Investor Insights

SHARE

Equities not so expensive

Ahead of the July 4 holiday here in the US the local stock market has closed at a record high. But shares may not be any more expensive on average than they have been over the past decade.

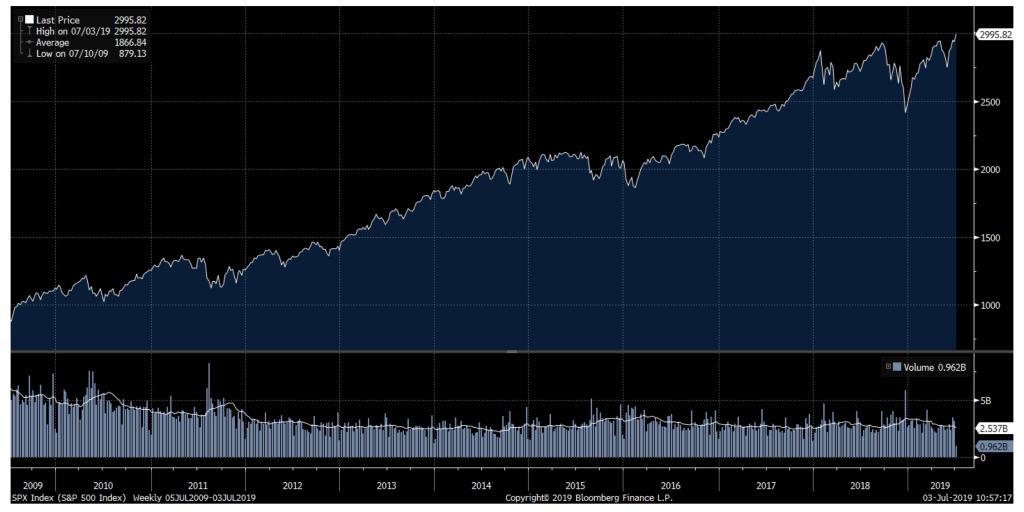

The afternoon of the 3rd of July, the S&P500 index, a broad measure of stock prices in the US, closed at an all-time high 2,996 points. In the chart below we can see that the rise to this point over the past 10 years has been almost uninterrupted (with the obvious exception of a slip in the last few months of last year). Presented with this data it would be easy to conclude that equities are expensive. However, when viewed in the context of interest rates over this period the picture is different.

S&P500 Index over the last 10 years

Source: Bloomberg

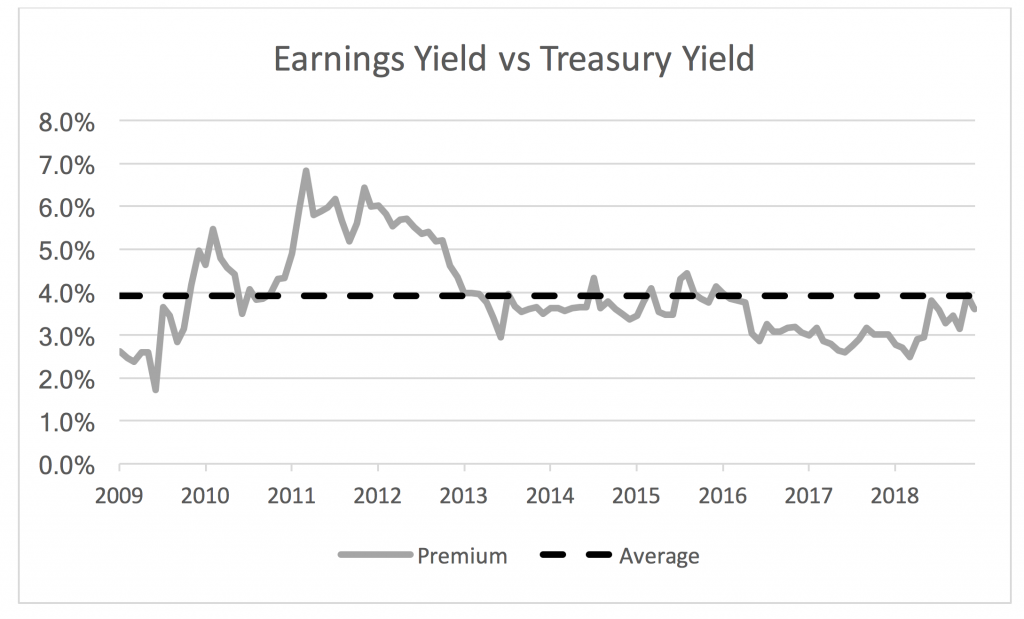

To do this I have taken the 10-year US government bond yield and compared it with the earnings yield of the S&P500. The bond yield is a representation of the risk-free rate or the long term annual return an investor can achieve without taking any risk of default or loss of notional capital (of course the US government can always make good on its promise to repay by taxing more, so the theory goes).

The earnings yield is the inverse of the forward PE of the S&P500 and reflects the annual rate of return generated by investing in a broad basket of US shares. The amount by which the earnings yield exceeds the bond yield can be thought of as the additional return being offered by (risky) shares over and above the (riskless) government bonds. This is shown in the chart below.

Premium of S&P500 earnings yield over 10-year US government bond yields over the last 10 years

The return premium offered by equities over government bonds has averaged 3.9 per cent in the US over the past decade. This is shown by the black dotted line in the chart. Coincidentally, the equity premium today is not far off this long run average, at 3.6 per cent. This means that equities are not more or less expensive (relatively speaking) at their new high than they have been throughout their decade-long rise to that point. Happy Independence Day.