Investor Insights

SHARE

Tencent, the quiet achiever

With all the noise in recent days over new antitrust initiatives in the Chinese technology space, the stellar ongoing performance of Tencent’s many businesses seems to have been lost in the mix.

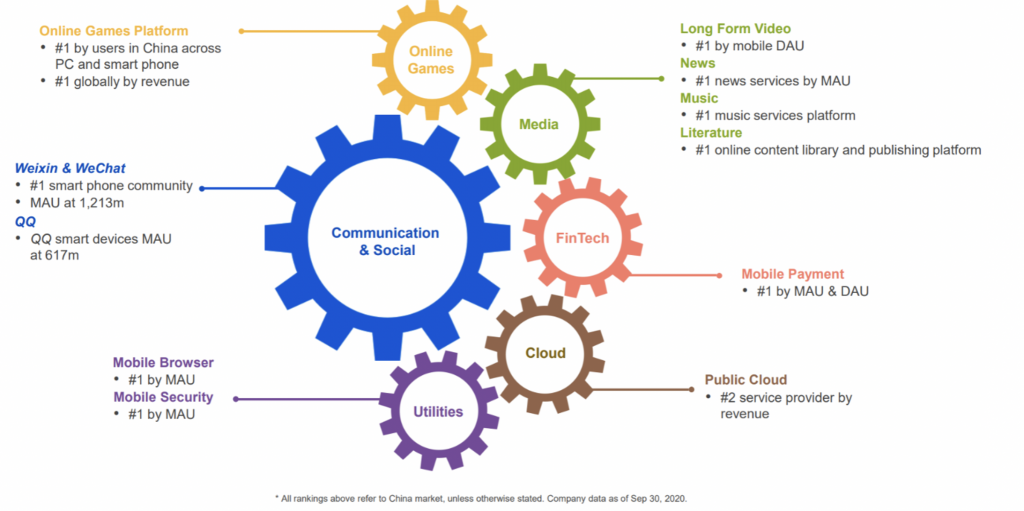

By way of reminder, Tencent can be viewed as a Chinese market-leading platform of multiple digital software-based platforms. As illustrated below, around its core messaging apps, Weixin and WeChat, are its gaming platforms, media platforms, fintech platforms, cloud platforms and mobile internet utilities platforms.

Tencent – a platform of platforms

Source: Company Presentation

These platforms cross-pollinate to unlock significant growth in high-margin gaming revenues, video subscription revenues, digital advertising revenues, payments revenues and wealth management revenues. And this is before we even get to Tencent’s relatively new cloud business which is focussing on the high-margin platform and software layers.

This is worth examining further. China’s cloud-based enterprise software market is behind that of international peers – but the trajectory of digital transformation is the same. One of Tencent’s long-term growth options relates to the ongoing adoption of its enterprise productivity toolkit which includes WeCom, its cloud-based messaging app for work; Tencent Meeting for video collaboration; and Tencent Docs for cloud-based documentation and processing. Consider that Tencent Meeting, for example, already has 100 million registered users, despite its relative infancy.

Similar to Alibaba’s cloud business (the largest in China), Tencent’s cloud business does not contribute much to the Group’s bottom line today. But in the future, it surely will. And we believe this is just one new business that is being undervalued by the market today. Could there be others?

Almost certainly. It is often overlooked that Tencent has significant equity investments in more than 700 third-party businesses that it deems to have strategic synergies with Tencent’s core platforms. From Meituan, to JD.com, to Kuaishou, to Spotify, to Universal Music Group, to Snap and Epic Games, to name just a few. Each of these represent seeds that have been planted today and could be nurtured into multi-$billion opportunities of the future.

Good things happen to great businesses. And Tencent is an extraordinary business. We expect Chinese regulations in the technology space to continue to make noise – as does the continual talk of new American and European regulations. But for those investors with a longer-term time horizon, Tencent is an investment opportunity that is difficult to exclude.

Montaka owns shares in Tencent. This article was prepared 13 November with the information we have today, and our view may change. It does not constitute formal advice or professional investment advice. If you wish to trade Tencent you should seek financial advice.