Investor Insights

SHARE

The difference between funding for small and big banks

In a recent webinar to discuss the August reporting season, I was asked to provide thoughts on questions about the bank stocks. In my second post, I am covering: What is approximately the cost of funds gap between say the big banks and the small banks?

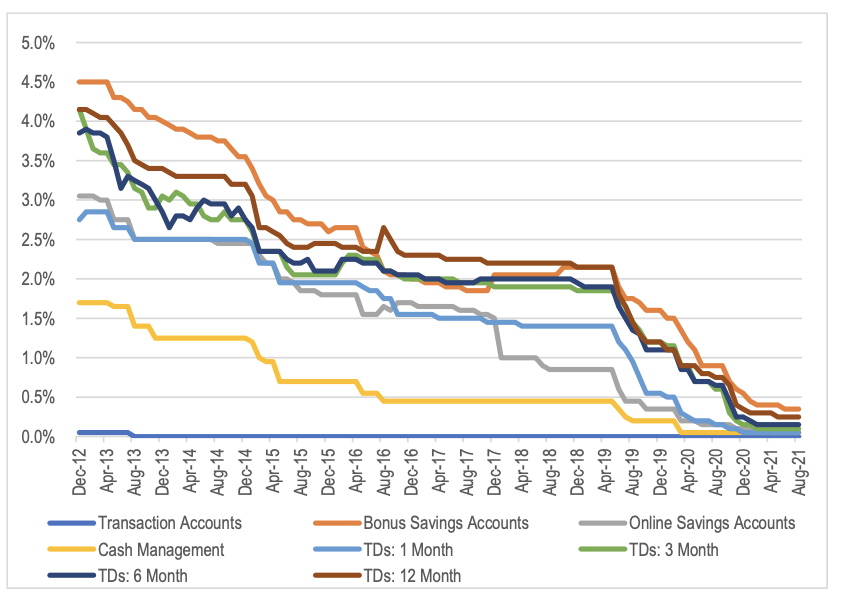

The low interest rate environment has meant that the normal funding cost advantage enjoyed by banks through their deposit base has narrowed. This is because there is a floor in the rate banks can pay depositors (excluding charging fees) of 0 per cent. As the official RBA overnight and medium-term bond rates fall, the cost of wholesale funds falls with it. Transaction accounts pay 0 per cent or close to 0 per cent. In the last 12 months, it has been the rates offered on savings accounts and term deposits that have been slashed.

Figure 1: Average deposit rates by deposit type

Source: RBA

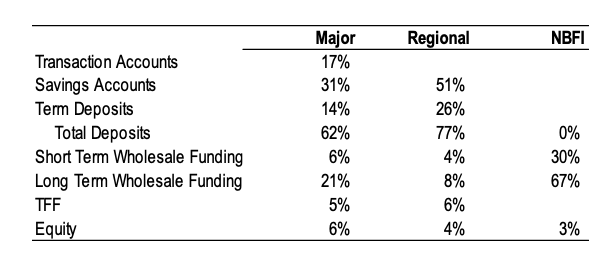

If we think about the mix of funds for a major bank relative to a regional bank and a non-bank financial institution (NBFI e.g. a mortgage securitisation business like AFGS or Resimac), the funding cost position on a marginal basis comes down to their mix of funding types and their credit spreads.

A rough indication of the current funding mix for each one the majors, regionals and NBFIs is shown in the table below.

Figure 2: Funding mix

Source: MIM

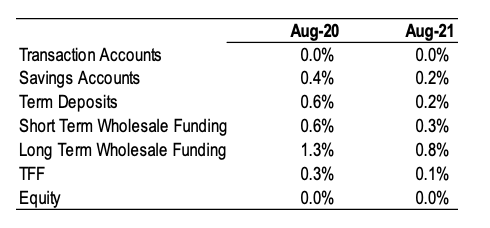

The table below provides a rough indication of the current funding cost of each of these types of funding relative to this time last year. Note however, that the actual funding cost for each type of lender will depend on the lender’s individual credit margin.

Figure 3: Approximate cost of funding by type

Source: MIM, RBA

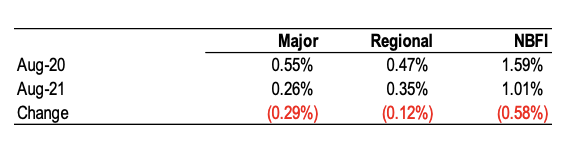

Applying the funding mix above, and incorporating a shift from term deposits to at-call deposits in the mix over the last 12 months, we can estimate the reduction in funding costs over that period.

Figure 4: Indicative average funding cost – Aug 2020 vs Aug 2021

Source: MIM, RBA

Note that the major banks still have a fairly large funding advantage, but the important thing is that the funding costs of the NBFIs will have fallen far more significantly. The major banks are the price setters in the mortgage market. Therefore, mortgage rate movements are likely to be correlated with the funding costs of the major banks. NBFIs are price takers. As a result, a 30 basis point reduction in their funding costs relative to the majors is likely to see their net interest margins increase by a similar amount. This makes a significant difference to an NBFI’s earnings.

You can read my first question also here:

Why near-term bank dividends should remain strong

You can watch the full webinar here: Montgomery’s reporting season review

The Montgomery Funds owns shares in Westpac and Commonwealth Bank. This article was prepared 13 October 2021 with the information we have today, and our view may change. It does not constitute formal advice or professional investment advice. If you wish to trade these companies you should seek financial advice.