Investor Insights

SHARE

Montgomery Investment Management offers an income strategy for income-seeking clients through a partnership with Aura Funds Management

Painfully low interest rates on cash-style investments have seen many investors seeking reliable monthly income. Montgomery Investment Management (Montgomery) is delighted to announce its Distribution Partnership with Aura Funds Management, a subsidiary of Aura Group. Montgomery will offer wholesale clients the Aura High Yield SME Fund, with a history of delivering reliable monthly income from a unique mix of online lending platforms in Australia.

Many investors have suffered a severe diminution of spending power from cash in the bank and term deposits delivering low returns. Credit Income Funds aren’t term deposits or a substitute for cash, and they can offer attractive income yields paid monthly. Traditional lenders (e.g. banks) have focused their lending operations on large business customers, seeking to profit from scale. Consequently, small and medium enterprises (SMEs) have been searching for alternative sources of credit. This combination of low cash yields and an absence of lending to SMEs by the banks, delivers investors a unique opportunity to provide funding.

The Aura High Yield SME Fund (the Fund) has generated reliable and strong risk-adjusted returns distributed as monthly income for 56 months to March 2022 from a well-diversified portfolio of SME loans. This provides wholesale investors with a relatively new opportunity and alternative to low bank or term deposit returns. Launched in August 2017, the Fund has delivered a compound annual return of 9.75 per cent, after expenses, and assuming distribution reinvestment.

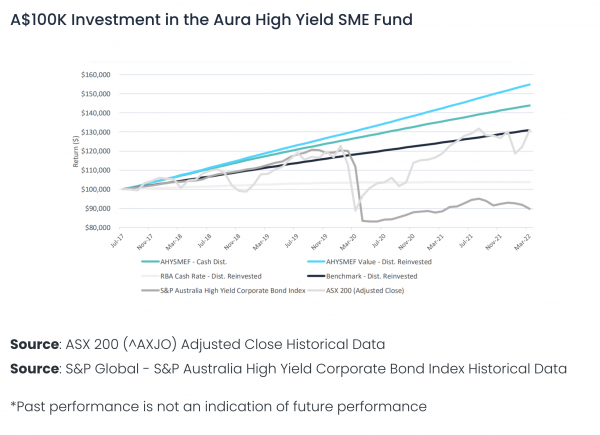

Figure 1: Aura High Yield SME Fund Performance Comparison

Source: Aura High Yield SME Fund, March 2022 Statistics

The Fund has delivered on its target, paying reliable distributions ranging from 0.62 per cent to 0.93 per cent monthly, with an average 0.78 per cent per month. Importantly, these returns are accompanied by a very low standard deviation of 0.08 per cent. As shown in Figure 1, a $100,000 investment earned an average of almost $10,000 in distributions per annum. Since inception, with distributions reinvested, one hundred thousand dollars has earned approximately $54,000, meaning the original $100,000 investment is worth approximately $154,000 in March 2022.

The Fund is open-ended, priced monthly, offers monthly applications and redemptions (with at least 30 days’ notice), is available on the Macquarie Wrap (IDPS), Netwealth (IPDS) and Powerwrap (IPDS) platforms and has two ratings, including “Very Strong/Complex” by Foresight Analytics and “Commended” by Evergreen Ratings.

The Fund is designed for wholesale clients with a minimum initial investment of $100,000.

Roger Montgomery, Chairman of Montgomery Investment Management, said, “Following the signing of our global equities Distribution Partnership with US-based Polen Capital twelve months ago, I am delighted Montgomery can now offer a high-quality income solution for our wholesale clients in partnership with Aura Funds Management and working with Brett Craig, the Portfolio Manager. Brett’s focus on income, by lending to small and medium enterprises through loan originators, has produced an enviable track record to date.”

Brett Craig is the Portfolio Manager and a Director of Aura Funds Management. He and his team of analysts are supported by an Investment Committee comprising Calvin Ng, co-founder and Managing Director of Aura Group, and Allan Savins, the Interim Chief Executive Officer of BNK Banking Corporation Limited.

Before joining Aura Group in 2016, Brett spent 11 years in Macquarie Bank’s debt markets business, where he originated, structured and distributed debt products. He is something of an industry pioneer, known as the first to originate, structure, negotiate and subsequently execute a bank debt facility for an Australian alternative finance lender.

Brett Craig, Portfolio Manager and Director of Aura Funds Management said “We are excited to commence the Distribution Partnership with Montgomery. We have spent a considerable amount of time with the team and are impressed with the client relationships that have been developed over the last decade, and the distribution capability within Montgomery. We look forward to providing a high-quality income solution to the Montgomery clients.”

The Fund, which currently has A$91 million in funds under management, is well-diversified, lending to 7,858 SME borrowers via five lending platforms and across various industries. The Agricultural sector currently accounts for 36 per cent of the loan book. The weighted average loan is $143,581, the average duration is four months, and the longest loan is 36 months. Aura Fund Management’s investment process first focuses on preserving capital, followed by the return on capital.

Roger Montgomery said, “I am pleased to complement our suite of quality investment options with the addition of a fund that has produced a successful track record of generating reliable monthly income and an attractive yield. I am equally delighted that Montgomery will represent and support Brett and the team in offering the very successful Aura High Yield SME Fund. With the RBA Cash Rate sitting at a record low 0.10 per cent, most Australians are income poor, and I believe the Aura High Yield SME Fund can assist those seeking meaningfully higher monthly income by lending to the SME sector through a fund that carefully selects appropriate opportunities and risks on their behalf.”

Montgomery is also working with Aura Funds Management to bring a second credit income offer to market later in 2022 for retail investors.

Learn more about Montgomery’s partnership with Aura Funds Management and Brett Craig in this series of videos.

Watch our videos

Note, all data quoted is as at 31 March 2022 and is subject to change.

IMPORTANT INFORMATION

DISCLAIMER

Units in the Aura High Yield SME Fund (Fund) are issued by Aura Funds Management Pty Ltd (ABN 96 607 158 814, Authorised Representative No. 1233893 of Aura Capital Pty Ltd (ABN 48 143 700 887, AFSL No. 366 230)) (Aura). Aura is the trustee of the Fund and a subsidiary of Aura Group Pty Ltd. This information is for wholesale or sophisticated investors only and is provided by Montgomery Investment Management Pty Ltd (ABN 73 139 161 701, AFSL No. 354 564) as the authorised distributor of the Fund.

An investment in the Fund must be through a valid paper or online application form accompanying the Information Memorandum.

The information provided is general in nature and does not take into account your investment objectives, financial situation or particular needs. Before making an investment decision you should read the Information Memorandum and (if appropriate) seek professional advice from a licensed financial advisor to determine whether the investment is suitable for you. The investment returns or repayment of capital of the Fund are not guaranteed. The value of an investment may rise or fall and you may risk losing some or all of your capital. Past performance is not a reliable indicator of future performance.