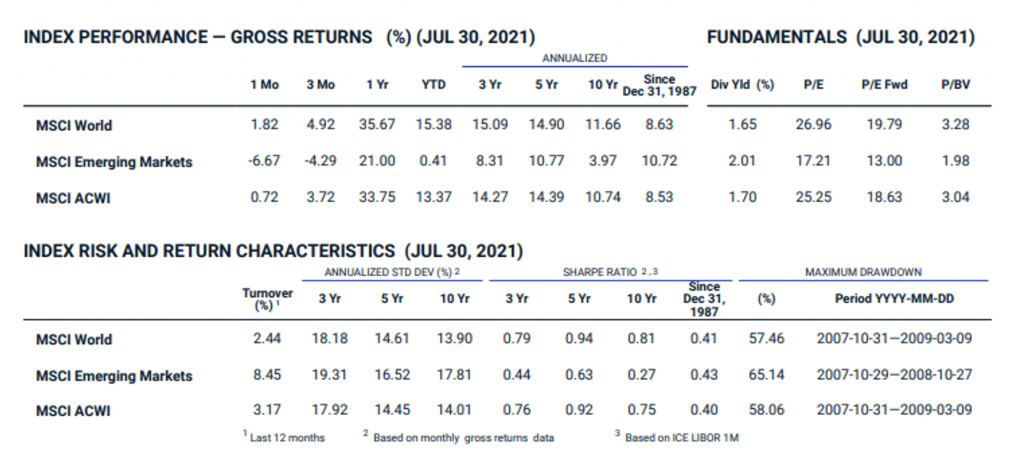

The respective performances of these indices (in USD) over the past 15 years are shown in the charts and tables below.

Apart from the recent under-performance of Emerging Markets and the contribution it has made to the ACWI index over the last year, both the MSCI ACWI and MSCI World Indices have performed pretty similarly over most time periods.

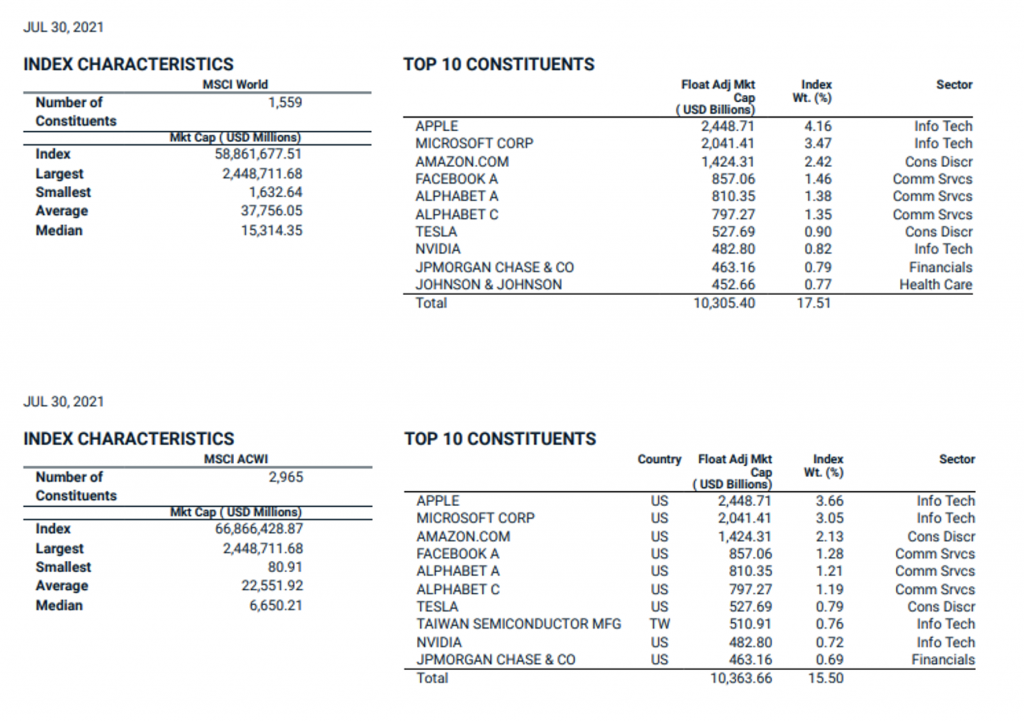

When we look at the index characteristics and Top 10 constituents of both indices, we can see that the only stock to make it in the Top 10 in the MSCI AWCI from Emerging Markets allocation is the Taiwan Semiconductor MFG. The MSCI ACWI also has considerably more stocks in the index, being ~1,400 more and the smallest stock is just USD $80 million market cap vs USD $1.6 billion for the MSCI World.

As most readers know, our global equity partner here at Montgomery is the $70+ billion asset manager, Polen Capital based in the US. Their flagship global growth equity strategy, which we offer here in Australia and NZ called the Polen Capital Global Growth Fund uses the broadest global equity market index, MSCI ACWI as its benchmark. This provides it with the broadest opportunity set in order to find the highest quality, globally advantaged growth investments.

The concentrated nature of the strategy also means that Polen have much higher weights in their portfolio’s Top 10 Holdings than the index, as shown below. Looking through the whole portfolio there is not currently no investments in companies domiciled in one of MSCI’s Emerging Markets Index country constituents. This is only a recent move, given the exiting of both Tencent and Alibaba from the portfolio over the past quarter. You can read Roger’s article where he discuss this decision in more detail here: Regulatory crackdown on the education sector and China related stocks

Polen Capital Global Growth Fund

If you would like to learn more about the Polen Capital Global Growth Fund, visit the fund’s web page:

POLEN CAPITAL GLOBAL GROWTH FUND