Investor Insights

By , Polen Capital

SHARE

Is the Future of E-Commerce Still Bright?

Three years ago, in March 2020, the head of the World Health Organization declared the COVID-19 outbreak a global pandemic. Immediately after, entire nations went into lockdown, upending life as we knew it. Amid the health crisis, people adapted to the “new normal” by adjusting their lifestyles and developing new habits. Fast forward to today, we can see that several trends which emerged during the pandemic were quick to fade, while others are likely to have long-lasting implications in the post-pandemic era.

The toilet paper shortage in the early days of the pandemic serves as an example of short-term changes in consumer behavior. Toilet paper became a highly sought-after commodity in the outbreak’s initial weeks after stay-at-home orders led to a 40 per cent increase in household demand as Americans prepared to hunker down1. Yet, the craze proved short-lived, and very few – if any – shoppers these days are seen frantically stockpiling several months’ worth of toilet paper rolls.

However, the mandatory quarantines and lockdowns around the globe also created more persistent effects, such as the acceleration in e-commerce. With many brick-and-mortar businesses forced to shut down during the pandemic, consumers had no alternative but to shop online—and they did, en masse. At the height of the pandemic, e-commerce became the modus operandi for consumers unable – or unwilling – to buy what they needed in physical stores.

The E-Commerce boom

According to the U.S. Census Bureau’s Annual Retail Trade Survey (ARTS), e-commerce sales increased by 43 per cent during the first year of the pandemic, soaring from $571 billion in 2019 to more than $815 billion in 2020. In 2021, e-commerce sales climbed to $960 billion, supported by consumers flush with stimulus cash. Last year, online shopping passed the $1 trillion mark for the first time, a milestone many experts had previously forecasted would take place later this decade2.

Yet, as the health picture improved and the economy reopened, in-store channels experienced a post-pandemic rebound supported by eager shoppers who craved to get out of their homes and interact with their favorite brands in a physical store. According to a report by Mastercard3, monthly U.S. e-commerce sales declined in March 2022 for the first time since the pandemic began, while in-store sales rose. Not surprisingly, many investors started reflecting on whether the long-term shift to online shopping would persist or reverse as consumer behaviors normalised.

Back to the trend line

Despite the e-commerce market nearly doubling in size in just three years, signs of slower revenue growth by a number of the leading players in the space have led some skeptics to speculate that the industry’s best years are now behind. Compounding this narrative is that higher inflation, surging borrowing costs, and a softer economic outlook have led several management teams to restructure their business models and operations to adjust to the new environment.

