Investor Insights

SHARE

Aura High Yield SME Fund: Letter to Investors 03 June 2022

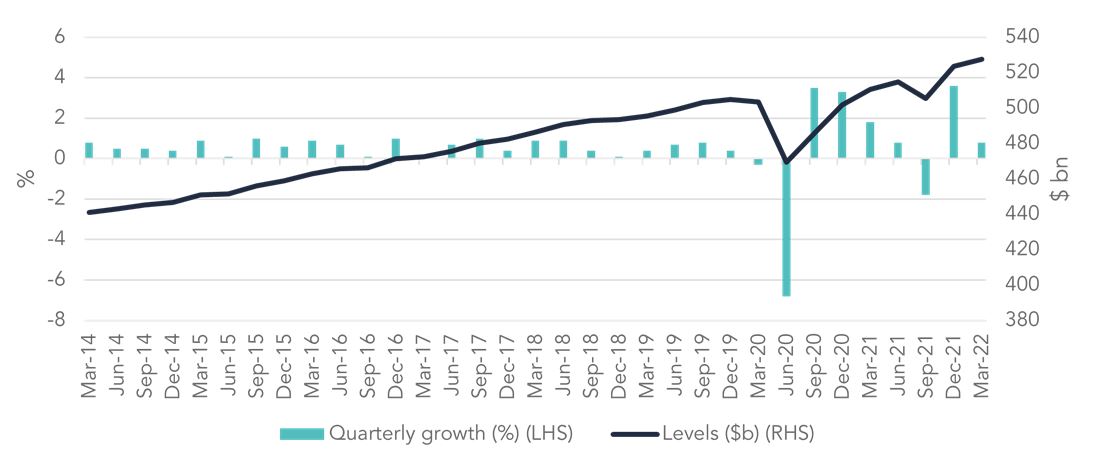

This week the Australian Bureau of Statistics reported a second consecutive quarter of GDP growth. Australian GDP rose by 0.8% in the March quarter and was up 3.3% through the year, a more subdued increase following a 3.6% rise in the last December quarter. This is the second quarter in a row that we have seen a rise in GDP, following a contraction in the September 2021 quarter back when the Delta outbreak was causing significant disruptions both socially and economically.

Economic Activity Increased in the March Quarter1

- The Australian economy rose 0.8% over the quarter

- In nominal terms, GDP rose 3.7%

- Terms of trade rose 5.9%

- Household savings ratio decreased to 11.4% from 13.4%

GDP Seasonally Adjusted

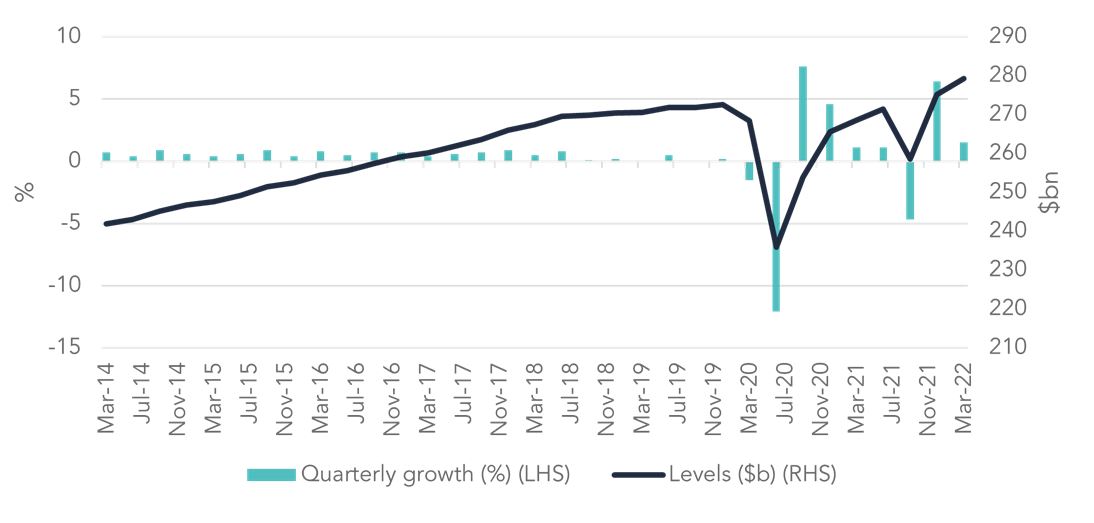

The quarters growth was predominantly driven by household and government spending, with final consumption alone contributing 1.4% to GDP. Household spending reported a 1.5% increase, with COVID-19 restrictions heavily reduced and expenditure on recreational activity such as restaurants, hotels, transport, travel and culture increasing. Expenditure on food declined by 2% reflecting the shift towards eating out at restaurants, a much-needed injection into our hospitality industry following the pandemic. Spending on discretionary goods and services increased by 4.3%, exceeding pre-pandemic levels for the first time.

Household spending growth was strongest in the eastern states, given they were most affected during the Delta wave. For this quarter, the ACT was up 3%, VIC 2.7% and NSW 1.9%.

The rise in household expenditure far outweighed the growth in household income. The household saving to income ratio fell from 13.4% to 11.4%. This sits at the lowest level since the start of the COVID-19 pandemic but remains above pre-pandemic levels. Wage growth is trailing inflation despite a strong labour market.

Household Final Consumption Seasonally Adjusted

Government expenditure also contributed to the rise, with funding provided to compensate flood-affected areas in NSW and QLD. With the extreme weather conditions, enormous pressure was placed on supply chains and activity, requiring the Government to step in and provide much needed support. Government income support to households was $5.7 billion above pre-Covid levels and Government subsidies were $3.1 billion higher.

Terms of trade rose 5.9% with export prices up 9.6% and import prices up 3.5%. Export levels were driven by strong overseas demand for Australia’s mining and agricultural commodities. Other producing nations are importing greater levels of Australian commodities due to the harsh lockdowns in China and the ongoing conflict in Ukraine preventing production and hampering the free flow of trade. Australian imports surged this quarter, growing by 8.1%.

Consumer prices rose 2.1% during the quarter and 5.1% over the year. It was the fastest quarterly growth rate since the September 2000 quarter and the fastest annual increase since June 2001, predominantly driven by the rising cost of fuel and housing. Inflationary pressures are likely to continue.

There was a record $7.5 billion ramp-up in inventories, indicating a rise in forward orders and businesses replenishing stocks as they see demand increase and a degree of certainty that they will experience less business disruption in the future.

Having outlined all the above, with numerous global events continuing to impact the Australian economy and a newly elected Government, the June quarter national accounts are expected to demonstrate further volatility.

Portfolio Management Commentary

There is plenty of movement occurring in the economic environment at the moment. The March quarter delivered positive economic news, with GDP reporting a second consecutive quarter of growth. Despite persistent inflationary pressures, we are seeing household spending increase across the board and businesses beginning to increase stock levels after years of being hampered by the pandemic.

The housing market reported its first overall fall in housing prices for the first time since September 2020, with a 0.1% drop recorded nationally in May. The decline is likely partly due to the rising interest rates and rising cost of living. The market will be watching the RBA on Tuesday to see whether they increase the cash rate again, after the 25 basis point increase in May.