Investor Insights

SHARE

Is Floor & Decor the category killer?

The U.S. housing market, after having staged a solid recovery since the depths of the financial crisis, is starting to show some signs of moderation. On the face of it, now would seem like the wrong time to be considering an investment in a company leveraged to the fortunes of the U.S. housing market. We disagree, and believe that the negative headlines have created some favourable stock price opportunities.

U.S. existing home sales (SAAR) have been down year-over-year. Housing turnover has been trending negative. There are also concerns around housing affordability in the U.S. given the strong house price appreciation since the crisis. Now seems like the wrong time to be leveraged to the fortunes of the U.S. housing market. We disagree.

Robust sales growth

Over the years we have been keeping an eye on a company called Floor & Decor Holdings (NYSE: FND), a specialty retailer of hard surface flooring such as wood, stone, and tiles. While the company exists in a mature and arguably boring category, its recent sales growth has been any but. Over the last five years, same-store sales growth has averaged 15 per cent. This is practically unheard of for a retailer, particularly in a category such as flooring. In addition, FND has been aggressively rolling out new stores, with a large store-rollout runway ahead. What has allowed FND to achieve such a phenomenal sales growth track record?

Unique model

FND has been dubbed a “category killer.” While such labels typically draw our scepticism, we believe the description, as it relates to FND, has merit. The company has a unique business model that is a first for the space. FND has warehouse-format stores that average approximately 73,000 square feet, much larger than the stores of competitors. For example, Lumber Liquidators (NYSE: LL) has approximately 6,500 to 7,500 square feet stores. Home Depot (NYSE: HD) and Lowe’s (NYSE: LOW), the two big-box home improvement giants, dedicate only 3,000 to 5,000 square feet of their massive stores to hard surface flooring. This dynamic is important, and feeds into some of the nuanced advantages FND has cultivated that its competitors simply are unable to replicate.

These large format stores allow FND to stock a wide range of flooring stock keeping units (SKUs), with FND’s flooring assortment spanning from entry-level to high-end. But more importantly, FND has arguably the highest proportion of in-stock, job-ready quantities of SKUs (with more than 80 per cent of FND’s SKUs being in-stock). Given that FND’s sales skew disproportionately towards what are known as “Pro” customers, the high-portion of in-stock SKUs creates an advantage here.

Pro customers, who are typically professionals that have been contracted by the end user to complete a remodel, are looking to efficiently complete a flooring job such that they can move on to other jobs. When the desired flooring SKU is out-of-stock, with it potentially taking many weeks to order in, it creates delays in finishing the flooring job for that professional. As FND has a high-portion of in-stock SKUs, with their stores set up for the easy loading of product onto the professional’s truck, it creates a more seamless process for the Pro customer.

Price leadership

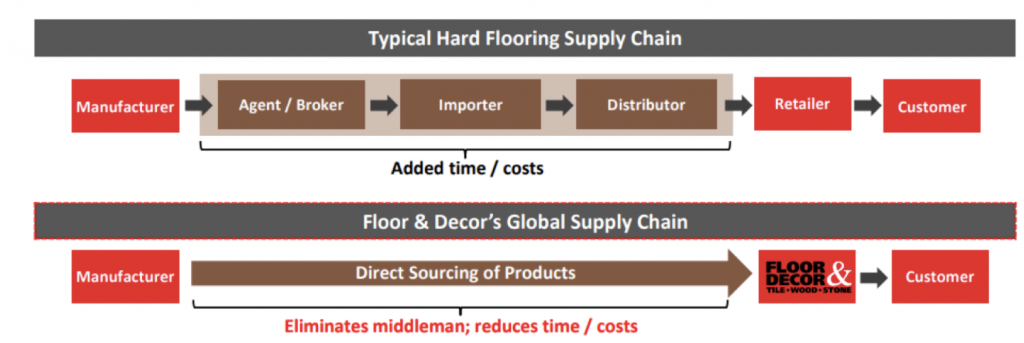

Another aspect of FND’s advantage is the fact that it is a price leader, following an everyday low price (EDLP) pricing strategy. FND sources its products directly from suppliers, eliminating agents and distributors that would each be taking a margin.

Source: Company filings

This allows the company to sell products at levels that many smaller, independent flooring retailers simply can’t match. Independents, which represent an estimated 30-40 per cent of the hard surface flooring industry, represent a veritable market share growth opportunity for FND, which has a demonstrably better business model than these competitors.

One Florida-based FND customer we interviewed said that it was typical for flooring professionals to quote a job on a per square foot basis. The Pro customer would then seek out the lowest prices on flooring stock and related accessories. To the extent that they can get a cheaper price, given the fixed nature of the job cost, it would all be margin that the Pro can bank. An EDLP strategy, where Pro customers know they’re getting the lowest price when they go in-store, is another factor behind the impressive growth and share gains exhibited by FND.

FND is cheap

While the above-mentioned macroeconomic concerns, in addition to tariffs imposed by the U.S. on China, should not be dismissed, we believe they are more than reflected in the FND share price. FND’s management team has put forward a long-term target of 400 stores within the next 10-15 years, up from the current c.100 stores. While this is a large growth opportunity, the current share price implies that the company misses its 400-store target by 15 per cent. In addition, you’d need to believe that same-store sales growth slows to around 5 per cent longer term, which is not much more than the 3-5 per cent growth rate that the entire hard surface flooring category is expected to grow at. This seems unfairly negative, given the advantaged-nature of FND’s business model, and our expectation that the company should continue to achieve market share gains.

The current share price is also implying that FND’s gross margin compresses by over 100 basis points per annum over the next five years, and then despite the respectable comparable sales growth, operating margins expand by less than two percentage points over the next decade. This seems too pessimistic, and the market seems to be missing the deleterious effect new store openings are having on consolidated margins.

Given that FND is expanding its store base by around 20 per cent per year, these new stores, which operate at a lower sales productivity and margin rate until they mature, are having a dilutive impact on total company margins. This dynamic becomes clear when we observe the difference between the fully-burdened EBITDA margin (i.e., including supply chain, transportation, corporate costs etc.) of a store that has been open for more than 3 years of 15 per cent, with the corporate average of 11 per cent. Over time, the new store units will become a smaller portion of the existing store base, and we would expect the negative impact from new store openings to dissipate and for company margins to expand.

While risks exist around our FND thesis – mainly a softening of the U.S. house market, and tariff-related margin risks – we continue to believe that at current levels FND represents an attractive investment opportunity. It is an example of negative sentiment at an industry level creating opportunities for those willing to dig deeper and look through the gloomy headlines.

The Montgomery Global Fund and Montaka own shares in Floor & Decor (NYSE: FND). This article was prepared 08 August with the information we have today, and our view may change. It does not constitute formal advice or professional investment advice. If you wish to trade Floor & Decor you should seek financial advice.