Investor Insights

By , Polen Capital

SHARE

Playing the infinite game: patient investing

In his 2019 book The Infinite Game, author Simon Sinek describes how taking a long-term view — what he calls adopting an infinite mindset — is critical for success. Although discussed in the context of leadership, the same principle applies to investing, which has historically favored those who take a long-term view rather than react impulsively to the inevitable ups and downs that occur on the path to creating wealth. Of course, while countless investors have demonstrated that the market rewards those who stay the course, the reality is that doing so isn’t always easy. On the contrary, it takes discipline, self-restraint, and patience.

Investors can quickly lose sight of this reality, particularly in the current environment. Faced with record inflation, rising interest rates, and geopolitical unrest, it’s only natural for investors to want to take action. Shifting strategies or pulling out of the market are among the ways that some investors try to insulate themselves from volatility. Yet the reality is that taking these or other similar steps rarely yields the desired outcome over the long term. Patience isn’t just a virtue. We believe it’s an essential ingredient in any successful financial strategy.

Why we believe patience pays off

As a society, we’re constantly bombarded with information that can either scare us or make us feel like we’re missing out. As a result, it’s easy to feel compelled to take steps we believe will safeguard our assets or to try to time the market or cash in on the latest trend. That’s one reason so many investors have shifted from a buy-and-hold mentality in recent years to one that favors trading securities much more frequently. While the desire to buy low and sell high is understandable, it’s virtually impossible to do so regularly without a crystal ball.

In our view, making a conscious decision to be patient is critical, even though it’s challenging. People are often hardwired to seek instant gratification. We want results, and we want them now. As such, we have a strong bias toward taking action to reach a resolution sooner rather than later, even when waiting can be the more prudent thing to do.

Practically speaking, that means that many investors are willing to sell their assets in a down market in the hopes of avoiding deeper losses. Our experience suggests that, in many cases, had they just remained invested, their outcome could have been markedly different. On the opposite end of the spectrum, those same investors are also prone to selling assets that have increased in value far too soon. While there’s nothing wrong with locking in gains, doing so can come at a high cost if it means missing out on a substantial upside.

