Investor Insights

SHARE

Aura High Yield SME Fund: Letter to Investors 05 August 2022

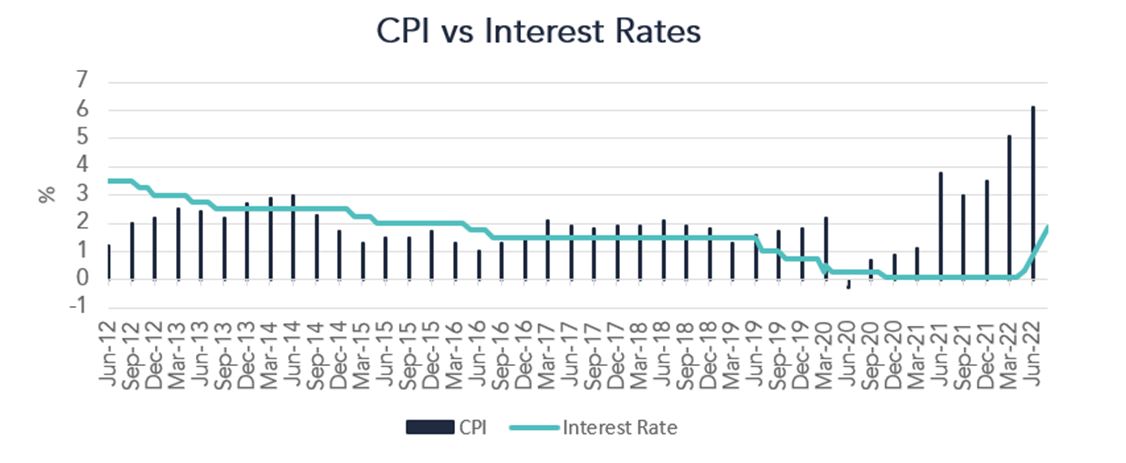

The RBA raised rates for the fourth consecutive meeting with a view to combat the soaring rate of inflation. They are not shying away from introducing additional rate rises moving forward. As noted last week, the headline inflation for the July quarter came in at 6.1 per cent, well above the 2–3 per cent target range.

Monetary Policy Decision 1

At Tuesday’s RBA meeting, the board decided to increase the interest rate by 50 basis points to 1.85 per cent. With the RBA facing a persistent challenge of trying to reign in inflation, their only real lever to pull here is the interest rate.

With their priority being to bring the inflation target back into the 2–3 per cent range, whilst maintaining a low level of unemployment the RBA is facing a difficult challenge. With ongoing uncertainty due to the many domestic and global scenarios we have discussed before – and the need to rebalance supply and demand – the RBA is responding to a significant upward shift in monetary policy.

Inflation is currently at the highest level it has been since the early 1990s. It is expected that inflation will reach its peak later this year before it starts to return to the more normalised territory. The RBA’s forecast is for CPI inflation to be around 7.75 per cent over 2022 and slightly above 4 per cent over 2023 before returning to around 3 per cent over 2024.

The RBA has supported their rate rise with the expectation that the economy and employment will continue to grow strongly this year, consumer spending has remained resilient in the current economic environment and businesses are continuing to make investments.

As mentioned previously, the key source of uncertainty for the RBA at this stage is the behaviour of households spending and how this will evolve in a higher inflationary and higher interest rate environment. The RBA would be hoping that household spending pulls back, allowing inflation to cool off and reduce the need to hike rates further.

Portfolio Management Commentary

We are currently seeing consumer confidence fall and house prices decline. On the other hand, employment remains strong, and many households have built up and maintained financial buffers with the savings rate sitting at a higher level than before the pandemic.

From an investment management perspective, our major concern is that the RBA is hitting the brakes too hard as it tries to bring inflation back towards the target band. In our view, the probability of a second technical recession in two years is increasing with the ferocity of the RBA hikes. The main concern is that the RBA has not seen the full flow through impact of the May through July moves, mixed with the removal of quantitative easing (QE) measures. In some way, inflation is currently elevated as a result of the excessive stimulus injected into the economy by the RBA, not only through accommodative monetary policy but more importantly significant amounts of QE.

In the US, where there have been significant increases in the cash rate, the economy is now in a technical recession by the classic economic definition (two consecutive quarters of negative economic growth). Democrats are looking to redefine recession in this instance as we are not seeing a corresponding uptick in unemployment as we have seen in past recessions.

The economy is in a relatively strong position from a growth and employment perspective, so it is not all doom and gloom. We are working with our originators to ensure we are funding high-quality businesses and keeping a close eye on the portfolio. We still see a large number of good opportunities to fund and are seeing strong inflows into the Fund. We will release our distributions and monthly report next week.

Last week marked the fifth anniversary of the Aura High Yield SME Fund. We are particularly proud of the fact we have protected our investor capital since inception, particularly through a very uncertain and volatile period over the last two years. We thank all of our investors for their continued support since the inception of the Fund and look forward to working with you all in the years to come.