Investor Insights

SHARE

Aura High Yield SME Fund: Letter to Investors 29 April 2022

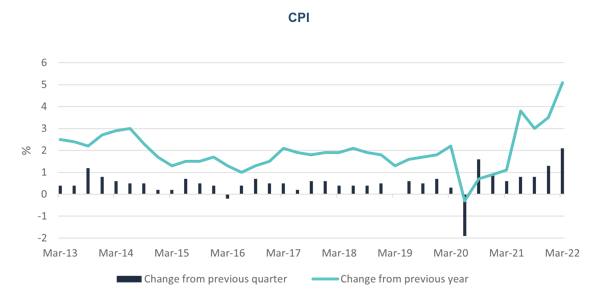

The inflationary data released by the Australian Bureau of Statistics this week came as no surprise. After months of supply and demand imbalances and geopolitical issues at play, the significant inflationary pressures are validated with 5.1% annualised rate. The next question is, how soon will the rate rise come?

Consumer Price Index 1

The Consumer Price Index (CPI) rose 2.1% over the quarter and 5.1% in the last 12 months, reaching the highest level of underlying inflation since 2009. According to the ABS, the CPI recorded its largest quarterly and annual rises since the introduction of the GST back in 2000.

Whilst pricing increases were recorded across the board, the main contributors to the rise for the March quarter were recorded for new dwellings, up 5.7%, automotive fuel, up 11% and tertiary education, up 6.3%. Price rises were recorded across all food and non-food grocery products for the quarter, highlighting pricing pressures across transport costs, supply chain disruptions and increased input costs, which were being passed onto the final product price and therefore end consumer. The ongoing disruptions to supply chains are causing shortages for building supplies and significant increases in petrol prices. The extensive lockdowns currently occurring in Shanghai are placing further pressure on supply as production has ceased and ports remain at a stand still. Fuel costs rose for the seventh consecutive quarter, attributable to the ongoing conflict in Ukraine and easing COVID-19 restrictions increasing global demand. Further escalation in the Russian invasion of Ukraine is putting significant pressure on the price of petrol after most developed countries imposed heavy sanctions and restrictions on Russia, a top exporter of petroleum.

Portfolio Management Commentary

The rate of inflation has been consistently above the RBA’s 2-3% range for the past three releases now, creating further evidence for a rate rise to come. We are eagerly awaiting next week's RBA meeting, which may trigger the first rate rise we have seen since November 2010. Many other central banks have already begun the rate hike, therefore we would expect the RBA to begin soon. With the Federal election on the horizon, there will be a fine balance on the RBA’s decision to lift rates next Tuesday before the election, or if they will maintain stability until after the election and announce a rate movement in June.

We would like to flag an update to the Aura High Yield SME Fund Information Memorandum (IM) dated 21 April 2022. The change comes as the Fund is now close to achieving a $100m FUM level, triggering the Fund Manager to review the Fund’s investment strategy and ensure it is in line with the evolution and growth of the Fund. To enhance the Fund’s ability to invest appropriately, we have made minor amendments to the IM. We have removed the target fund size of $100m as we are now on track to surpass the milestone. Previously, the Fund was restricted to allocating no more than 30% of the Fund’s assets into debt exposures to any one SME AltFi lender once the Fund size reaches $100m. We believe a more granular diversification mandate is more appropriate, deciding to instead restrict the Fund to not hold more than 5% proportionate interest of the Fund’s assets to any one underlying loan. We believe this change supports appropriate levels of diversification in the portfolio.

1 ABS – Consumer Price Index – March 2022

This information is for accredited, qualified, institutional, wholesale or sophisticated investors only and is provided by Aura Funds Management Pty Ltd (ABN 96 607 158 814, Authorised Representative No. 1233893 of Aura Capital Pty Ltd AFSL No. 366 230, ABN 48 143 700 887). Aura Funds Management Pty Ltd is the Trustee of all the Funds mentioned and a subsidiary of Aura Group Pty Ltd.

Any financial product advice given in this report is of a general nature only. The information has been provided without taking into account the investment objectives, financial situation or needs of any particular investor. Therefore, before acting on the information contained in this report you should seek professional advice and consider whether the information is appropriate in light of your objectives, financial situation and needs. Aura does not guarantee the performance of its funds, the repayment of any capital or any rate of return. Investing in any financial product is subject to investment risk including possible loss. Past performance is not a reliable indicator of future performance. Information in this report is based on the information provided to Aura by third parties that may not have been verified. Aura believes that the information is reliable but does not guarantee its accuracy or completeness. Aura is not able to give tax advice and accordingly investors should obtain independent advice from an accountant and/or lawyer before making any decision based on the tax treatment of its investors.

You must read the Fund Fact Sheet or Information Memorandum and seek professional advice before making a decision to invest in any of the funds.