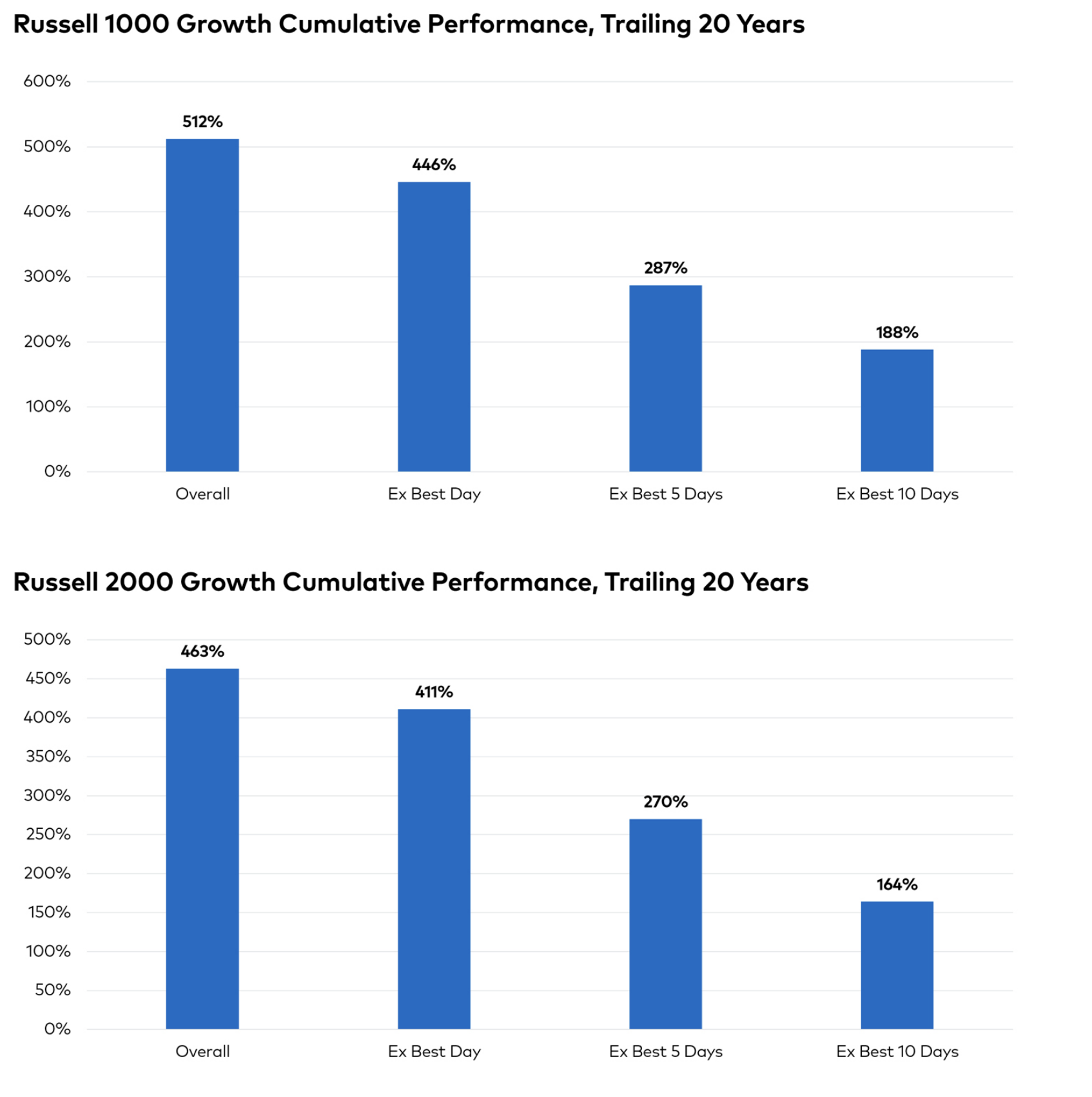

With investing, taking action for action’s sake can lead to poor outcomes. Exhibit 1 shows the impact of missing the one, five, and ten days in the market with the highest total return for the Russell 1000 Growth and the Russell 2000 Growth over the past 20 years.1 Notably, some of these “best days” can occur during highly uncertain times, such as the challenging market downdraft at the end of 2008, and the tumultuous early phase of the COVID-19 pandemic in 2020. To us, this underscores the difficulty of attempting to time the market and the wisdom of staying invested for the long term.

Exhibit 1: Impact of Missing the Best Days in the Stock Market, August 31, 2002 to August 31, 2022

Source: Bloomberg, as of August 31, 2022

Patience takes determination, resilience, and the confidence to stand by investments backed by careful, fundamental research. To be clear, being patient isn’t the same as being passive. It’s not about taking your eye off the ball and letting come what may. Nor is it about being too stubborn or inflexible to adjust one’s strategy when merited. Instead, the goal is to see past any noise in the market today and to hold steady in pursuit of greater rewards.

For the patient investor, those rewards are possible thanks to the power of long-term compounding. Our research indicates that successful companies plow profits back into their business to promote further growth, which can lead to greater value and higher stock prices over time. Investors who trade in and out of the market, whether driven by fear or to chase returns from the latest meme stock, frequently miss out on that compounding effect and sacrifice substantial long-term growth.

Taking the patient approach

At Polen, we believe that patient investing starts with adopting an owner’s mindset rather than that of a trader. For us, that means taking the time to identify and invest in what we see as the highest-quality companies and having the discipline to maintain those positions over the long term. We carefully study each company we invest in, engaging with their management teams and examining multiple aspects of their business before allocating capital. We take a bottom-up approach focused on understanding the business, its potential for profitability and growth, and any risk factors that could stand in the way.

Notably, the companies we invest in aren’t new, untested, or at the forefront of the latest fad or trend. They are proven, established businesses with robust balance sheets and the financial flexibility to keep investing in and growing their business in any environment, including periods of high volatility and recession. Once we’ve invested in a company, we continuously monitor its progress and note any factors that could prompt a change in our outlook (Exhibit 2). We believe that this measured, unemotional approach is critical not only for capital preservation but also to position ourselves to reap the full benefits of long-term compounding.

Exhibit 2: Select Factors That May Prompt a Polen Capital Decision to Sell an Equity Security

Source: Polen Capital

While no business is immune to macroeconomic conditions like the ones currently affecting the market, we believe short-term fluctuations shouldn’t be cause for concern. We believe that investors with a diversified portfolio of companies with outstanding fundamentals should reflect that while the path to wealth creation may be bumpy, the patience to play the infinite game can improve one’s chances of succeeding.

1 The Russell 1000® Growth Index is a market capitalization weighted index that measures the performance of the large-cap growth segment of the U.S. equity universe. It includes Russell 1000® Index companies with higher price-to-book ratios and higher forecasted growth values. The index is maintained by the FTSE Russell, a subsidiary of the London Stock Exchange Group. The Russell 2000® Growth Index is a market capitalization weighted index that measures the performance of the small-cap growth segment of the U.S. equity universe. It includes Russell 2000® Index companies with higher price/book ratios and higher forecasted growth values. The index is maintained by the FTSE Russell, a subsidiary of the London Stock Exchange Group. The volatility and other material characteristics of the indices referenced may be materially different from the performance achieved. In addition, the composite’s holdings may be materially different from those within the index. Indices are unmanaged and one cannot invest directly in an index.

This information is provided for illustrative purposes only. Opinions and views expressed constitute the judgment of Polen Capital as of September 2022 and may involve a number of assumptions and estimates which are not guaranteed, and are subject to change without notice or update. Although the information and any opinions or views given have been obtained from or based on sources believed to be reliable, no warranty or representation is made as to their correctness, completeness, or accuracy. Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice, including any forward-looking estimates or statements which are based on certain expectations and assumptions. The views and strategies described may not be suitable for all clients. This document does not identify all the risks (direct or indirect) or other considerations which might be material to you when entering any financial transaction. Past performance does not guarantee future results and profitable results cannot be guaranteed.