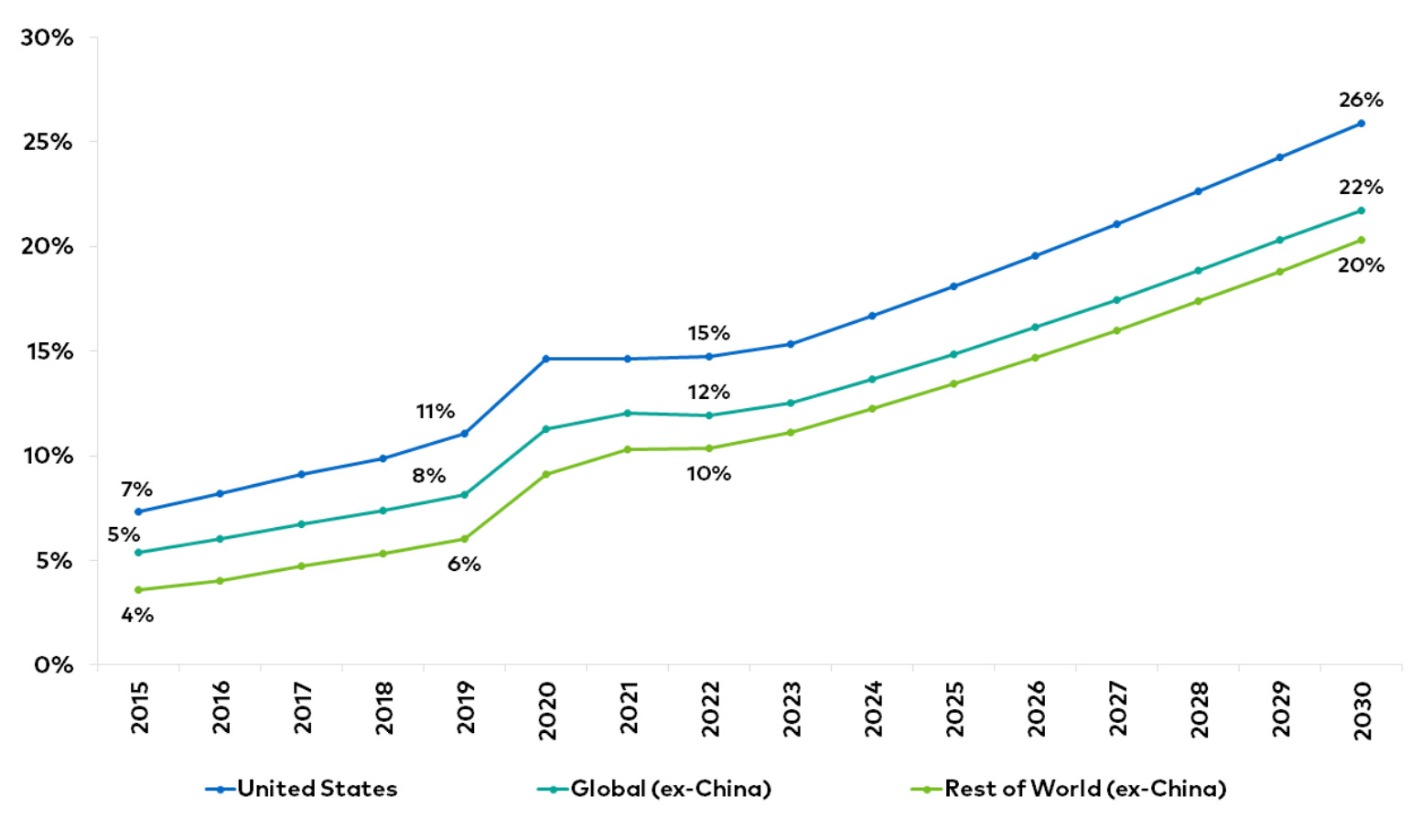

While e-commerce sales have accelerated year-over-year in absolute terms, the e-commerce market’s share of total retail spending remained flat at about 15 per cent over the past two years, as the chart below illustrates. Hence, despite e-commerce sales continuing to grow at a solid clip, e-commerce penetration of the broader market has mean-reverted back to the pre-pandemic long-term trend.

Estimated E-Commerce penetration rates by region

Source: AllianceBernstein, January 2023.

Even though some might misinterpret the data and think that penetration rates have flattened due to weakness in the e-commerce sector, the truth is that this has to do more with the faster increase in total retail spending (the denominator). Simply put, e-commerce has continued to gain momentum in absolute terms, but its relative growth has moderated.

The long-term outlook

Looking ahead, we believe the secular trend in global e-commerce growth remains intact. According to our research, demographic tailwinds – such as younger consumers – will remain a key engine for e-commerce growth in the years to come. Each year, these digitally savvy shoppers become a larger segment of the overall market. In emerging markets, smartphone penetration—which has been steadily on the rise – is also an important secular tailwind, given that almost all internet use is done via mobile devices.

Furthermore, new business models’ wider breadth of services will likely help innovators increase their value propositions and gain market share. For example, in-house logistics can optimize the customer experience thanks to quicker deliveries, and fewer lost orders. Meanwhile, we’re still in the early stages of social commerce and live shopping, which bring the store to the customers by allowing them to checkout directly from social platforms instead of an app or website. As brands increasingly leverage social media, several new revenue avenues are opening in this space.

Additionally, there are currently fewer financial barriers than before. The worldwide trend of cash/check converting to credit/debt still has legs in our view, and new models like Buy Now, Pay Later (BNPL) should also be accretive to conversion rates, particularly on big-ticket items. Meanwhile, checkout buttons (i.e., PayPal, Apple Pay, Google Pay, Buy with Prime, etc.) should contribute to fewer abandoned baskets.

Investor takeaways

Finally, at a 15 per cent share of total retail sales, we believe the U.S. e-commerce market is still relatively underpenetrated and has much room to grow. After all, markets such as South Korea and the U.K. have penetration rates above 30 per cent. An industry forecast by AllianceBernstein projected penetration rates to continue increasing over time and modeled the U.S. market getting to 26 per cent by 2030. Similarly, e-commerce as a percentage of all retail sales remains well below 20 per cent across several other large markets, including Continental Europe, Latin America, and Southeast Asia.

Even with slower go-forward rates, the incremental dollars up for grabs are large and growing, as seen below. If Bernstein’s estimates prove to be generally accurate, their forecast implies $1.3 trillion in aggregate incremental e-commerce sales in the U.S. between 2023-2030. For a company like Amazon, which we estimate has a 40% share of the U.S. e-commerce market, this would imply an additional $520 billion in Gross Merchandise Volume (GMV)4 for the company out to 2030 if they maintain their current market share. Comparing this to our estimate of Amazon’s 2022 global GMV of $650 billion implies that Amazon could see 8 per cent annualised total GMV growth from its U.S. e-commerce business alone5.

Incremental U.S. E-Commerce Dollars ($Billions)

Source: AllianceBernstein, January 2023.

For investors, this means that the e-commerce landscape will likely remain a prime ground for innovation and growth. Going forward, we expect e-commerce platforms to take advantage of emerging technologies like 5G, blockchain, internet-of-things (IoT), automated robotics, virtual reality, and artificial intelligence to capture market share, illuminating attractive investing opportunities along the way.

1 Why the Pandemic Has Disrupted Supply Chains | CEA | The White House

2 United States Census Bureau. (2023, February 17). Monthly Retail Trade – Quarterly Retail E-Commerce Sales Report

3 Mastercard Incorporated – Mastercard SpendingPulse: Services on the Rise in March, while U.S. Retail Sales Grow 8.4%

4 Gross Merchandise Volume (GMV) represents the total value of sales over a certain period of time, including sales by Amazon itself and the marketplace.

5 $520 billion calculated using 40% (Bloomberg estimated market share) multiplied by Bernstein’s estimate of the incremental dollars expected to be generated in U.S. e-commerce out to 2030.